The bearish trends of the market which have seen several cryptocurrencies reach new high lows were reflected in the overall total value locked in April.

Total Value Locked (TVL) has been the standard for measuring the success of decentralized protocols (dApps). According to BeInCrypto Research, there was a plunge in TVL throughout April. The total value locked by the end of the month was in the region of $202.55 billion. This was a 9% decrease from TVL on the first day of the month, which was approximately $223.99 billion.

Total value locked (TVL) is the total value of crypto assets deposited in decentralized finance protocols. TVL can also be said to represent the sum of all staked crypto assets that earn rewards and interests through decentralized protocols.

What contributed to the decrease in total value locked?

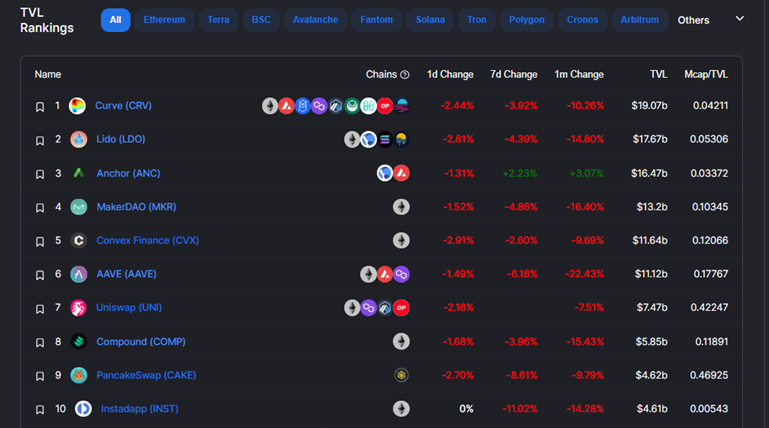

A drop in TVL in nine of the top ten decentralized protocols can largely be attributed to the cause of the decline in overall total value locked.

Curve (CRV) remained the dApp with the most value locked in April. On April 1, 2022, Curve TVL was approximately $20.76 billion. On April 30, 2022, Curve TVL was around $19.53 billion.

Lido Protocol (LDO) retained its position as the dApp with the second-most value locked in April. On April 1, 2022, Lido TVL was in the region of $18.77 billion. On April 30, 2022, Lido TVL was $17.67 billion. Similar drops in TVL were seen across the board during the month of April.

TVL declines across the board

MakerDAO TVL started April with $14.93 billion. However, by the end of the month, it had declined to $13.38 billion. Similar drops were seen with Aave (AAVE) which dropped from $13.77 billion, down to $11.92 billion. Compound (COMP) declined from $6.7 billion during the same time period, down to $5.93 billion.

Convex Finance (CVX), Uniswap (UNI), PancakeSwap (CAKE), and Instadapp (INST) all witnessed declines in TVL as well. Losing $660M, $170M, $230M, and $770M respectively.

Despite the drop in TVL in the above protocols, the Anchor Protocol brought gains. On April 1, 2022, Anchor TVL was $15.15 billion and on the last day of the month, Anchor TVL rose to around $16.6 billion.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.