The Consumer Price Index (CPI) in the U.S. has hit a three-decade high. It is noteworthy that the U.S. Labor Department data pins the non-seasonal figure at 6.2% over the last 12 months.

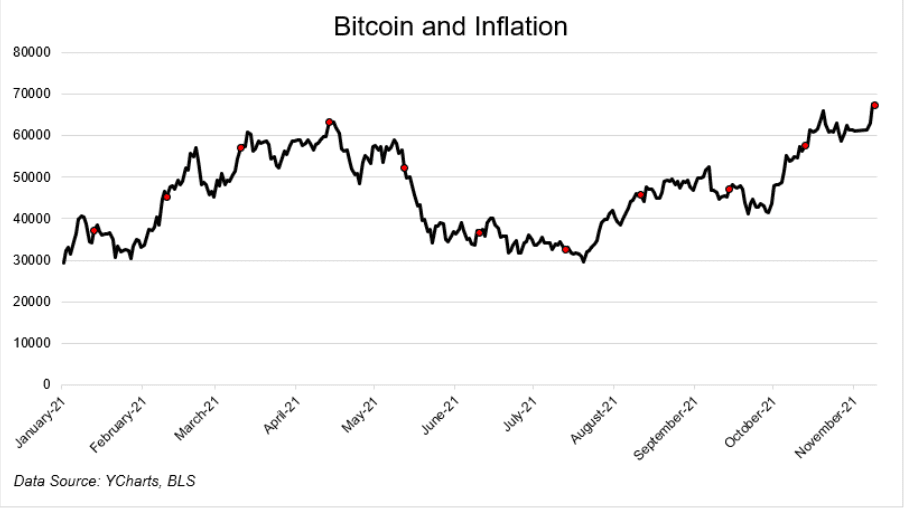

Source: theirrelevantinvestor.com/ red dots represent CPI releases

Bitcoin and inflation pairing well

Naturally, the significantly higher inflation number than what the market expected turned into positive news for Bitcoin and other correlated crypto assets.

On the back of which, BTC hovered close to an ATH of $69k on Wednesday. That’s a market value rise of as much as 1.9% with other major cryptos gaining 2.4% on the Bloomberg Galaxy Crypto Index.

It is not news that many in the crypto community consider Bitcoin akin to digital gold, to hedge their money against price rise. As a deflationary asset with limited supply, the argument remains that it is out of both government’s and central bank’s control.

With a price rise of 0.9% in October, Lawyer Preston Byrne commented,

“According to official numbers, your money is now losing 1% of its value every 30 days”

And, some analysts even fear that the ‘inflation situation could get worse before it gets better,’ pushing more investors to hedge that value loss by parking money in Bitcoin.

Hedge or no

In the past as well, JP Morgan had associated the Bitcoin price rally with the resurgence of inflation fears. Now, that the CPI figures stand at a 3-decade record high, the pertinent question- is the rally here to stay? Last week, JP Morgan strategists had pinned Bitcoin’s current fair value at around $35,000, on the back of its volatility.

But, they noted if the “relative volatility gets halved into next year,” then a price target of $73,000 “seems reasonable.”

However, the inflation outlook is ‘sticky.’ Among many voices, Economist Steve Hanke has called the inflation figures ‘persistent’ instead of just ‘transitory.’

In this context, Arizona State Senator Wendy Rogers had also commented “crypto is better than fiat” and added,

Say no to Fedcoin. Say yes to private crypto.

— Wendy Rogers (@WendyRogersAZ) November 9, 2021

According to Sui Chung, chief executive of CF Benchmarks,

“[Bitcoin rally] seems to now be fueled by the sustained inflation that we are witnessing across all the world’s major economies.”

Economist Peter Schiff disagreed with the Bitcoin narrative that it is the better inflation hedge than gold and drew a comparison.

In reaction to hotter than expected #inflation data #gold rose $18, closing near $1,850 per ounce, its highest level in five months. But while #Bitcoin initially pumped to a new all-time high close to $69,000, the ensuing dump sent it tumbling 8.5%, back below $63,000 at the low.

— Peter Schiff (@PeterSchiff) November 10, 2021

Crypto commentator Anthony Pompliano argued against “politicization” of the topic, commenting,

“I don’t think anyone’s advocating for the collapse (of) legacy system.”

Instead, he said that Bitcoin advocates are pushing the asset as gold 2.0, as “gold has failed during high levels of inflation.”