All the activity carried out in the options market usually has a direct impact on the price of the underlying asset. Major events like option expiries are usually awaited, as they end up giving the price a definitive direction.

Ethereum, at this point, is standing at an indecisive juncture. Its price has been consolidating in and around the $4.2k-$4.3k bracket for more than seven days now. Notably, the price upticks in the aforementioned period have largely been under 3%.

So, the question is- will the Ethereum market prolong its monotonous state over in the last week of November, or the market will witness some lively action over the next few days?

The upcoming expiries

At the time of writing, from the derivatives point of view, over 307 ETH are set to expire in two batches over the next few hours. The first batch, expiring on 25 November, is a minor one involving merely 14k ETH.

However, the expiry of 26 November is the biggest that the Ethereum market would face before the 31st December one. Well, over 293.2k ETH are set to perish on 25 November.

Now, as can be seen from Skew’s chart attached below, the number of calls are currently dominating the number of puts by a large margin. This suggests that a majority of traders are confident about Ethereum’s future prospects.

Source: Skew

A look into the breakdown below, further points out that calls or buy contracts is dominating the proceedings in the price bands above $4k. Puts or sell contracts, on the other hand, have a say in the lower price regions.

Since Ethereum’s price has relatively been revolving in the upper range of late, one can expect a buying spree to set in. More so, because call owners would be triggered to exercise their option of buying their respective ETH tokens. The same would aid in inching the asset’s price further, and more people would end up entering the market along ETH’s way up.

However, for the aforementioned chain-reaction to materialize, Ethereum would have to sustain its price level for at least the next 36-hours.

Source: Skew

Other key factors

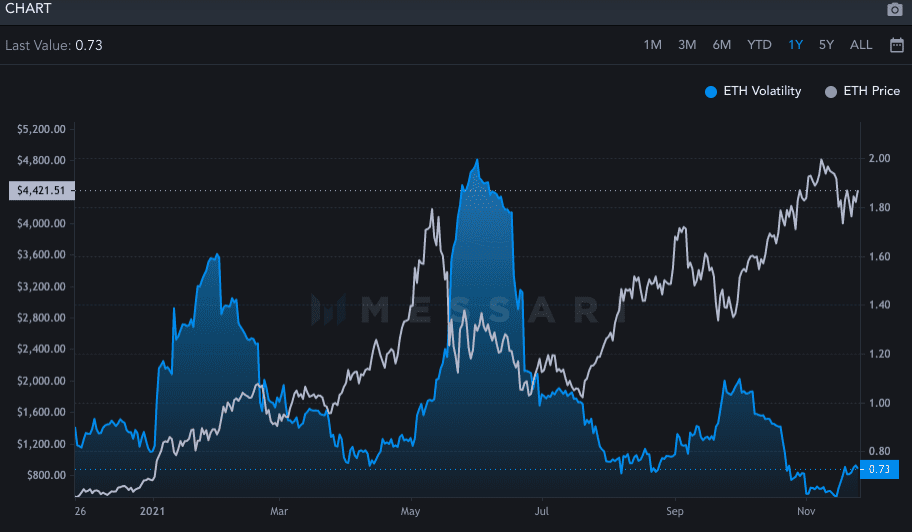

The volatility in the Ethereum market has fairly been under the control of late. As per Messari’s data, the same has been revolving below one throughout November. Now, it is a known fact that a less-volatile environment usually prohibits a major price swing.

Thus at this stage, it can be said that Ethereum would likely continue to revolve in the current price bracket over the next few hours.

Source: Messari

The largest alt’s velocity landscape has been calm and composed of late, which is quite a good sign. Interestingly, an uptrend is usually accompanied by steady velocity while a turbulent landscape opens up the door for corrections.

Well, things looked good on Ethereum’s price chart. Weekends have been fairly less dramatic than the weekdays throughout November. Further, as can be seen from the chart attached below the uptrend seemed to be definitive. At the time of writing, Ethereum’s price was seen hovering right under a crucial resistance.

If it manages to break above soon and give a confirmation, then, nothing much would stop its journey to $4.5k and beyond. Even if Ethereum gets rejected at that level, it has two supports levels that would most likely prevent it from dunking below $4k.

By and large, Ethereum’s near-term prospects, at this stage, fairly look good.