The past week in the decentralized finance (DeFi) ecosystem was dominated by Terra’s collapse and its aftermath on various ecosystems it was connected. Now BNB chain has come to the rescue of several stranded projects on Terra by offering financial and technical assistance.

After its spiral collapse, Terra co-founder Do Kown proposed a revival plan and a hard fork to revive the blockchain. Chainalysis introduced new tools to monitor and track stolen funds across multiple blockchains. Swiss asset manager Julias Baer is eyeing crypto and DeFi potential.

Top DeFi tokens saw another week of bleeding, with the majority of these tokens trading in red over the past week.

Do Kwon proposes Terra hard fork to save the ecosystem

Do Kwon, co-founder of the troubled Terra Luna blockchain, announced a revised plan to restore the ecosystem after significant market volatility and inherent protocol design flaws wiped out a vast majority of the blockchain’s market cap. As told by Kwon, Terraform Labs proposed a new governance model on May 18 to fork the Terra Luna blockchain called Terra (token name: LUNA).

However, the new chain will not be linked to the TerraUSD (UST) stablecoin. Meanwhile, the old Terra blockchain will continue to exist with UST and be called Terra Classic (LUNC). Under Kwon’s plan, if passed, the new LUNA blockchain will go live on May 27.

BNB Chain offers another lifeline to Terra ecosystem projects

Binance will welcome migration and provide support to projects from the Terra ecosystem following this month’s unraveling of the DeFi platform and its algorithmic stablecoin.

BNB Chain (BNB) has committed to providing investment and support to projects considering migrating from the Terra ecosystem in the wake of the biggest black swan event to hit the cryptocurrency space in recent years.

DeFi-ing exploits: New Chainalysis tool tracks stolen crypto across multiple chains

Chainalysis launched a beta version of its Storyline software on Wednesday. Touted as a “Web3-native blockchain analysis tool,” Storyline aims to track and visualize smart contract transactions with a focus on nonfungible tokens (NFTs) and DeFi platforms. This is in line with the growing popularity and prevalence of NFTs and DeFi in the cryptocurrency space over the past year.

Chainalysis provides blockchain analysis and annual reports on cryptocurrency crime trends and other analytics. The ever-changing landscape has seen DeFi and NFTs become important cogs in the ecosystem, with Chainalysis estimating the two sectors account for more than half of global cryptocurrency transactions.

Swiss asset manager Julius Baer eyes crypto and DeFi potential

The 132-year-old Swiss asset management firm, Julius Baer, intends to offer exposure to cryptocurrencies and decentralized finance for its high net-worth clients. The firm’s CEO Philipp Rickenbacher confirmed the move into the cryptocurrency space during his delivery of the company’s strategy update for the next three years.

Rickenbacher noted that the recent slump in the cryptocurrency markets presented a watershed moment for its clients to gain exposure to the nascent asset class.

DeFi market overview

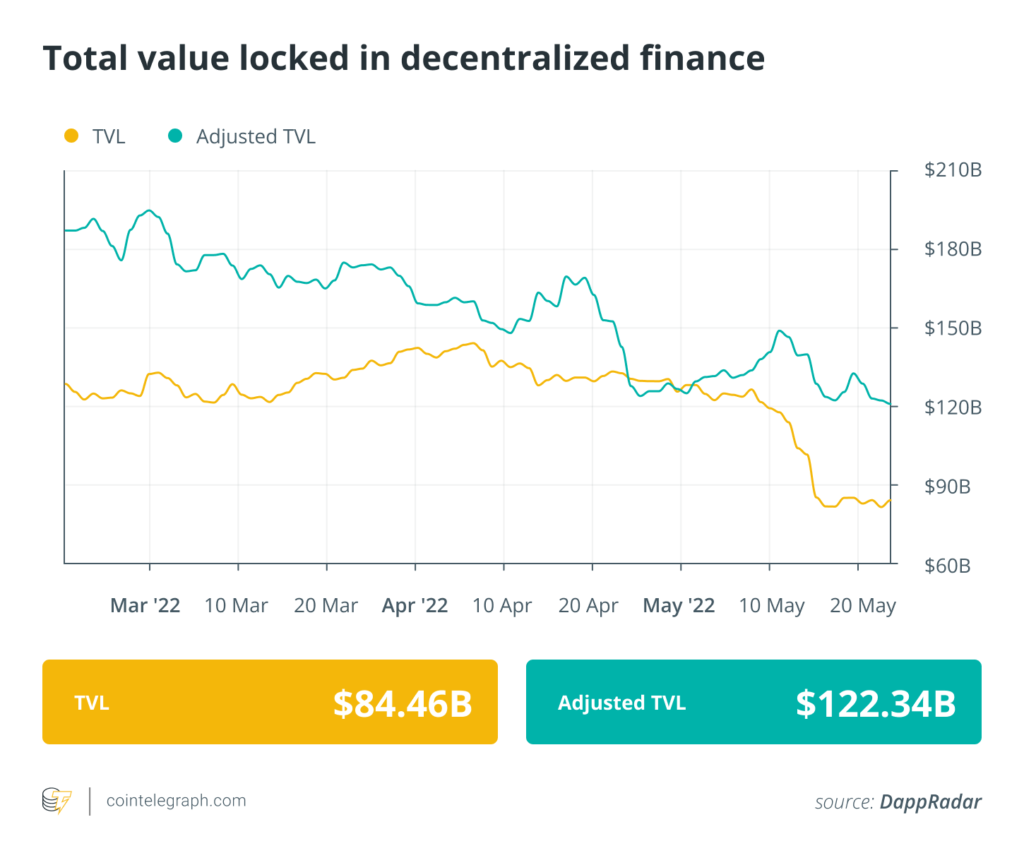

Analytical data reveals that DeFi’s total value locked remained under the $100 billion mark, falling to $84.2 billion. Data from Cointelegraph Markets Pro and TradingView reveals that DeFi’s top 100 tokens by market capitalization registered a week filled with volatile price action and constant bearish pressure.

Majority of the DeFi tokens in the top-100 ranking by market cap traded in red, barring a few. Kyber Network Crystal v2 (KNC) was the biggest gainer with a 74% rise over the past week, followed by Kava (KAVA) at 25% and PancakeSwap (CAKE) at 5%.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us again next Friday for more stories, insights and education in this dynamically advancing space.