Amid recent macroeconomic extremes, Bitcoin has maintained a quiet stance, almost eerie for its HODLers. Nonetheless, its hashrate and accumulation are soaring — what could this mean for its price?

Bitcoin has been consolidating in a narrow range between $18,800 and $20,200 since the mid-Sept price fall. In volatile markets like cryptocurrency, similar quiet periods of consolidation are rare.

Recent Glassnode findings show that the current BTC price action resembles both pre-crash November 2018 and pre-rally March 2019. Despite price downturns, mining and accumulation statistics are improving. Let’s look into what this means for the health of the network.

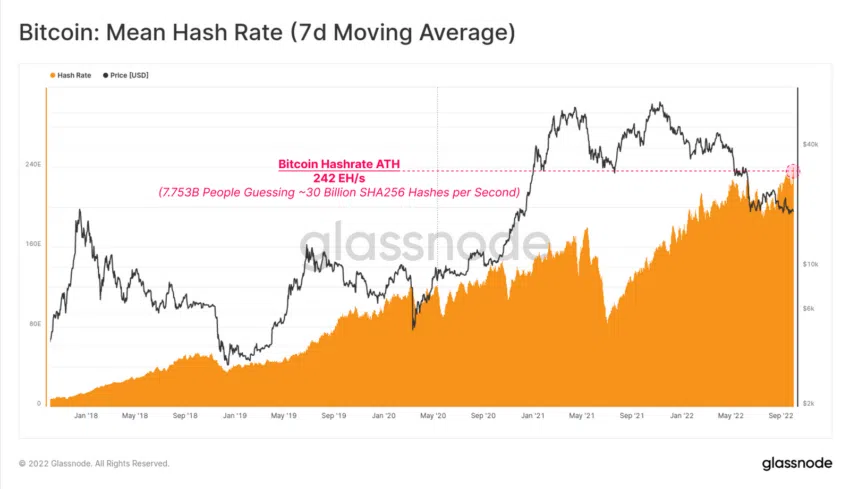

Bitcoin hashrate makes new ATH

Last week, the Bitcoin hashrate made a new all-time high of 242 exahashes per second.

In the chart below, we can see that Bitcoin’s longer-term, slower hash ribbon was once again overtaken by the faster ribbon, indicating improved mining conditions in late August. Since the price saw no major uptick during this time, the rise in hashrate was likely due to more efficient mining hardware and more mining rigs working in general.

Historically, these hash ribbon moving average swaps precede price gains. Historically, when the hash-rate drops and subsequently recovers, major BTC price bottoms have been made.

Is a price bottom in?

Apart from the hashrate, Bitcoin accumulation levels also reached a 7-year high. CryptoQuant data shows that 6-month-old and older Bitcoins now make up 74% of the realized cap. During the 2019 and 2015 bottoms, this score sat at 70% and 77%, respectively.

Lastly, for the first time in this cycle, the percentage of supply in loss has reached the 50% level.

CryptoQuant data shows that the price bottoms during previous cycles normally occur when the percentage of supply in loss reaches 50% or more.

The current data shows the highest percentage of losses at 52% on the daily chart, 50.4% on the weekly (7DMA), and 48% on the monthly (30DMA).

While quite a few metrics suggest that BTC should be near a bottom, the overall momentum will likely still depend on macroeconomic conditions as well as its correlation with the Nasdaq and S&P 500.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.