1inch, despite not being a part of the top 100 cryptocurrencies, was leading the crypto market rally at one point on 16 March. Up by almost 18%, the altcoin achieved a significant accomplishment on 16 March.

Missed it by an inch

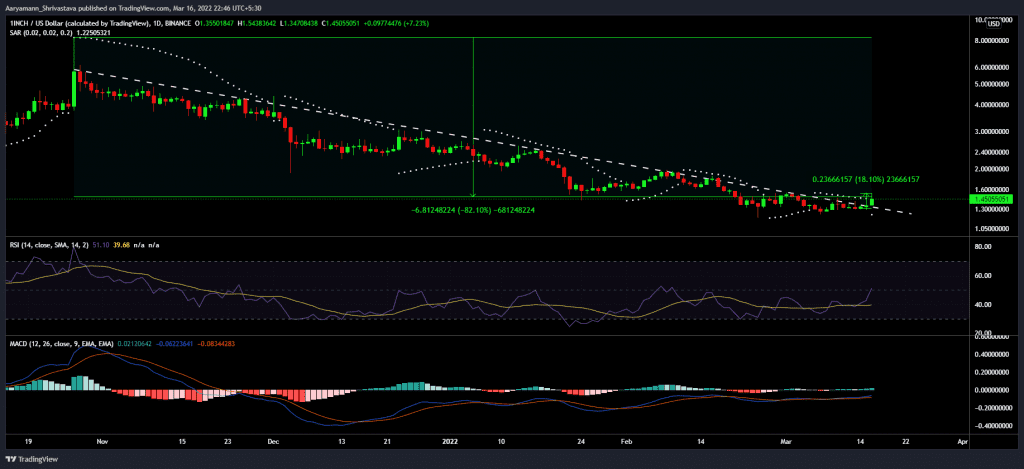

Despite being 82% below its all-time high of $8.29, the altcoin on 17 March breached its five months-long downtrend. The price action had been testing the $1.30 mark as a resistance consistently, but all its attempts to breach failed deplorably.

However, a close above $1.47 would finally provide the push 1INCH needs to establish a sustainable rise.

Well, price indicators did support a short-term stable positive movement in favor of the coin. At press time, the Relative Strength Index (RSI) reached into the bullish zone for the first time in 5 months. At the same time, the MACD indicator signaled a bullish crossover with optimism rising for the past few days.

1inch Price Action | Source: TradingView – AMBCrypto

This bullishness could actually put 1INCH in a good spot going forward since the DEX hasn’t been making much growth in the last two months. Volume on a monthly basis has been reduced from $14 billion to $5.1 billion this month.

But the predicted volume for this month is indicating another $4.9 billion in the next 15 days.

1inch monthly volume for March | Source: Dune – AMBCrypto

Regardless, 1INCH still represents just a small portion of the decentralized exchange space dominating less than 1% of the market share. Of the remaining 99%, about 90% of the space is dominated by Uniswap, Sushiswap, Curve, and Balancer combined.

But its investors still have much to look forward to. Primarily because 1INCH at the moment is not vulnerable to random price swings. The volatility is at its lowest in almost a year which will act as a huge support for 1inch for sustaining the price rise it witnessed.

1inch volatility | Source: Intotheblock – AMBCrypto

Furthermore, there is a much higher demand for buying 1INCH in the market. Sell-pressure took a back seat in the rally on 17 March. Investors’ support will keep the altcoin rising further until the broader market cues turn absolutely bearish.

1inch buy and sell orders | Source: Intotheblock – AMBCrypto