Decentralized finance (DeFi) protocols have diversified investment opportunities in the crypto industry by facilitating novel and innovative passive income generation schemes.

Delving a bit into how they work, DeFi systems are based on blockchain technology and run on programmable chains such as the BNB Chain and the Ethereum Network.

The chains use decentralized peer-to-peer (P2P) finance architectures to cut out the middleman and enable lending, borrowing and liquidity provision. This leads to higher interest rates compared to those provided by regulated financial institutions such as banks.

For perspective, many regulated banks provide interest rates of less than one percent per year, while some DeFi platforms offer interest rates of over 20% per year.

Investing in DeFi provides numerous benefits. Yubo Ruan, CEO and founder of Parallel Finance, told Cointelegraph:

“DeFi has immense potential for users compared to traditional markets. For example, DeFi trading is available 24/7 and 365 days a year, which can create new opportunities and even the ability to trade after hours alongside a full-time career independent of finance.”

“DeFi’s speed and efficiency create immense opportunities for moving in and out of positions very quickly for arbitrage for example. Additionally, no matter what background or money you have access to, you can have access to DeFi,” he said, adding, “There are more than a billion people who are unbanked and unable to use traditional markets. This is a massive benefit for the unbanked to access and invest with DeFi in a world where banks simply don’t exist for them.”

There are over 100 DeFi projects in the crypto sector today. As such, finding the ideal project can be challenging, especially for newbie investors. The following is a breakdown of factors to consider when choosing a well-grounded DeFi project.

Total value locked

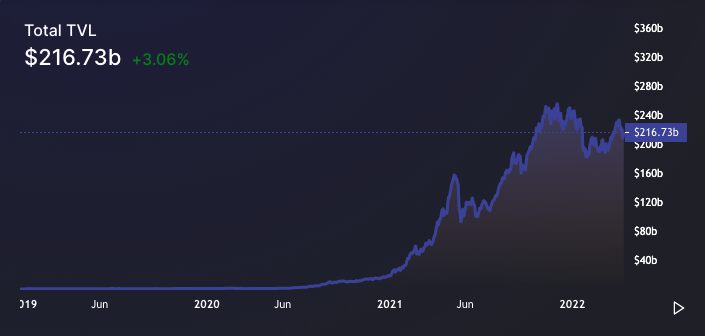

Total value locked (TVL) should be considered when looking for an outstanding DeFi project. A high TVL is a strong indicator of investor confidence in a platform and its core drivers.

DeFi projects with significant assets locked in custody are generally perceived to have more upside potential and are deemed to be more secure compared to those with low TVL. Projects with a consistently positive TVL growth rate are desirable.

Check the fully-diluted valuation

It is important to consider a DeFi token’s fully-diluted valuation (FDV) before investing. FVD in DeFi is the theoretical market cap of a token relative to the prevailing market price and the number of coins in circulation.

When the fully-diluted valuation is too low, the consistent increase of new tokens is likely to outpace demand for the token leading to a price drop. In DeFi investments, native tokens are adversely affected in low FDV market situations.

Token price stability

Promising DeFi tokens typically have a consistent long-term uptrend. Of course, rallies of over 30% within a short period of time are enticing at first glance, but they could be unstainable parabolic market reactions that are usually followed by a significant drop.

Pump and dump schemes play a role in some momentary price hikes. These types of ploys are prevalent in the crypto space and usually affect low and mid-cap tokens.

Subsequently, investors should disregard short-term price performances in the absence of other positive indicators and choose tokens backed by projects with stellar long-term growth fundamentals.

Risks

Risks such as platform exploits and rug pulls are common in the DeFi industry. As such, it is important for investors to do significant background research on platform security before investing in DeFi projects.

Security audits by independent cybersecurity firms usually reveal potential loopholes. Investors are advised to take these assessments into consideration.

Choosing the right DeFi investment strategy

Choosing the right DeFi investment strategy can yield significant returns. The following is an outline of some common DeFi investment strategies.

Staking

Staking is among the easiest DeFi investment strategies. It entails locking idle assets in a smart contract for a stipulated amount of time.

Staking a DeFi asset allows an investor to become a validator in a proof-of-stake (PoS) network. Proof-of-stake systems differ from proof-of-work (PoW) consensus algorithms, which usually require computing devices to validate transactions.

PoS mechanisms are run by validators who earn rewards based on the number of tokens that they have.

DeFi projects typically reward investors with governance tokens, which increase investors’ voting power. The coins can also be traded for other cryptocurrencies.

In DeFi, platforms that support staking usually also provide lending and borrowing services.

Related: How to stake cryptocurrencies in 2022, explained

Yield farming

Yield farming is a sophisticated investment mode that combines staking, lending and borrowing to optimize earnings.

Yield farming protocols typically have high returns. However, they also have higher risks compared to just holding prime cryptocurrencies.

In yield farming networks, users can, for example, use their staked assets as collateral to take out loans and buy tokens with huge upside potential. This is usually done to maximize staking rewards.

Utilizing leveraged products, however, magnifies losses.

Unlike in commercial banks, only collateral is needed to get a loan. No credit checks are performed. This is because the ecosystems are managed via smart contracts, which automatically enforce rules written in code.

Apart from borrowing and lending, some DeFi yield farming pools support token pairs to earn rewards. Putting money in these investment vehicles allows investors to earn a certain percentage in fees each time the tokens are used in a transaction.

Rising demand for certain token pairs typically leads to more trades and higher yields for investors. That said, investing in volatile liquidity pairs can lead to impermanent loss.

Related: What is yield farming?

DeFi indexes

DeFi indexes provide stakeholders with a diversified cryptocurrency asset portfolio. Their compounded structure is similar to that of exchange-traded funds (ETFs) in traditional finance. S&P 500 ETFs, for example, track the value of 500 major companies listed on United States stock exchanges. DeFi indexes have a similar framework but track cryptocurrency tokens.

The DeFi Pulse Index is an example of a popular DeFi index. It tracks projects with significant usage and a committed development team.

The MetaVerse Index is another notable DeFi index. It tracks a basket of tokens in various virtual environments such as sports, entertainment and business. Token market capitalization and liquidity weighting are taken into account when including a token.

DeFi indexes with a consistent long-term growth rate and low volatility are recommended.

Choosing a wallet and buying tokens

After determining the ideal DeFi protocol and investment strategy, getting a crypto wallet will help to facilitate token purchases. Crypto wallets are used to store coins that are needed to purchase tokens on DeFi platforms.

When choosing the ideal wallet, it is important to consider factors such as accessibility, compatibility and whether it is a custodial or non-custodial wallet. Software-based wallets, for example, offer higher accessibility and are more convenient when compared to hardware-based wallets.

However, hardware wallets are safer because of their sophisticated encryption mechanisms, which are designed to thwart most cyberattacks.

Some popular software, or hot, crypto wallets include MetaMask, Coinbase, Brave and Fortmatic. Trezor and Ledger are among the most trusted hardware, or cold, wallets.

Most popular wallets can connect to exchanges where DeFi coins can be traded. The first step in obtaining a DeFi token is visiting the protocol’s website and linking the wallet to buy native coins. One can then invest in the pool of their choice on the platform.