As of March 2022, research from statista.com shows that there are over 10,000 Cryptocurrencies in the world. This gives investors a wide range of options on which Cryptocurrency to Invest. So, let me guess, you’re probably looking for a safe and secure crypto project to invest in or trade with prospects of high return in 2022?

Well, you might want to consider adding the HBAR token of the Hedera Hashgraph project to your crypto portfolio, as the recent market structure offers low prices to build up a long position on the HBAR token.

Read on, and let us show you how.

What is Hedera Hashgraph (HBAR) ?

The Hedera Hashgraph focuses on the same use case as the blockchain offering a public distributed network for storing transactions. However, the Hashgraph follows a rather different approach by using a novel Directed Acyclic Graph – DAG, a different architecture that offers all the benefits of a blockchain but does away with its scaling issues, and low transaction speed among the popular blockchain trilemma.

Although the DAG is also used in famous crypto projects such as IOTA and Byteball, the Hashgraph was developed by Leemon Baird. Baird, an American, patented the Hashgraph in 2016.

Trending Stories

Let’s present a simple explanation of how the Hashgraph consensus works under the hood.

– Participants on the network, otherwise called “Nodes” use the Gossip protocol to exchange data.

– Two random nodes receive information about a transaction, who in turn transmit it to two other nodes, a continuous process till a sufficient number of informed nodes can verify the transaction.

– Only transaction data is exchanged between nodes, without other network information.

– Unlike blockchains that store transactions in blocks, the Hashgraph stores transactions in Hashes and chronological order.

Products currently offered by the Hedera Hashgraph include HBAR, the cryptocurrency, the possibility to write smart contracts, and file service. Following the network’s KYC procedure, any user can easily set up an account or create dApps on the network.

Market Size and the future of the Hedera Hashgraph project

As at press time, the Hedera Hashgraph has a total maximum supply of 50 Billion USD and current circulating supply of 20.74 Billion USD. Hbar came up with a novel idea to solve the general scaling problem that’s currently plaguing the crypto-blockchain ecosystem by deploying a unique architecture for a distributed ledger technology (DLT).

In addition to the unique architecture, Hedera also uses a proof-of-stake (PoS) as consensus, making it a leading player in the green crypto niche.

Another worth mentioning selling point for Hedera is transactions that are as low as $0.0001USD, in addition to claims of handling up to 10,000 transactions per second in comparison with the 5-20 TPS for most proof-of-work blockchains.

The Hedera Hashgraph has so much more to come in the future as it still has thirteen available slots out of the allocated thirty nine slots for the world’s leading organizations that govern the network (https://hedera.com/council).

Fundamental Analysis

The above chart shows HBAR’s release schedule for six years, where 23% of HBAR coin will be released by the end of the current year 2022, 27% at the end of 2023, 32% at the end of 2024,and the rest 34% at the end of 2025.Such steady progression means that there will be no sudden hike in supply that could crash the price of the HBAR coin and growing demand for the utility of the network would drive the price higher.

Also, it’s very unlikely that founders of Hedera, Leemon Baird and Mance Harmond would be able to dump their coins on the market as they have delayed the release of 76% of their HBAR holdings till the end of 2023.

The pie chart above highlights the distribution/allocation of the 50 Billion non-inflationary HBAR coin among the different stakeholders.

Hbar Price Prediction 2022 :

The above monthly chart of the HBARUSDT shows a decline in demand for the HBAR token starting from the breakdown of the 0.3036 support on December ’21.A second breakdown of bullish inside-bar support (0.1937) last month forced the RSI reading below level-25, confirming lower prices to stack up more HBAR tokens at a price discount.There’s no better time to buy into the HBAR token than when the prices are low.

Keep in mind that it’s always safer to buy more HBAR tokens when there’s extreme fear in the market and it’s better to sell and lock in profits when the market is extremely greedy. Therefore, we project that the HBAR token will range between the $0.073 and $0.27 price zone by the end of 2022

Hbar Price Prediction 2023 :

Following the expected market cycle for the current year, the next year 2023 is projected to see an entry of the overbought RSI level-75 after an exit of the oversold price zone of RSI level-25, also known as the crypto winter and quickly scurry for the $0.40 price target before it finally breaks above the current all-time high at $0.58.

Hbar Prediction of the next 5 years:

The entire cryptocurrency market would have fully developed in the next five years and the HABAR token is going to be a major player that institutional investors will be doubling up their bets on as the DAG architecture would have been tested and the market HBAR token would have experienced its first crypto winter.

Plotting a Fibonacci projection on the December ’19 and February ’20 price swing, we project a price range of $0.755 at the 2.0% Fibonacci level and $1.3775 at the 2.272% Fibonacci level.

Coingape Experts Analysis :

Other cryptocurrencies follow a similar DAG architecture as the Hedera Hashgraph. These include IOTA (Internet of Things application), NANO, and Obyte (Byteball). The closest in competition to the Hashgraph is IOTA since it has been around for a much longer time and has experienced and survived a crypto bear market.

Going forward, we’ll be looking at the technical/implementation difference, Adoption metrics, and Enterprise/Industry agreement to gauge the competitor analysis with IOTA.

Technical differences between Hedera Hashgraph and IOTA

Looking at the technical differences, the Hashgraph is more secure and fault-tolerant, which means that it is not centralized, unlike IOTA which requires a centralized coordinator at inception in 2018, though there is news that IOTA 2.0 is leaderless, meaning no coordinator and its currently in Devnet.

Another worth mentioning technical difference is that Hedera is permissioned i.e enterprise-focused compared to IOTA 2.0 which is a public-facing decentralized DAG solution.

Adoption metrics

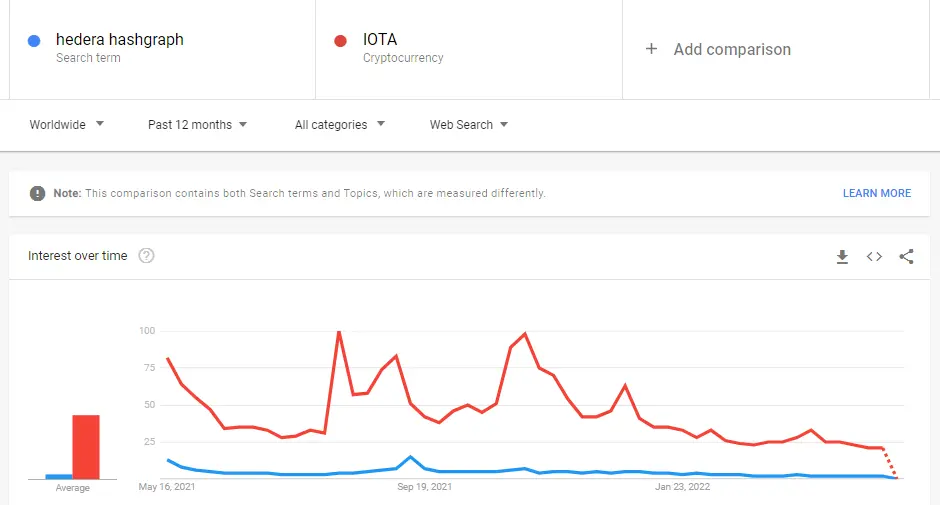

Let’s measure the adoption metrics of Hashgraph vs. IOTA by taking to Google trends. Looking at the above chart analytics, IOTA has a higher adoption figure compared to the Hedera Hashgraph which can be attributed to its first-mover advantage.

Both HBAR and IOTA are generally seeing a decline in search trends, owing to the current decline in the price of cryptocurrencies across the board. However, time and time again, the cryptocurrency market has shown us that following a contrarian approach and buying the dips and HODL (Hold on to Dear Life), has been a profitable strategy.

Enterprise/Industry agreement

Following a news release on February 03, 2022, the HBAR Foundation partnered with the global video game publisher Ubisoft to support the growth of gaming on the Hedera network, making Ubisoft a member of the Hedera governing council.The Hedera governing council also comprises existing partners of the Hedera Foundation, which includes but is not limited to companies like Boeing, Chainlink Labs, Google, IBM, LG, Standard Bank, and Swirlds, to mention a few.

Follow the link below for details of companies in the Hedera governing council.

(https://hedera.com/council).

Markets Prediction for the Token

Despite the current price plunge across the cryptocurrency market, analysts on TradingView still hold a strong opinion towards a bullish price trend for the HBAR paired against the Greenback.

FAQs

Q: Will HBAR go up in 2022?

To answer this, we’ll have to use an index to gauge the current trend and the possibility of a change in polarity. Following the relative strength index on the monthly time frame, it’s clear the HBAR token is currently in a downtrend as it hovers below the level-25. If we get RSI readings above level-75 this year 2022, then we should see an increase in demand and consequently a surge in the price trend.

Q: Can Hashgraph flip existing blockchain architecture?

Compared to existing blockchains like Bitcoin and Ethereum, the Hashgraph’s security and promises have not been put to the test though it shows great prospects, so only time will tell.

Q: Is HBAR worth trading for the long term?

Our experience in the blockchain gives us the confidence to trade the HBAR token as a long-term bullish holding on the spot crypto market.

Q: What trading strategy is best for trading the HBAR token?

Momentum-based trading strategies generally suit the cryptocurrency market and the HBAR token is not an exception. Our preferred indicator for momentum trading is the RSI (4), buying when the RSI of the HBAR token goes above level-75 while paying attention to bullish divergence chart setups.