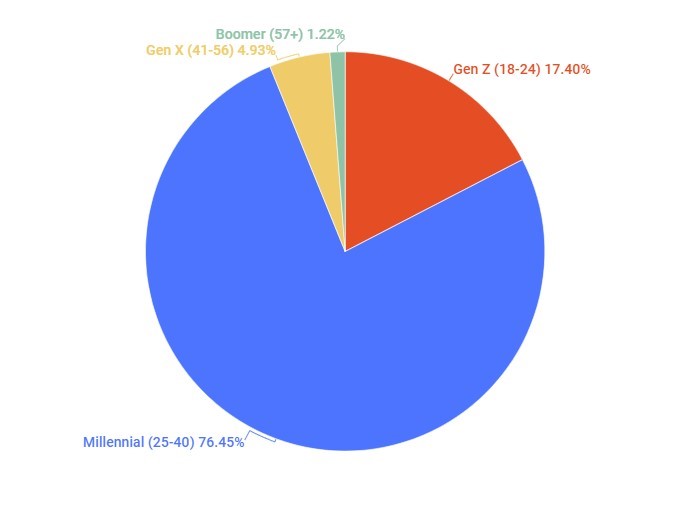

- 94% of crypto investors are Gen Z and Millennials.

- In detail, 17.40% are Gen Z, while 76.46% are Millennials.

- While Gen Z and Millennials are the majority, Gen X are outspending them in the crypto sphere.

As cryptocurrencies concur the world, more and more people are either investing or considering investing in crypto. While the future of cryptocurrencies is yet to be decided, statistics show that 94% of crypto investors are Gen Z, also known as Zoomers, and Millennials.

According to statistics, Zoomers, the age range of 18-24, are 17.40% of the total number of investors, while Millennials, the age range of 25-40, are 76.46%. Meanwhile, 4.93% of all crypto investors are Gen X (41-56), and only 1.22% are Boomers (57+).

While the crypto market is only 13 years old, and it is still suffering from brutal ups and downs due to various reasons, number of investors is still growing. Yet, one thing to be noticed is that while Gen Z buyers outnumber Gen X by 3.5x, as Millennials also outnumber Gen X by 15.5x, Gen X turned out to be the most generous buyers.

When it comes to spending, Gen X are on the top of the list with a number of $9.611 in 12 months, followed by Millennials with $8,596, Gen Z are after that with $6,120 and Boomers are last with $4,567.

In a closer look to the facts, these numbers can be very expected. Gen Z were born during the mid 90s and the early 2000s, which naturally means that they grew up at the same times when people first knew the internet.

In other words, Gen Z grew up online, when early games were the fresh start of virtual communities. Along with that comes the seduction of the decentralized nature of the digital assets.

Millennials, on the other hand, were also in direct contact with the internet ever since they started growing up. While Gen X and Boomers were late for this development. Being more in touch with the online world could keep an open mind to new markets and products such as cryptocurrencies and NFTs.

Another factor is these categories’ stability in life, since making a generous investment requires stability to guarantee limiting the risks.

There are a lot of reasons for these statistics to have such numbers, yet it all results in crypto being a blooming market as the world develops to a higher level of technology.