Cardano is among the cryptocurrencies that come to mind when contemplating the most bearish top digital currencies from their all-time-highs. One of the reasons for its bearish performance is the Cardano blockchain’s gradual development.

The slow development has delayed Cardano’s ecosystem of organic growth and this has consequently affected ADA’s price action. This has especially been observed in its failure to bounce back significantly after every dip. However, the extended decline also makes it a candidate for another breakout.

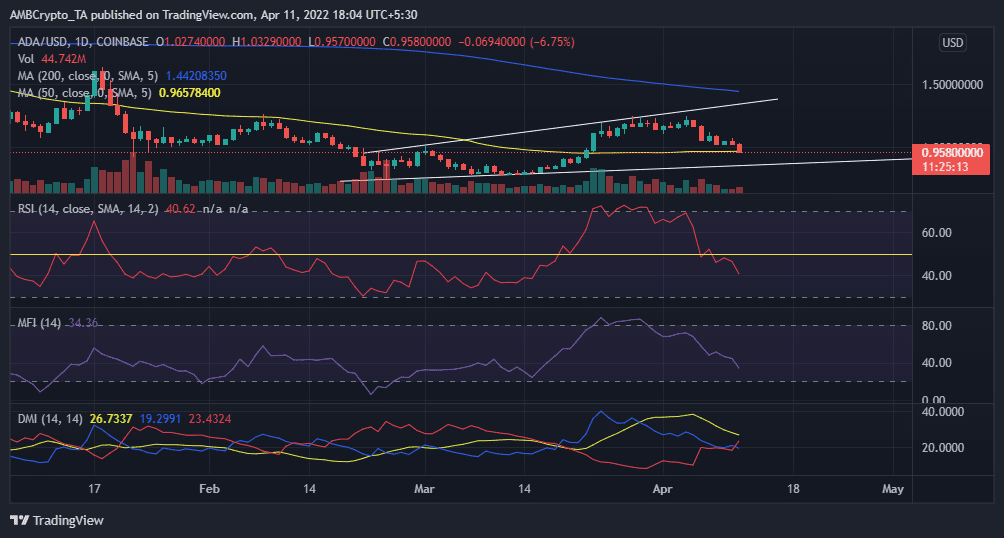

ADA showed promise in its latest bull run which saw it rally from its sub $0.80 lows to a new local top at $1.24. However, the cryptocurrency has since retraced to lower price levels and is currently trading at $0.96 after tanking by roughly 23.27% from its recent top.

Will ADA continue on the bearish trajectory or bounce back?

Perhaps ADA’s price action may offer insights into its near-term performance. ADA’s bearish trajectory still has some space to cover before it encounters support. Its RSI in the daily chart aligns with the price direction and the MFI confirms outflows in the last few days.

ADA’s 4-hour chart reveals that the price has already broken through the short-term support, a sign of strong bearish pressure confirmed by the DMI. However, the RSI is flashing oversold signals, suggesting the likelihood of a reversal to the upside in the short-term.

The short-term outlook is further enforced by a market cap increase in the last 24 hours as per its on-chain analysis. However, development activity has reduced in the last few days and so has its weighted sentiment.

ADA’s market cap increase is certainly something to consider especially since the price has been bearish for the last week or so. However, it is worth noting that it is a slight increase and most of the other metrics point towards a suppressed price action.

The above conditions do highlight ripe conditions for another short-term move to the upside. However, this is subject to the overall crypto market sentiment which is currently leaning on the side of fear.