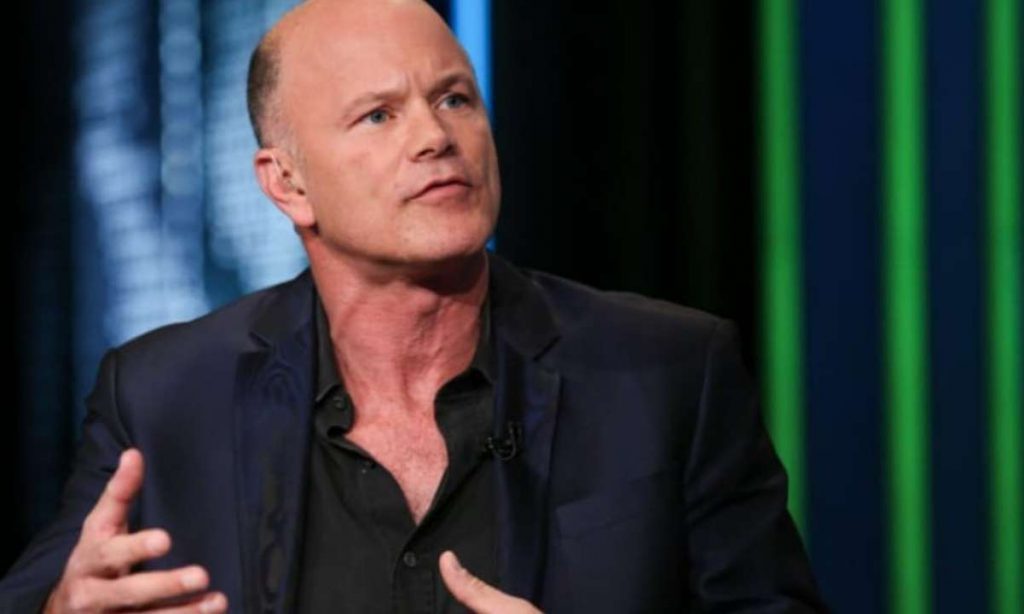

Mike Novogratz is not happy with U.S. President Joe Biden’s decision to pick Jerome Powell to chair the Fed for a second term. And he’s speaking not as a Bitcoiner but as an overall investor: He believes Powell could be detrimental to the markets’ growth.

In an interview for CNBC this week, Novogratz hinted that from his point of view, Jerome Powell had failed to understand the political and economic reality of the United States and that the markets have a similar view, being pessimistic about his tenure.

Careful With Jerome Powell

Speaking about the cryptocurrency market, Mike Novogratz said that “people are getting pretty bearish” on crypto after Jerom Powell’s appointment, especially following the changes in the “macro story.”

“We have inflation showing up, you know, in pretty bad ways in the U.S. So, we can see, is the Fed going to have to move a little faster … That would slow all assets down. It would slow the Nasdaq down. It would slow crypto down if we have to start raising rates much faster than we thought.

The United States is experiencing its highest inflation in 30 years. At 6.2% annually, the consequences are already starting to ripple through the rest of the world, with 39 of the 46 world’s largest economies showing higher inflation year-on-year.

Mike Novogratz argues that now that Powell has the confidence of a new mandate, he can be more aggressive with his policies without needing to measure his actions so as not to put his job at risk. And Jerome Powell’s thinking so far seems to favor an expansionary monetary policy.

Mike Novogratz Remains Focused on the Cryptocurrency Industry

However, Mike Novogratz is a cryptocurrency lover and doesn’t plan to stop being one. As CEO of Galaxy Digital, he has to constantly study market trends and expectations. He assures that the more distant future looks promising for cryptocurrencies after the short-term ups and downs.

The crypto ecosystem is growing, and more and more institutional investors are entering the game, spurring the industry’s growth.

“The amount of institutions Galaxy sees moving into this space is staggering. I was on the phone with one of the biggest sovereign wealth funds in the world today, and they’ve made the decision on a go-forward basis to start putting money into crypto. I’ve had the same conversations with big pension funds in the United States.”

Novogratz always argued —especially in 2017 and 2018— that institutional investors would play a major role in the rise of the cryptocurrency industry and that Bitcoin could easily reach $100K soon.

Last month, Novogratz warned that the end of the NFT rush could be approaching and advised investors to take profit and bet on Bitcoin or Ethereum.

As Cryptopotato reported on October 8, Novogratz explained that many NFTs trade for large sums of money primarily because of the emotionality of those involved and expectations – not because of proper fundamentals:

“That’s not normal, in any way, shape, or form … It seems to me like a pretty good time to at least book some profits, and fold it back into Bitcoin or Ethereum or another token.”

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to $1750.