FTX is a cryptocurrency exchange that lets users buy, sell, and trade supported coins. FTX also provides crypto loans and borrowing, as well as access to leveraged tokens and NFTs, as well as trading challenges and leaderboards.

FTX also supports over 300 coins, with more being examined and added on a regular basis.

To see if FTX is a solid alternative for crypto investors and traders, we looked at their platform, fees, user experience, customer support, available coins, and more.

Pros & Cons

Pros:

- Leverage and other advanced crypto products are available

- Low trading commissions

- Low trading commissions

- Built-in NFT marketplace

- Availability around the world

Cons:

- Trading tools and interface may be too advanced for new investors

- Not available in the U.S. (however it does have a US based version – FTX.us)

- There is no live chat support option

Tradable Assets

For spot trading, FTX provides over 300 coins, some of the assets supported on the exchange include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Ripple (XRP)

- Cardano (ADA)

- Dogecoin (DOGE)

Trading Features

FTX trading features include spot trading, plus options and futures trading with leverage, below are the features described in detail.

Spot Trading:

You can trade FTT, BTC, and other cryptocurrencies on FTX’s spot markets, which have a similar interface to futures. It offers approximately 100 distinct spot trading pairs in total.

Meanwhile, its American subsidiary offers almost 60 cryptocurrency and currency spot trading pairings, as well as options contracts denominated in 0.01 Bitcoin and 0.1 Ether crypto swaps.

Bitcoin mini futures are also available on the platform.

Futures:

Traders have access to margin trading with up to 101x leverage. There are over 100 quarterly and perpetual futures pairings on the platform.

Options:

Traders can use a variety of call and put options to speculate on future price direction and hedge against open positions.

Call and put options provide the holder the right but not the obligation to buy or sell at a future strike price.

Traders can use leverage to long or short options; at expiration, the futures contract settles to a dollar amount equal to the expiration price.

MOVE:

Traders can use these contrasts to predict how much the price of bitcoin will move over time. A margin based on the price of the underlying index is required for each MOVE contract.

The higher the predicted movement of a product, the more volatile it is. The costs levied on MOVE contracts are comparable to those levied on the underlying spot market.

Fees

The maker/taker fee structure at FTX is tiered, and trading costs are dependent on 30-day transaction volumes. Platform fees are reduced for holders of the FTT token.

Below is a table detailing the maker/taker fees on the platform:

Platform fees are reduced for holders of the FTT token. The following are the different levels of discounts:

FTX users may be charged withdrawal fees, as well as costs for trading or producing leveraged tokens, in addition to trading fees.

Security

FTX offers industry-standard security features, including the following:

- Two-factor authentication – Two-factor authentication (2FA) through an authenticator app such as Google Authenticator is required by FTX. There is also a 2FA hardway key available.

- Withdrawal lock – After large account changes, such as the removal of 2FA or a change in account password, FTX locks withdrawals on accounts for 24 hours.

- Third-party monitoring – Chainalysis works with FTX to monitor suspicious behaviour and transactions on the exchange, and Chainalysis sends alerts to the FTX security staff immediately.

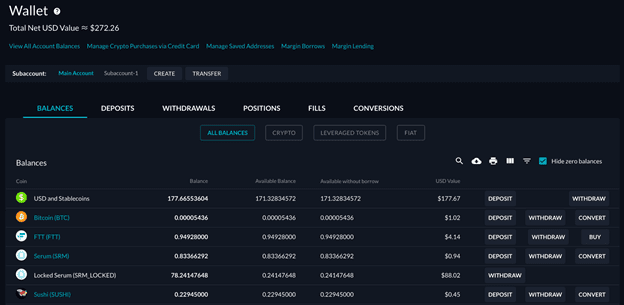

- Sub-accounts – Users can create sub-accounts with limited rights in FTX. Traders can use this feature to restrict other people from accessing their main account.

- Approved address whitelisting – FTX requires that all withdrawal wallet addresses be whitelisted, limiting access to permitted external wallet addresses.

Customer Support

FTX only offers customer support via an online ticket system, email and Telegram chat. The average time it takes for a member of FTX’s staff to react to a support request is not specified.

FTX vs Alternatives

Here’s how FTX compares against alternative cryptocurrency exchanges:

FTX vs Binance

Both FTX and Binance are cryptocurrency exchanges with cheap costs when compared to their competitors. Binance, like FTX, offers a partner exchange for US citizens called Binance.US.

However, there are some key distinctions between the two systems, such as:

- Binance has a live chat support option, whilst there is no live chat option available at FTX.

- The fees charged by Binance are slightly higher than those charged by FTX. Binance charges maker/taker costs ranging from 0.02 percent to 0.10 percent, whereas FTX charges maker/taker fees ranging from 0.00 percent to 0.07 percent.

- Over 400 coins are supported by Binance, whilst over 300 are supported by FTX.

FTX vs Coinbase

FTX and Coinbase are two of the most popular cryptocurrency exchanges in the world (by volume).

Both provide access to hundreds of cryptocurrencies and place a strong emphasis on security to protect users’ funds from fraudsters.

Here are the differences between the two:

- While Coinbase does not offer margin trading, derivatives, stocks, or even prediction investments, FTX does.

- Coinbase’s mobile apps provide built-in user education tools and news pieces, but FTX’s do not.

- Coinbase charges a fee for crypto conversions, but FTX does not.

- Coinbase is available in the United States, but FTX isn’t (though its sister site is).

Conclusion

Advanced crypto traders who want access to leverage, futures, and derivative products, as well as very low trading fees, should consider FTX.

FTX also offers a diverse range of cryptocurrencies, with new ones added each month. However, the trading interface on FTX is not for beginners, and new users may feel overwhelmed.