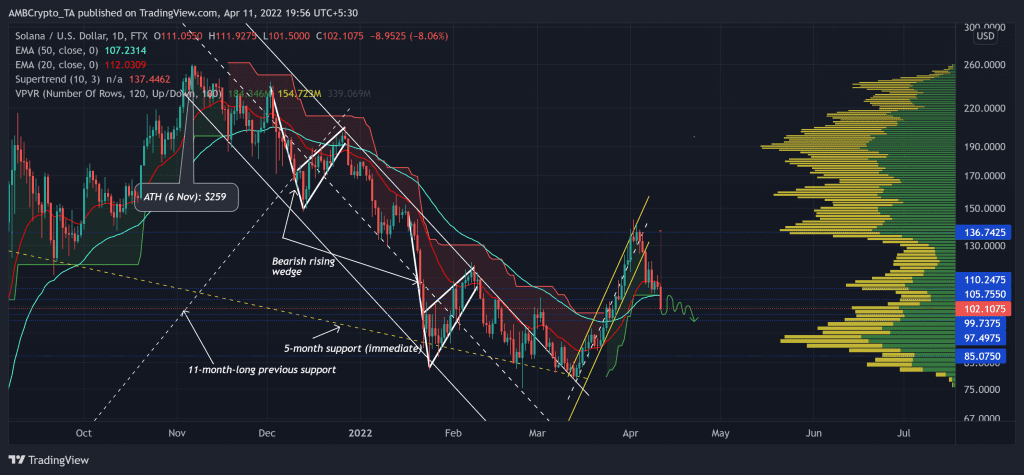

Solana’s (SOL) recovery has been in line with most altcoins in the market that rallied after Bitcoin’s revival from $37,700. While the sellers initiated a sell-off from the $136-mark, SOL saw an up-channel breakout.

A closer look at its daily chart revealed the possibility of further retracements. Should the 20 EMA (red) continue to plunge, SOL could enter into a squeeze phase in the $99-$105 range. At the time of writing, the alt traded at $102.1075, down by 7.9% in the last 24 hours.

SOL Daily Chart

The previous bearish phase saw a monstrous 71% retracement from its lifetime high. During this phase, SOL depreciated in a descending channel (white). But the bulls were visibly keen on upholding the six-month horizontal support at the $85-mark.

This resulted in a bullish comeback rally in which the Supertrend entered the green zone for the first time in four months. Consequently, the token gained over 83% between 14 March and 3 April. As observed in the volume range, the $136-mark offered high liquidity and resistance to the bull run.

While falling from the up-channel, the 20 EMA looked south while the Supertrend turned red. This trajectory hinted at a bearish edge that could lead to further retracements towards the $100-mark. Since that level offers strong liquidity, the buyers could step in and attempt to turn the tide in their favor.

Rationale

The RSI reaffirmed the overall bearish narrative as it lost the vital mid-line support. A continued southbound movement would only add fuel to its existent bearish fire.

Also, the Aroon up (yellow) still looked south towards the zero-mark. On its way down, it could propel further pullbacks on the price chart.

Conclusion

Considering the recent change in its Supertrend sign and the bearish readings on its technical oscillators, SOL could find itself in an extended decline. In this case, the buyers must ensure the $100-mark to prevent a heightened downslide.

Besides, considering the impact on the broader sentiment of Bitcoin’s movement would also be vital in making a profitable move.