Impacted by the general decline in the cryptocurrency ecosystem, 1inch suffered a considerable blow to its trading volume and revenue in Q3, Messari found in a new report.

Launched in May 2019, the 1inch Network is an all-in-one decentralized finance (DeFi) protocol housed within several blockchains, namely Ethereum, Arbitrum, Optimism, Polygon, Avalanche, BNB Chain, Gnosis, Fantom, Klaytn, and Aurora.

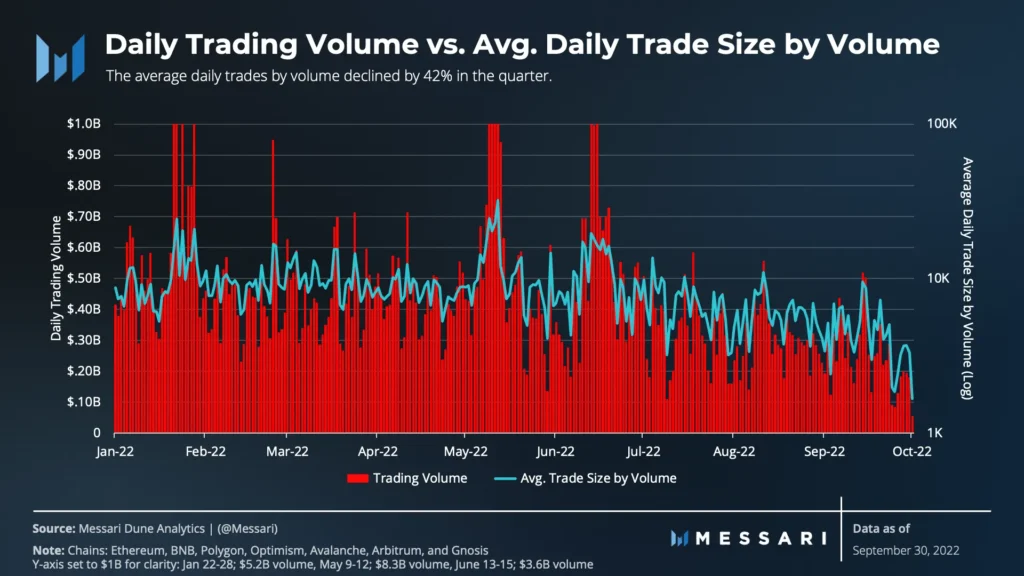

In its new report assessing the DeFi platform’s performance in Q3, Messari found that the total trading volume on 1inch fell by 45.5% between July and September.

Moreover, within that period, the total trading volume on its multiple deployments fell from $49.5 billion to $27 billion. Interestingly, despite the severe fall in total trading volume, Messari found that the total trades count remained flat on a quarter-on-quarter basis.

As for its financials, across its ten deployments, revenue recorded by 1inch in Q3 totaled $1.03 billion. Unfortunately, this represented an 84% decline from the $6.75 billion logged as revenue by the protocol in Q2.

Interestingly, in spite of the hardship foisted on the general cryptocurrency market due to the collapse of Terra and Three Arrows Capital, 1inch’s revenue grew by a whopping 92% in Q2.

1INCH in Q3

During the bullish correction of the cryptocurrency market in July, while the price of many crypto assets grew consistently within the 31-day period, 1INCH’s price suffered severe volatility, data from CoinMarketCap showed.

It, however, managed a sharp rally in the last few days of July before closing the trading month at $0.79.

It continued on the uptrend to peak at $0.88 on 14 August. However, with the failure of the bulls to sustain the price rally, 1INCH spent the rest of Q3 logging a decline in its price. By 30 September, 1INCH’s price had fallen to a low of $0.58, a 13% decline from the $0.67 it started Q3 with.

Before you make your next trade

As of this writing, 1INCH exchanged hands at $0.5746. Its price rallied by 1% in the last 24 hours. Within the same period, its trading volume was up by 43%. Having spent most of the year declining, the asset currently trades at its December 2020 price level.

On a daily chart, buying pressure rallied, albeit slowly. At press time, the Relative Strength Index was in an uptrend at 46.39. It inched closer to the 50-neutral region as of this writing. Resting above the neutral line, 1INCH’s Money Flow Index (MFI) was spotted at 51.62.

Note, however, that although buying pressure mounted, sellers had control of the 1INCH market at press time. This was confirmed by the position of the Directional Movement Index (DMI). The sellers’ strength (red) at 21.44 rested solidly above the buyers’ (green) at 18.48.