- Most officials predict that crypto technology won’t be necessary for liquidity management practices for at least the next five years.

- The US Fed plans to release the digital dollar once lawmakers approve its proposal.

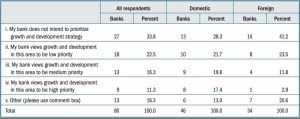

A US Federal reserve board surveyed top bank officials from 80 banks to know their stance on the near future of crypto-related products and services. The board released the results of its survey on July 15. The results showed that over 56 percent of these officials said their growth and development plan for the next two years does include distributed ledger technology (DLT) or crypto-related products and services.

However, 27 percent said they would make this technology a medium or high priority within the period mentioned above. Meanwhile, 40 percent of these officials said they would make this technology a medium or high priority for their banks for the next five years.

The Fed survey results. Source: Federal reserve

The responses of these bank officials aligned with the impact crypto have had on liquidity management practices. Most survey participants predicted that crypto technology would have no relevance to liquidity management practices within the next five years.

However, a few of the bank officials said they would adjust if it became necessary. Hence, they are actively following events in the market. The participants of this survey were the top financial officers of banks that hold nearly 75 percent of the total reserve balances of the banking system as of May 2022. Forty-six of these surveyed senior bank officials were from domestic banks, while the remaining 34 were from foreign financial institutions.

The case for a digital dollar

If the US lawmakers or regulators approve the release of the digital dollar, the US central bank (the Federal reserve) would be responsible for its release and supervision. Some lawmakers are in support of the launch of the digital dollar. On Wednesday, Connecticut house of rep member Jim Himes proposed to Congress the benefits of the digital dollar.

Himes argues that a digital dollar would enable the US to keep up with innovations in financial technology. However, he suggested that the digital dollar should be an alternative, not a replacement, for the fiat dollar.

Nevertheless, the top financial regulators in the US (the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are working together to enforce crypto regulations and regulate other sectors of its financial services system.

Earlier in the week, the Senate approved that Michael Barr should become the next vice chairman for supervision in us’ apex bank. The confirmation of Barr (an ex-Ripple adviser) means that there will be seven members of the US Fed’s board of Governors this year.

Part of Barr’s responsibilities would be creating policy proposals for the Fed and supervising the enforcement of regulation of specific finance firms. He only reports to Fed chair Jerry Powell.