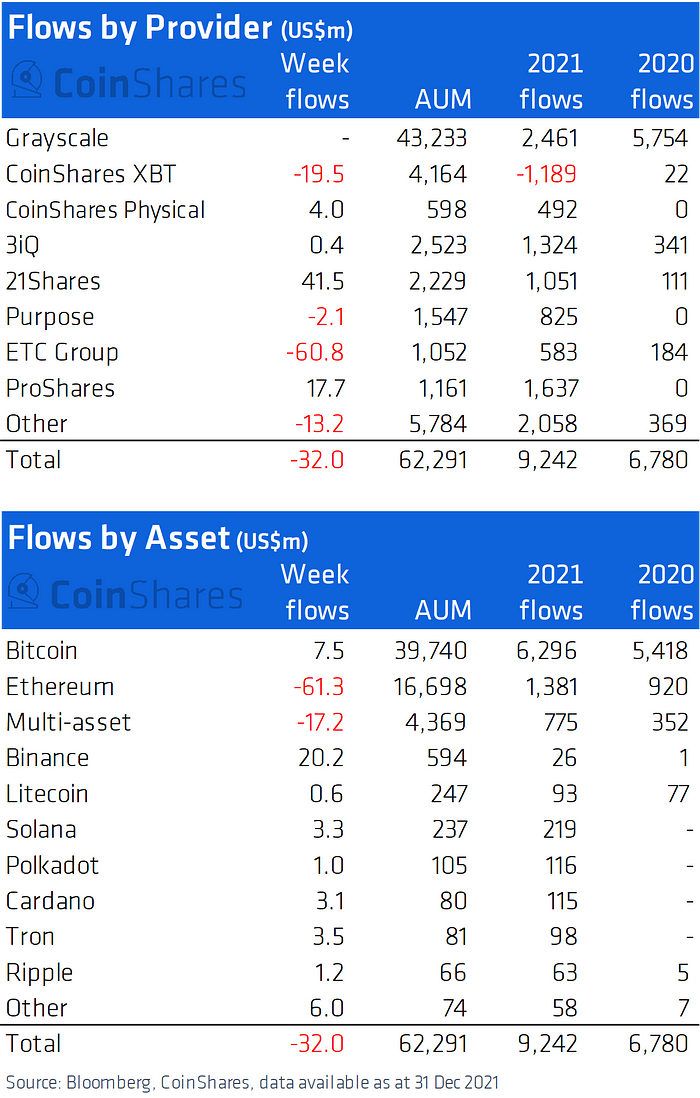

- Crypto investment products saw inflows totaling US$9.3bn in 2021, a 36% increase from 2020 which recorded $6.8 billion.

- Total assets under management shot up to $62.5 billion in 2021, with the number of investment products shooting up to a total of 132.

2021 was the year in which institutional investors took a stab at investing in cryptocurrencies, and CoinShares has published new data to back this claim. The report shows that the funds going into cryptocurrency investment products shot up by 36 percent to total $9.3 billion in 2021 for a grand accumulative sum of $62.5 billion. Investment products also had their best year yet and in total, there are over 130 such products from around the world.

The cryptocurrency market shot up to within a touching distance of the $3 trillion mark. Retail investors accounted for the bulk of this growth, with the number of addresses holding less than one BTC shooting to an all-time high, as did the number of non-zero addresses. However, institutional investors pulled their weight as well.

According to a recent report by London firm CoinShares, in 2021, the amount of inflows into cryptocurrency investment products totaled $9.3 billion. This was up 36 percent from the $6.8 billion recorded in 2020. The year prior had seen a surge of 806 percent as professionals first got involved in crypto. According to CoinShares, while the net growth in 2021 was smaller, it was indicative of a maturing industry.

Currently, the total assets under management (AUM) in crypto investment products stand at $62.5 billion. Grayscale accounts for the majority of this, with the DCG-owned firm ending 2021 with $43.6 billion in AUM. The firm holds the vast majority in BTC but also offers Ethereum, Chainlink, Litecoin, Bitcoin Cash, Cardano, Solana and SUSHI investment products.

12/31/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $43.6 billion$BTC $BAT $BCH $LINK $MANA $ETH $ETC $FIL $ZEN $LTC $LPT $XLM $ZEC $UNI $AAVE $COMP $CRV $MKR $SUSHI $SNX $YFI $UMA $BNT $ADA $SOL pic.twitter.com/vCkExTIjHh

— Grayscale (@Grayscale) December 31, 2021

Outflows shot up towards the end of 2021: CoinShares

While the inflows set new records, 2021 also had some of the highest weekly and monthly outflows in what was a year filled with activity. The final week of the year saw $32 million in outflows. This was lower than the first three weeks which had set a record with a total of $228 million in outflows.

Read More: Digital asset funds see record outflows amid crypto market descend

Bitcoin may be the king of the pack, but in 2021, it had the least impressive performance of any major cryptocurrency, CoinShares reported.

Bitcoin saw total 2021inflows of US$6.3bn versus US$5.4bn, a year-on-year increase of only 16%, where there was the lowest growth in inflows relative to other digital asset investment products.

Ethereum, on the other hand, had a great year. The leading altcoin saw ts inflows shoot up from $920 million in 2020 to $1.3 billion in 2021.

There was more good news from 2021, with CoinShares stating:

The total number of coins in investment product form has expanded from 9 to15. 37 investment products were launched in 2021 versus 24 in 2020 and now total 132, indicative of the demand and popularity of digital assets.