The seven-day average fees of Ethereum are a whopping 39 times that of Bitcoin. Ethereum has been enjoying a good run, seeing prices spike by over 30% since the middle of March.

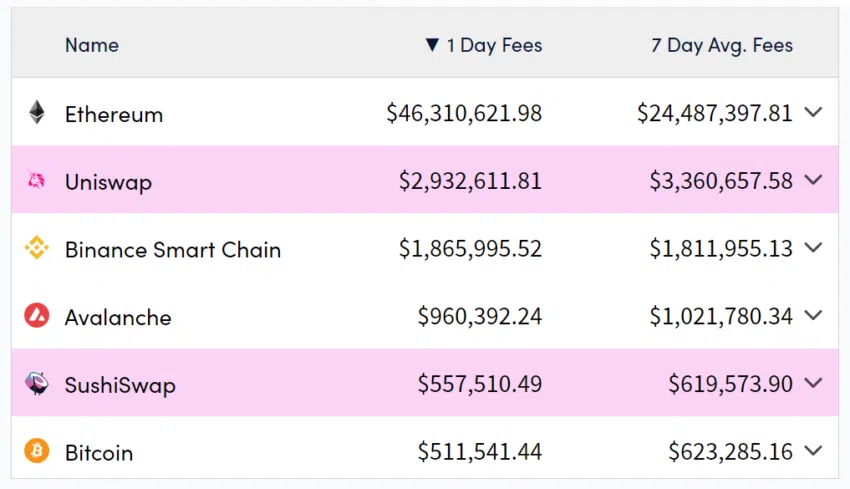

The network is currently seeing its fee revenue up 39x compared to bitcoin. The data comes from Crypto Fees, which shows a sizable difference over a seven-day period. Ethereum’s seven-day average fees stands at $24.4 million, while bitcoin’s seven-day average fees are at $623,000.

Ethereum is currently experiencing a lot of activity as its prices go up and investors find more confidence following some positive development incidents. A lot of the revenue comes from DEXs, which facilitate most of the activity in the Ethereum ecosystem. For example, Uniswap has generated over $3.3 million in fees over the past seven days.

Over the last 365 days, Ethereum has generated roughly $10.7 billion in transaction fee revenue. It has been experiencing a sharp rise, especially since Q4 2020. This coincides with strong activity in the DeFi and NFT spaces, which continue to dominate the market.

Total revenue on the Ethereum network has consistently been more than the Bitcoin network over time, as seen by data on Token Terminal. This number is only set to increase as Ethereum becomes more of a hub for DeFi activity.

There’s a lot to look forward to for Ethereum users as upgrades take place. 2022 will see scalability improvements to the network, which can only facilitate more usage. This, in turn, should boost revenue fees.

Ethereum looking set to grow as technical upgrades come into place

With Ethereum’s developers working on scalability improvements, and the merge already taking place on the Kiln testnet, Ethereum is set to have an excellent few months ahead. The network has been at the center of DeFi activity, though it has been plagued by performance and gas fees issues.

But that is all about to change as the upgrades of ETH2, now called the consensus layer, are incorporated into the network. This will lead to a marked improvement in the performance of Ethereum, which will do wonders for its price as well as general usage.

The merge is expected to take place on the mainnet later this year. That, as well as a growth in DeFi usability and new platforms, could attract many new investors to the market.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.