$9 billion in Ethereum was withdrawn from exchanges within the past three days, suggesting that whales might be accumulating.

A Massive 2.2M ETH Exited Exchanges In The Last Three Days Alone

As pointed out by a CryptoQuant post, on-chain data shows around $9 billion in Ethereum was taken off exchanges in the past few days.

The indicator of relevance here is the “exchange reserve,” which measures the total amount of ETH present in exchange wallets.

When this metric’s value goes down, it means investors are withdrawing their Ethereum from exchanges. Such a trend may be a sign of accumulation, and could be bullish in the long-term.

On the other hand, when the indicator moves up, it implies holders are moving their coins to exchanges either for withdrawing to fiat or for purchasing altcoins. This situation can end up being bearish for the crypto.

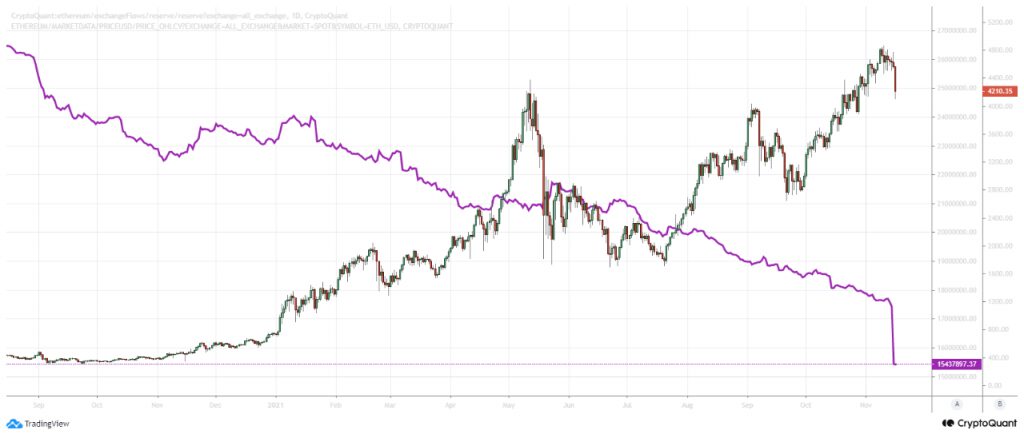

Now, here is a chart that highlights the trend in the value of the Ethereum exchange reserve over the past year:

Looks like the indicator has been dropping off for a while | Source: CryptoQuant

As the above graph shows, the Ethereum exchange reserves showed a very sharp decline over the past three days.

Related Reading | TA: Ethereum Nosedives, Why Bulls Could Struggle In Near Term

During this period, about 2.2 million ETH (more than $9 billion at the current rate) was taken off exchange wallets.

This is one of the largest quantities of Ethereum that was withdrawn in such a short amount of time. This could be a sign of accumulation from whales, or it could turn out to be a result of internal wallets transfer on an exchange.

Related Reading | Ethereum Scarcity: After London Fork, ETH’s Supply Change Drops To Almost Zero

But if it’s indeed because of accumulation from big players like institutional investors, then it could be quite bullish for ETH.

Also, the chart shows that the exchange reserves have been on the decline for a while now. As the exchange reserves effectively represent the available supply of Ethereum for purchase, such a constant decrease may be leading to a supply shock.

Due to supply-demand dynamics, such a prolonged trend can prove to be bullish for the cryptocurrency in the long term.

Ethereum Price

At the time of writing, ETH’s price floats around $4.2k, down 13% in the last seven days. Over the past thirty days, the crypto has gained 11% in value.

The below chart shows the trend in the price of the coin over the past five days.

Looks like ETH's price has declined in the past couple of days | Source: ETHUSD on TradingView

After rising above the $4.7k level again a few days ago, the coin has again dropped back down since, touching as low as $4.1k.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com