Be[In]Crypto analyzes the Bitcoin Percent Supply in Profit indicator, analyzing the risk of this indicator falling below a support level, which could initiate capitulation in the BTC market.

The Supply in Profit indicator measures what percentage of BTC supply in circulation is currently recording a profit. In other words, the indicator determines the percentage of existing coins whose price was lower than the current price at the time of the last move.

While its holding at the 62.5% area as support, it’s possible that this could also become a signal for the bullish trend reversal. The risk of capitulation is also outlined in the Long-Term Holder Capitulation Signal indicator.

Supply in Profit indicator defends support

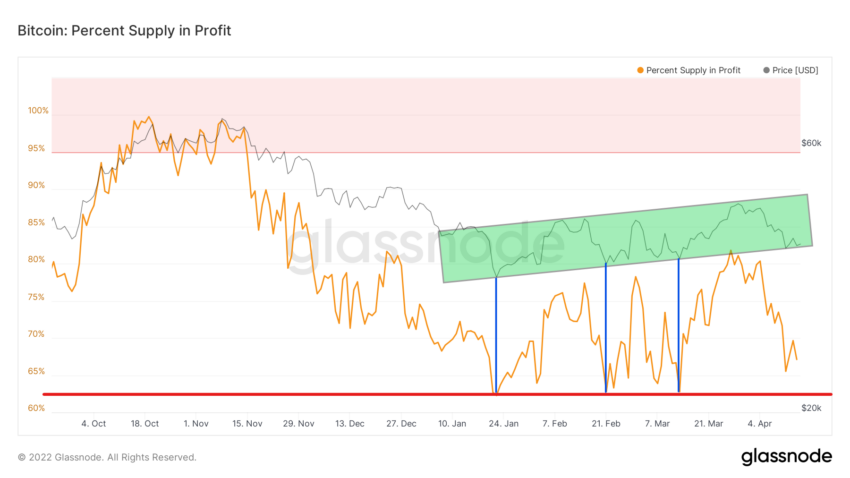

As of 2022, the Supply in Profit indicator has not fallen below the 62.5% level (red line). This year, it has bounced off the key support area three times, on Jan. 22, Feb. 21, and March 13, corresponding with local BTC price lows at $34,000, $36,350, and $37,555 (blue lines).

Currently, the indicator shows 67.1% and is in a short-term uptrend, as is Bitcoin’s price (green channel). Interestingly, the BTC price has reached the lower range of the rising channel, recording a bottom at $39,200 on April 11.

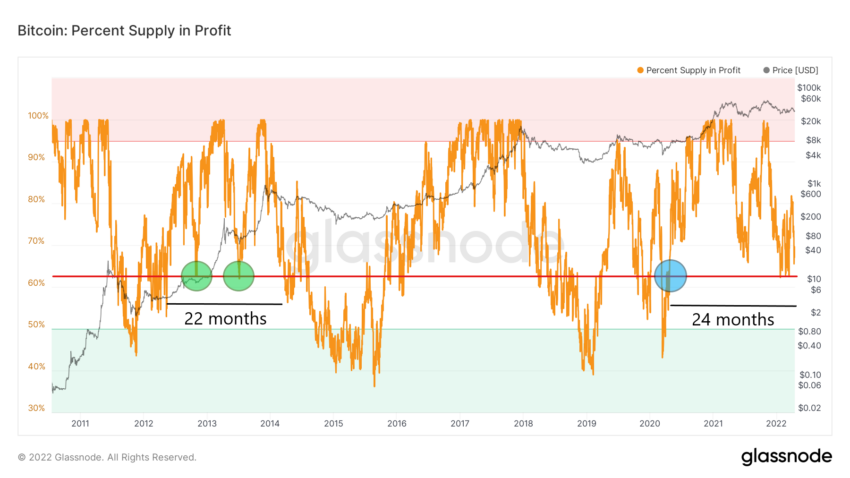

On a long-term basis, we see that Supply in Profit has been above the 62.5% level since April 2020 (blue circle).

We saw a similar situation during the bull market of 2012-2013, where the 62.5% area also served as support (green circles). During that same year, the Supply in Profit did not fall below the red line, which neared almost two years (22 months), between May 2012 and March 2014.

However, the loss of this key support led to a deepened bear market in both 2014 and 2018. Therefore, if the 62.5% level were to be broken in the coming weeks, capitulation in the BTC market could be expected.

Potential market capitulation

Upon further analysis, the indicator illustrates that the risk of capitulation in the Bitcoin market is still real. This is confirmed by another metric recently presented by a well-known cryptocurrency market analyst, @TheRealPlanC.

The Long-Term Holder Capitulation Signal shows periods where the BTC price drop was impacted by sell-offs from long-term holders.

Throughout Bitcoin’s history, this indicator has been below the 0 level four times (red areas), demonstrating a deepening bear market, which served as advantageous opportunities to buy Bitcoin.

As PlanC notes, there is “still room left to turn the trend,” but the red line area is getting closer. Its crossing does not necessarily lead to a deep capitulation, but it will certainly be an important red flag for the market.

One more chart that gives an interesting perspective on the possible BTC capitulation was published by analyst @OnChainCollege. The chart, Supply P/L Bands, shows two symmetrical charts of the 3-day moving average supply in profit (green) and loss (red).

The analyst notes that whenever the charts intersected, it was a signal of capitulation in the BTC market (circles highlighted). He notes that while “these metrics aren’t close to crossing,” they are “certainly approaching each other (orange arrow).”

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.