Bitcoin had finally broken past the $40,000 over the past 24 hours owing to Luna Foundation Guard’s (LFG) BTC buying spree. The price action was, however, dampened too soon as the coin after registering a hike of 7%, dipped by 4% at the time of writing. The 24-hour trading volume of Bitcoin also took a hit at the time of writing.

Bitcoin’s fear index read 28 which corresponds with the fear sentiment, this reflected fear surrounding another crash for the king coin. It turns out that there hasn’t been much impact on the prices even after the LFG Bitcoin purchase.

LFG at the beginning of this week had added 2508 BTC which is worth over $100 Million to its UST reserve. This has taken the BTC count to $42,406.92.

Additionally, the U.S inflation rate spiked by 8.5%, a rate that hasn’t been recorded in over 4 decades. The global cryptocurrency market cap stood at $1.95 Trillion after a fall of 2.5% in the past day.

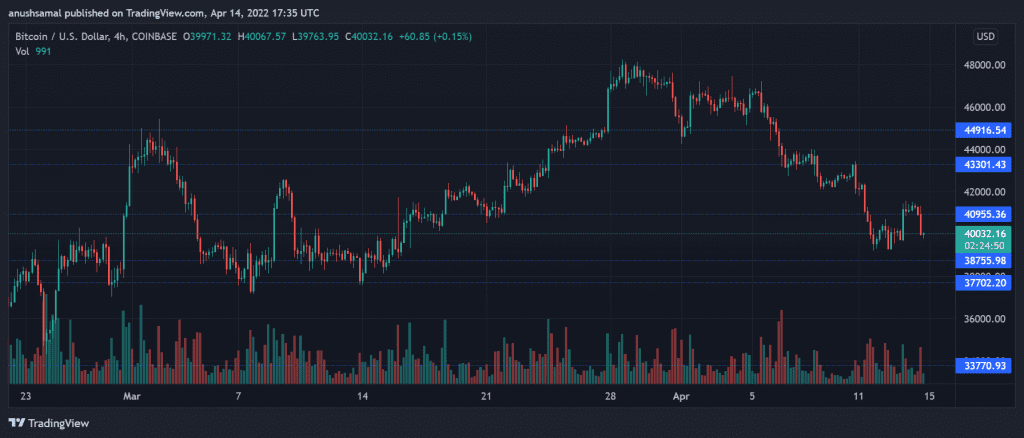

Bitcoin Price Analysis: Four Hour Chart

Bitcoin was trading for $40,030 at the time of writing, peeking slightly over the $40,000 mark. The coin had managed to break past its immediate resistance of $40,956 over the last 24 hours.

At press time, however, the asset was trading below the aforementioned resistance mark. Consistent push from the bulls over the next trading sessions could push prices up to $42,000.

A fall from the current price level would mean that BTC would trade near the $38,000 support line. Failing to stay above this, the next support levels stood at $37,000 and then at $33,000.

Trading volume had started to pick up at the time of writing as the last trading session closed in green signifying bullish action.

Related Reading | The Nightly Mint: Daily NFT Recap

Technical Analysis

Bitcoin had received a brief recovery in terms of buying pressure, however, after the recent fall buyers exited the market. For most of this month, BTC had witnessed considerably low buying strength.

On the Relative Strength Index, the coin was seen below the half-line which indicated that sellers were more than buyers in the market. This corresponded with the fear index too. For buyers to re-enter, broader market strength is required.

Chaikin Money Flow, which determines capital outflows and inflows was also in accordance with the RSI. Capital outflows were more than capital inflows as seen on the four-hour chart.

Related Reading | Ethereum At $3028, Where Is The Next Critical Support Level For ETH?

Bitcoin might try to reclaim its older levels as the coin again has been hovering close to the $40,000 resistance mark. The asset displayed a positive change in its price as reflected by the indicator above.

MACD determines the price movement of the coin.

BTC witnessed a bullish crossover at the time of writing which meant that over the next trading sessions, BTC could try teaching its immediate price ceiling. MACD had flashed green histograms at the time of writing which had meant bullishness.