We’re not in the throes of late-stage capitalism; we’re living through the late stages and the death rattle of the post-1971 fiat system. Mistaking the two (and basing solutions or policies on this mistake) is a recipe for counterproductive interventions and missed opportunities.

Never in my life have I felt a more pressing sense that we are approaching the end of something; that, to paraphrase William Butler Yeats, the metaphorical center cannot and is not holding. I think this sensation of approaching finality, of historical transition and of fraying order has saturated and informed our politics as well.

The collective imagination and will of our two political parties is limited to revivifying Franklin D. Roosevelt or Ronald Reagan, with increasingly diminished results. Each party wants to return the country to its preferred trajectory, but these paths have converged and ended. Hence the creeping sense that we have reached some terminal point.

Many, particularly those on the progressive left, refer to this state of affairs, this liminal phase, as “late-stage capitalism,” a phrase rooted in Marxism (but not coined by its founder). The term’s meaning has evolved over time but has recently become a kind of nebulous catch-all term, a meme of lament for the yawning wealth gap and the absurdity of everyday life, which has come to resemble, in its (at times) cartoonish futility, a Samuel Beckett play.

Current events have only intensified the lament. This has led some to speculate (or boldly assert) that we have reached the end of capitalism as a viable economic system; that capitalism, left to its own devices, will continue to remove or degrade our societal Jenga blocks until everything collapses. We are merely witnessing the inevitable conclusion of a self-defeating system, they say. Its natural end point is either a neo-feudalism in which ultra-rich overlords mete out crumbs to the destitute masses or a collapse that, in its wake, begets an anarchic, balkanized state of nature, favoring the strong and the well-endowed who, minimally constrained, will trample the weak with impunity.

Faced with this bleak outlook, why not preemptively intervene and chart a course into a different system? Why not grant the state more power to coordinate economic activity? Why not redistribute the wealth before it all ends up in the hands of the already-powerful few?

I think most of us understand the impulse here. The idea that something is fundamentally broken and that something fundamental must change is pervasive. But the answer is not to conjure the senile ghost of Reagan, nor is it to remix Roosevelt. And it is certainly not to abandon capitalism altogether in favor of essentially academic alternatives — whether socialism’s worker-run state or some vague conception of a prelapsarian, agrarian utopia. But too often our discourse seems confined to these paradigms.

There are several reasons for this intellectual logjam. First, I think we’re trying to jam round reality-pegs into square, partisan holes. Second, I think we’re mislabeling the moment and misdiagnosing its flaws because our language has not developed beyond Cold War binaries of capitalism and socialism, bourgeoisie and proletariat, workers and capitalists.

I posit that we are, indeed, in the late stages of something, but this “something” is not capitalism. Now, we may eventually reach the end of capitalism — I’m not foreclosing that possibility, nor am I suggesting that capitalism doesn’t have inherent, intractable issues. But much of the contemporary tragicomic grotesqueness we ascribe to “late-stage capitalism” is uniquely enabled and facilitated by fiat currency and not wholly inevitable or innate to capitalism. What we are currently witnessing is late-stage fiat. More expansive suggestions about the end of capitalism are theoretical and premature. Consequently, our efforts should not be marshaled toward the jettisoning or transcendence of capitalism, but rather toward error-correcting the introduction and proliferation of the fiat monetary order.

Contemporary conceptions of late-stage capitalism are primarily based on or born out of the accelerating and intensifying inequality of wealth, which is seen as the inevitable and inescapable result of capitalism. These results, the argument goes, are inherent to and thus predetermined by a capitalist system.

But this is simply not as axiomatically true as we’re led to believe. Sure, capitalism entails degrees of wealth inequality, extreme iterations of which we’ve historically sought to rein in with myriad legal guardrails. But the obscenely stretched levels we have today, and which have been especially exacerbated in the last 15 years, are causally related to monetary policies enabled by fiat currency.

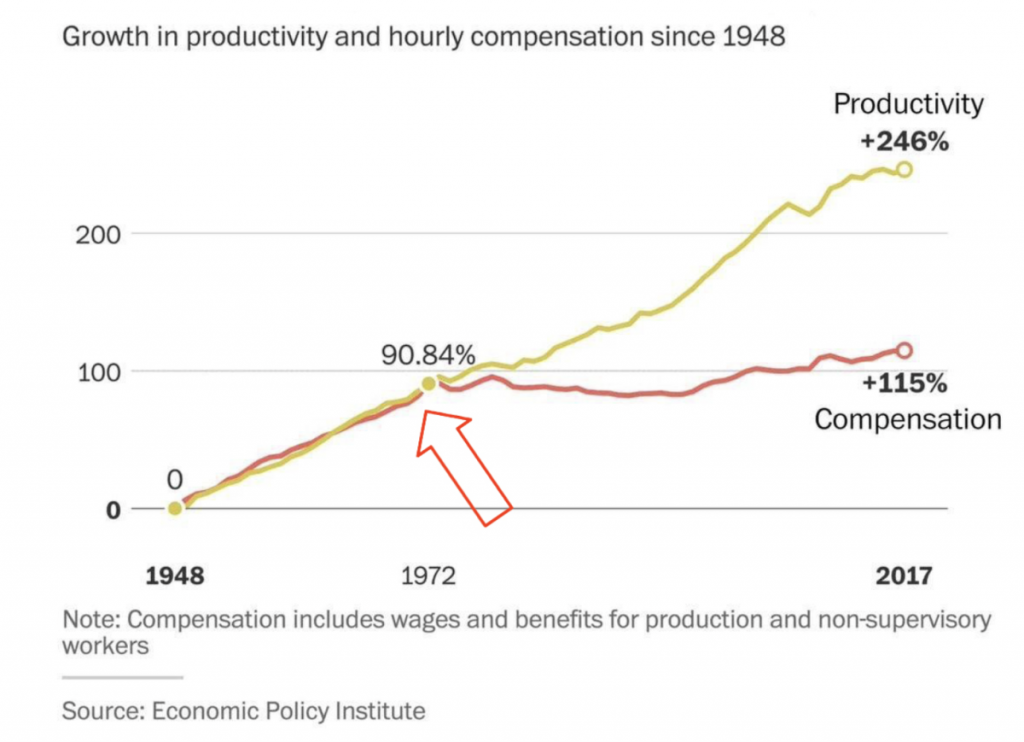

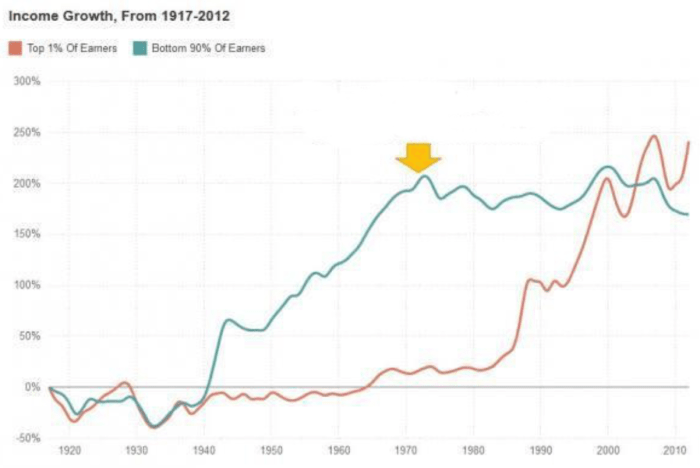

(Source)

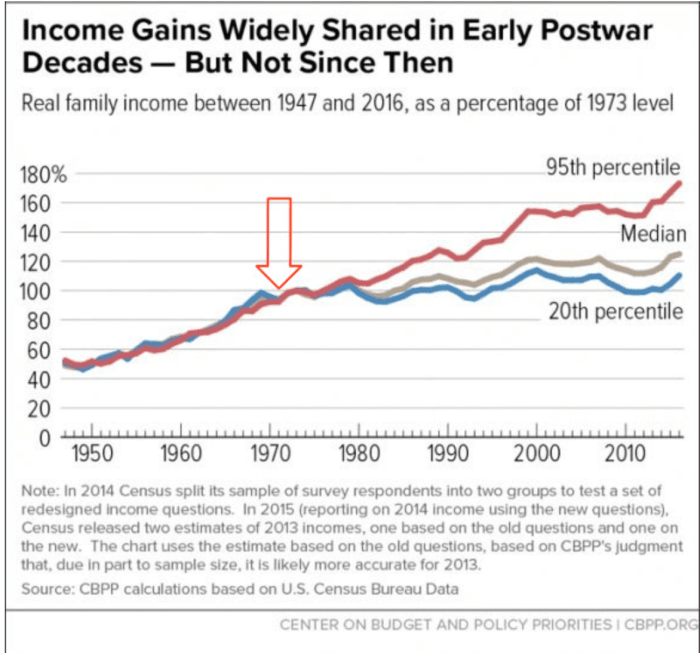

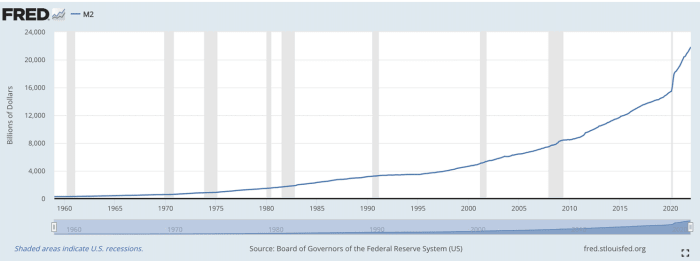

These charts show an inequality of wealth that has become increasingly acute since 1971, when we formally abandoned the gold standard and went to a full fiat system. From this point forward, we started expanding the money supply at an accelerating rate, culminating in the COVID-19 liquidity infusions.

(Source)

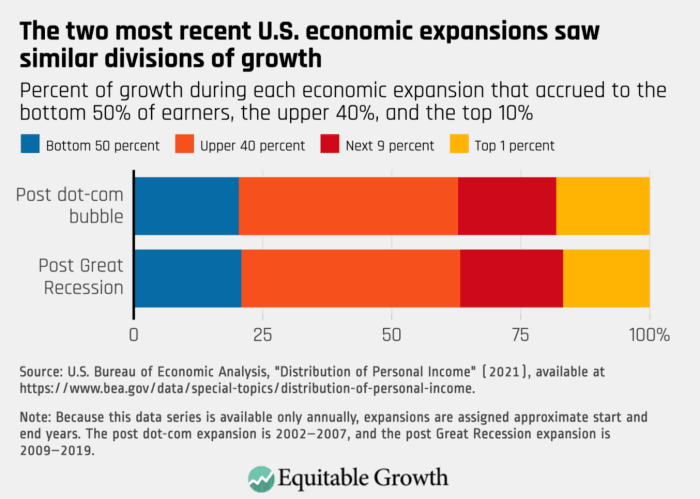

Increasingly, a rising tide does not lift all boats. This is because the bottom 50% of boats are not exposed to the tide. They’re not even in the water because they don’t own assets. This has only gotten worse in recent decades.

(Source)

The increasingly acute disparity is not the inevitable result of capitalism. Rather, it is the result of a fiat system in which those closest to, and exercising the most influence over, the rules of the monetary network reap the most benefits.

The anti-capitalism chorus reached fever pitch in the run-up to the 2020 election, as the fortunes of many of the world’s billionaires grew exponentially during the course of the COVID pandemic.

Almost entirely left out of this discussion was the role played by monetary policy. Let’s examine Elon Musk and Jeff Bezos, the poster boys of this growing wealth inequality throughout COVID. I am no apologist or cheerleader for either, but their fortunes were increased primarily by the Federal Reserve’s monetary policy. We flooded the economy with new money which, because of the Cantillon Effect, went first to the most creditworthy institutions and individuals, e.g., the wealthy, who then poured them back into assets, juicing the prices of those assets, which are disproportionately owned by the wealthy. You get the idea.

Here’s a chart of Tesla’s stock. Look what happened from March of 2020 onward:

(Source)

Here’s Amazon, which basically doubled after March of 2020:

(Source)

Someone like Musk, who owns a ton of Tesla stock, is made fantastically wealthy on paper. It’s not because he was ramping up exploitation over the pandemic. It’s because we printed a ton of money that, as is always the case, ended up pooling in assets and creating asset-price inflation.

The ability to print money at will (and remember, 40% of the dollars currently in circulation were created in 2020-2021), is an inherent feature of fiat currency. It is not an inherent or necessary feature of capitalism.

I would argue other phenomena often attributed to late-stage capitalism are uniquely enabled by a fiat system. The ability to wage war entirely on credit, for example, which distances the average citizen from the reality of war and thereby diminishes resistance to engaging in war, is enabled by the fiat system. This is elucidated in the work of Alex Gladstein.

The offshoring of labor and the hollowing out of our manufacturing capacity, which has crushed the working classes, has been facilitated and, in fact, necessitated by the dollar’s position as the reserve currency. This offshoring has only exacerbated wealth inequality.

I would lastly argue that the broad and ubiquitous breakdown of trust in institutions is related to fiat currency, as well. In a fiat-currency world, money itself lies. It can be manipulated and weaponized. To paraphrase Jeff Booth, when there’s misinformation at the base layer of society (which is the money), this misinformation leaks out everywhere. And we’re only at the beginning of this process.

This is not a problem inherent to capitalism. It’s a fiat-currency problem. The binary is not capitalism vs. socialism; It’s fiat vs. sound money. Much of our politics now is concerned with solving the wrong problem and jamming our very real systemic flaws into completely inaccurate Cold War binaries.

Properly identifying the plane on which the problem exists allows us to pursue effective solutions, like replacing the fiat system with one based on a neutral reserve asset with non-manipulable rules, i.e., Bitcoin.

This is a guest post by Logan Bolinger. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.