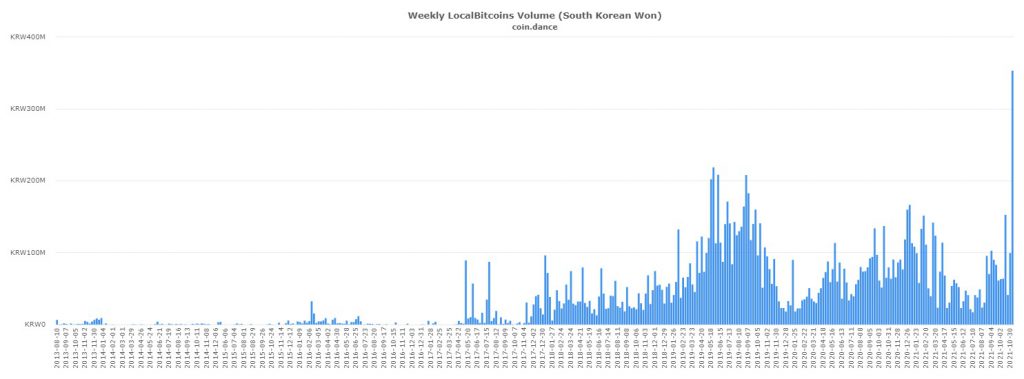

P2P crypto trading has hit a new all-time high in South Korea, data from LocalBitcoins shows. The jump in P2P trading comes at a time when there is a lot of uncertainty surrounding regulation in the country.

Peer-to-peer trading of cryptocurrencies in South Korea is hitting all-time highs as regulators offer some ambivalent comments on regulation. Data from LocalBitcoins shows that over 353 million in Korean Won was traded in the first week of November. This is a significant jump from previous weekly volumes.

Pondering crypto tax

The increased interest in P2P trading comes as regulators are working on implementing a regulatory framework. South Korea, already one of the leading governments when it comes to cryptocurrency market regulation, is doubling down on its bid to prevent any illicit activity.

The high P2P volume may be a result of investors seeking to make the most of their capital as regulators bear down. Recent reports have indicated that there is some confusion among investors because of the lack of clarity surrounding regulation.

One of the primary issues is the implementation of crypto taxation. South Korea officials announced that it would tax the asset class, to the tune of 20%.

But lately, reports have suggested that there could be a change or complete repeal to this taxation scheme. The taxation law will come into effect in 2022, though it remains unclear about what specific form it will take.

NFT regulation is also throwing more confusion into the mix, as the Financial Services Commission (FSC) said in early November that it would not subject the special asset to taxation. However, later, the Vice Chairman of the organization said that tax provisions would be made for NFTs.

Uncertainty still looms

At the moment, it’s uncertain exactly what the regulatory landscape in South Korea will look like, given the lack of conclusion so far. The South Korean opposition party challenged the taxation scheme and pushed for a delay to 2023, demanding a more generous tax plan.

Exchanges are one of the major elements of the industry under the microscope, with 2021 seeing the first regulatory compliance certifications being sent to them. Several exchanges have had to shut down following regulatory scrutiny.

As it stands, it’s unclear what the specifics of crypto regulation will be. However, it’s almost certain that there will be a framework implemented, and whether or not it is stricter than investors like remains to be seen.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.