The crypto market has been volatile this year and after the March rally, it seems to be under pressure once again. The broader crypto market cap has slipped under $2 trillion and BitMEX CEO Arthur Hayes believes that the worst is yet to come.

In his latest opinion piece, ‘The Q-Trap’ Hayes speaks in detail about the changing global macro-economic trends. He further explains the weakness in the Nasdaq 100 (NDX) index and how Bitcoin and the crypto market have been closely related to it. Sharing the technical chart for Nasdaq 100, Hayes writes:

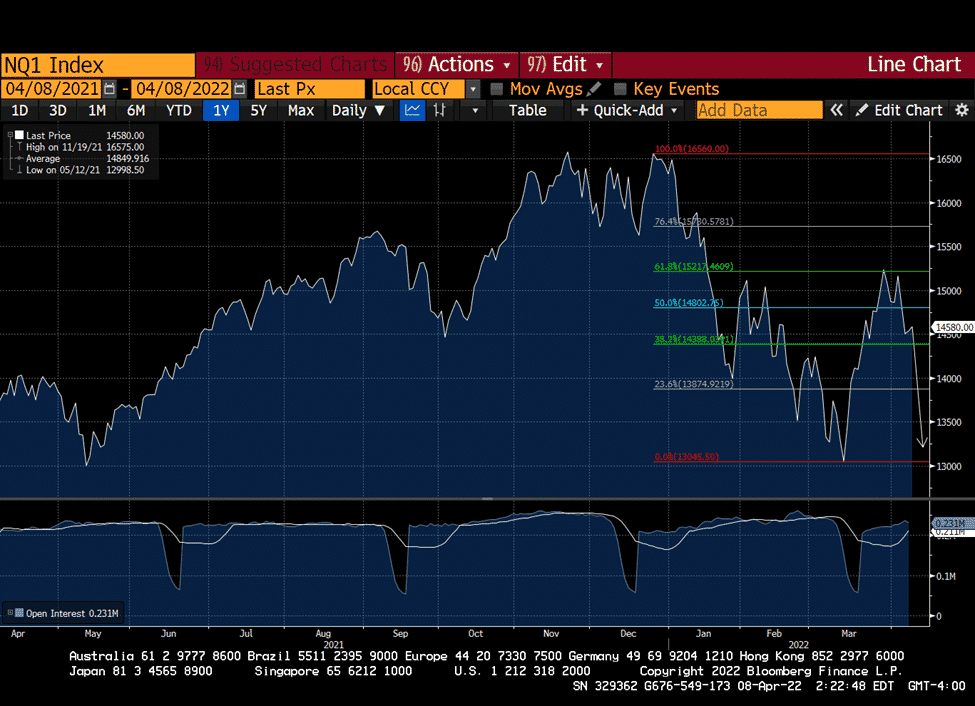

On 27 December 2022, the Nasdaq 100 closed at a high of 16567.50 and then subsequently hit a local low of 13046.64. Using the tried and tested Fibonacci Retracement, NDX failed to break through the 61.8% retracement on the bounce. A few days later it attempted to break that resistance level again, failed, and has continued lower ever since.

He further expects Nasdaq to break below its local low and slip to 10,000 and below it. On the other hand, he notes that as the Fed and other central banks have to deal with the inflation monster, they won’t be moving back from quantitative tightening anytime soon.

Crypto Crash 2022 Coming

Hayes predicts that there will be a strong ripple effect of the Nasdaq 100 correction over to the crypto market. “Bitcoin and Ether are highly correlated to the Nasdaq 100. If the NDX tanks, it will take crypto down with it. I am buying crash June 2022 puts on both Bitcoin and Ether,” he said.

Hayes also believes that Bitcoin and Ether will bottom before the Fed acts and reverses its policy from tight to loose. He adds that by the end of the second quarter this June 2022, Bitcoin (BTC) will hit $30,000 and Ether (ETH) can touch a bottom of $2,500.

However, Hayes adds that there are a number of altcoins he has started accumulating wherein he finds the valuations attractive.

Hayes adds that this is just his “prognosis” and he reserves the right to be wrong. In a concluding note, Hayes adds:

“This analysis is purely an attempt to trade a short-term situation that I believe will transpire in risk markets and hedge purchases of attractively priced altcoins”