After last week’s strong bounce back, the world’s largest cryptocurrency Bitcoin (BTC) is witnessing some selling pressure. As of press time, Bitcoin (BTC) is trading 2.4% down under $41,000 levels.

The recent pullback comes as Bitcoin faces strong resistance at the $42,000 level. As per the latest report, more than $21 million worth of long liquidations has happened over the last hour.

Almost $21 million in #Bitcoin Long Liquidations this last hour pic.twitter.com/8MxJpASejU

— On-Chain College (@OnChainCollege) March 21, 2022

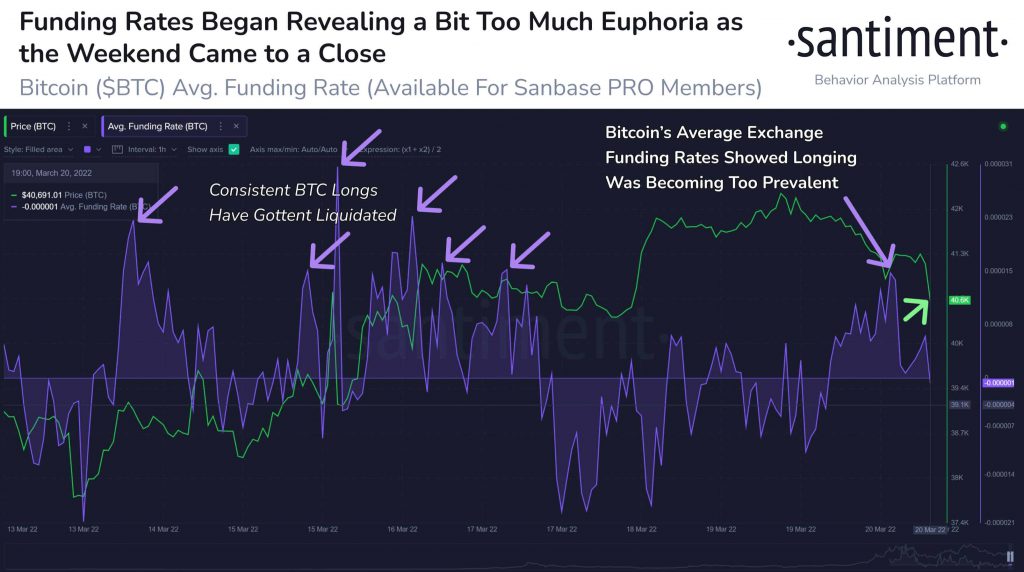

On-chain data provider Santiment reports that the Bitcoin funding rates surged very fast amid euphoria over the last weekend. It notes:

Bitcoin has fallen back to $40.8k to close the weekend after being as high as $42.2k a day and a half ago. Funding rates have been valuable in identifying when traders are leverage longing, which have generally led to abrupt price corrections.

What’s Ahead for Bitcoin?

As we know, Bitcoin has shown strong volatility, especially since Russia’s invasion of Ukraine. The BTC price has been showing wild swings in the range between $35,000-$42,000. Just before last week’s rally, we have seen BTC showing strong consolidation at around $39,000.

Bitcoin recently met resistance at $42,000, however, this won’t be an end to the upward resistance. It can take support at $40.4K before resuming its upward journey once again. If BTC manages to breach $42K on the upside, then $46K-$47K will be the next resistance level. Even if it breaks above this, the next interim price target remains $49K-$59K.

However, the downside risks remain at the same time. Popular market analyst Michael Van de Poppe writes: “If $39.6K is lost, we probably are going to see a lot of pain”. In this case, we can see the BTC price potentially falling to $35K. If it fails to hold these levels, it can further drop to $30,000.

Last week, the Federal Reserve raised interest rates but despite that, Bitcoin made strong gains. It looks like the market has already factored-in such events.