As the largest cryptocurrency, Bitcoin is gradually rising, numbers of altcoins have started to follow the same path. However, concerning the recovery race, the Zilliqa coin(ZIL) has indeed outperformed itself, registering a 240% in the last five trading sessions. This sudden pump in coin price was backed by the launch announcement of ZIL metaverse, ‘Metapolis.’

Key points

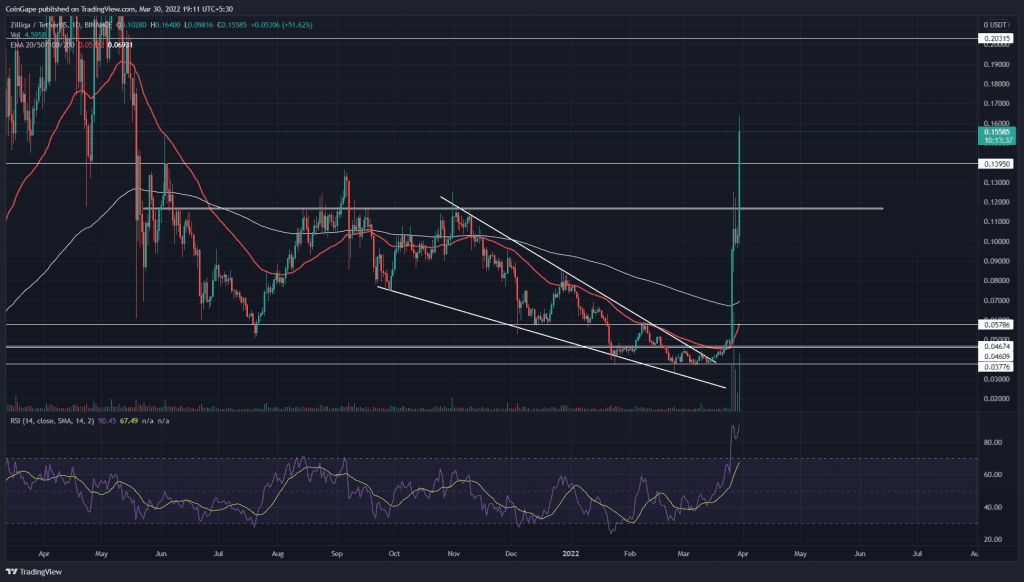

- The ZIL coin price gave a decisive breakout from $1.4, registering an intraday gain of $55.78%

- The daily-RSI slope surged into the overbought zone.

- The intraday trading volume in the Zilliqa coin is $458.4 Million, indicating a 3.37% loss.

Source- Tradingview

A falling wedge pattern carried the downtrend initiated in November 2021. The sellers dumped the altcoin to the $0.37 mark, which is the current bottom support for the ZIL traders. Furthermore, with an evident bullish divergence in the daily RSI chart, the buyers breached the pattern’s descending trendline on March 16th.

The ZIL price rose steadily and sliced through the $0.44 local resistance. Amid a series of events like the launch of Metapolis, various partnerships with other firms, and some hiring processes such as appointing Bradley Laws as its Head of Investors Relations, the coin price showed an upright rally of $240% gain.

Inviting beaches🏖️, sunny days☀️, and ice cold mojitos🍸. Miami is the go-to destination for amazing experiences, making it the perfect place to launch Metapolis.

Join us on April 2 when we open the doors to Metapolis, and a whole new world of possibilities.

Save the date! pic.twitter.com/7r6UgQ8jfX

— Zilliqa (@zilliqa) March 29, 2022

Moreover, the ZIL price climbed up a ZERO as it went from $0.048 to $0.18 in the last five days. The altcoin has recently breached an important resistance zone around $0.14, suggesting the buyers hope for another leg up.

However, the coin price might pull back to stabilize the aggressive buying. The expected support levels for a dip opportunity would be $0.14, $0.115, or $0.1 psychological level.

A post-retest rally could drive the ZIL price to a $0.2 psychological level.

Technical indicator

The Relative Strength Index(54) shows a similar parabolic rally entering straight into the overbought zone. However, The overvaluation of ZIL price accentuates a minor correction.

The upright rally has left crucial EMAs(20, 50, 100, and 200) slopes far behind in the daily technical chart.