Ethereum, which has managed a return on investment (ROI) of 8700%, has cultivated a lot of dampened market sentiments lately. In fact, following the market’s downfall, Ethereum has lost over 51% of its value since its ATH of $4,878.26 three months ago.

A profitable majority

And yet, data by IntoTheBlock seems to suggest that 67% of Ethereum holders are In the Money. This essentially means that the token is profitable for these investors at recent levels.

2% of all holders are At the Money level or breaking even without any profit or loss. On the contrary, the rest of the holders are suffering losses as the current price is less than the average purchase cost for these holders.

And, looking at the concentration of large holders, whales that hold more than 1% of the total circulating supply stand at 42%.

Having said that, a recent release by Santiment on-chain analytics agency also pointed out that the altcoin holdings of top non-exchange whales are on a rise. In fact, the addresses are at an All-Time High (ATH) of 26.22 million ETH.

🐳 #Ethereum‘s top non-exchange whale addresses have pushed to an #AllTimeHigh 26.22m $ETH held, as weak hands are releasing their coins on this dip. Meanwhile, top $ETH exchange addresses have dumped to 3.52m $ETH, the lowest amount since August, 2015. 😮https://t.co/xDgiDO0xbK pic.twitter.com/hPy5mCLBx3

— Santiment (@santimentfeed) January 24, 2022

What are the whales doing?

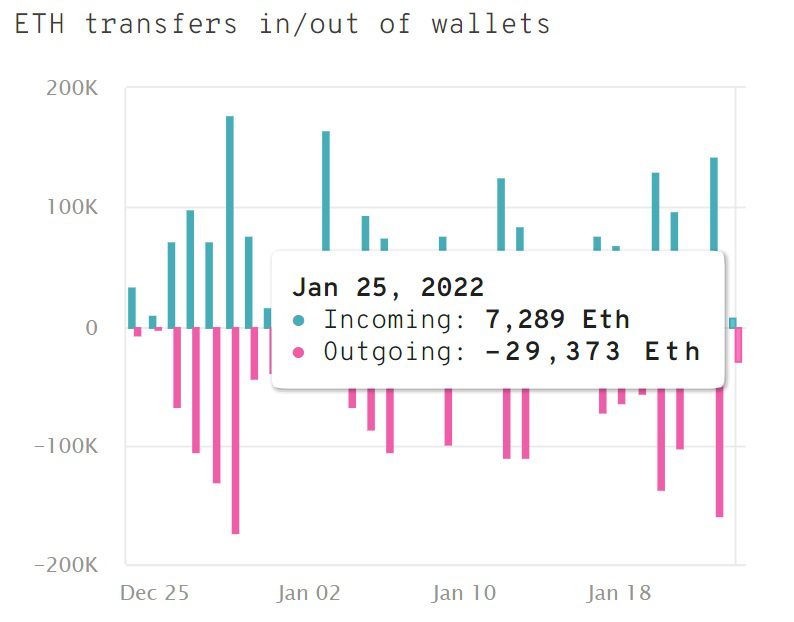

It is also worth noting here that an Ethereum Whale just purchased 500 million SHIB tokens. If we look at the last 24 hours, WhaleStats show close to 7000 ETH going in the top 1000 whale wallets and about 29,000 ETH moving out of these whale wallets. This could mean that these big holders could be diversifying their Ethereum holdings into other alts.

What’s bringing the price down?

Amid the price retreat, co-founder of Cobo Wallet, Shenyu, has noted that if Ethereum falls further down to $1,900, $600 million on MakerDAO will be liquidated, Chinese journalist Coin Wu reported. A further fall to $1,400 can see $1.7 billion in similar liquidations.

One of the reasons pointed out for the pressure on Ethereum is NFT issuers. Thousands of Ethereum tokens have reportedly been transferred from NFT marketplaces like OpenSea to exchanges, adding to the exchange inflows.

OpenSea and NFT issuers may be one of the pressures for ETH to crash. In the past two weeks, the amount of ETH transferred directly from OpenSea Wallet to Coinbase reached 21,000, and the amount of ETH transferred to royalty distributors reached 35,300. Source: @jx_block pic.twitter.com/WxuDwk3xic

— Wu Blockchain (@WuBlockchain) January 24, 2022

However, that’s not all.

The Net Transfer Volume from/to All Exchanges stood close to -59,000 on 24 January. This was a sign of more ETH flowing out of the exchanges than coming in.

On the other hand, if we look at the week ending 21 January, Coinshares Digital Asset Fund Flows are still negative for Ethereum in the sixth week. There is still nothing positive for the alt on this front as the total outflow stood at $16 million as of last week.

Is a bigger shakeup incoming?

Ethereum’s price might be reacting to different factors at this time, but the market should be bracing for other regulatory changes that might be possibly coming this year. Recently, Hayden Adams, the founder of the largest decentralized exchange protocol on Ethereum, Uniswap, took to Twitter to say that JP Morgan Chase has closed his bank accounts “with no notice.”

In response, former CFTC commissioner said that it is

“Likely a shadow de-banking of crypto by @federalreserve or @USOCC bank examiners, with direction from the top.”

Therefore, the crypto-market might be seeing bigger changes, especially with President Biden’s executive order reportedly on the way next month.

Also Read: With crypto winter back, the White House is making big plans for the sector