The digital asset sector, despite several hiccups, has boomed in the last few years, especially in terms of adoption. Across the globe, investors, traders, and renowned financial institutions have acknowledged the asset class. Well, the U.S. is no different.

The Federal Reserve issued its annual report examining the financial lives of U.S. residents. The 23 May report shed light on the extensive usage of cryptocurrencies as an investment tool rather than a purchasing mechanism.

Unbanked revolution

For starters, this is the very first time that a U.S. regulatory board incorporated cryptos in one of its surveys. It’s the latest sign of the U.S. central bank’s growing interest in understanding how the booming crypto economy is (and isn’t) mixing into the picture. As a part of this study, 11,000 adult Americans were taken into consideration between October and November 2021.

In 2021, 12% of surveyed adults held or used cryptocurrency, according to the report. The data showed that crypto was favored as an investment tool over a transactional one. Only 2% of adults used it for purchases and 1% to send money to friends or family.

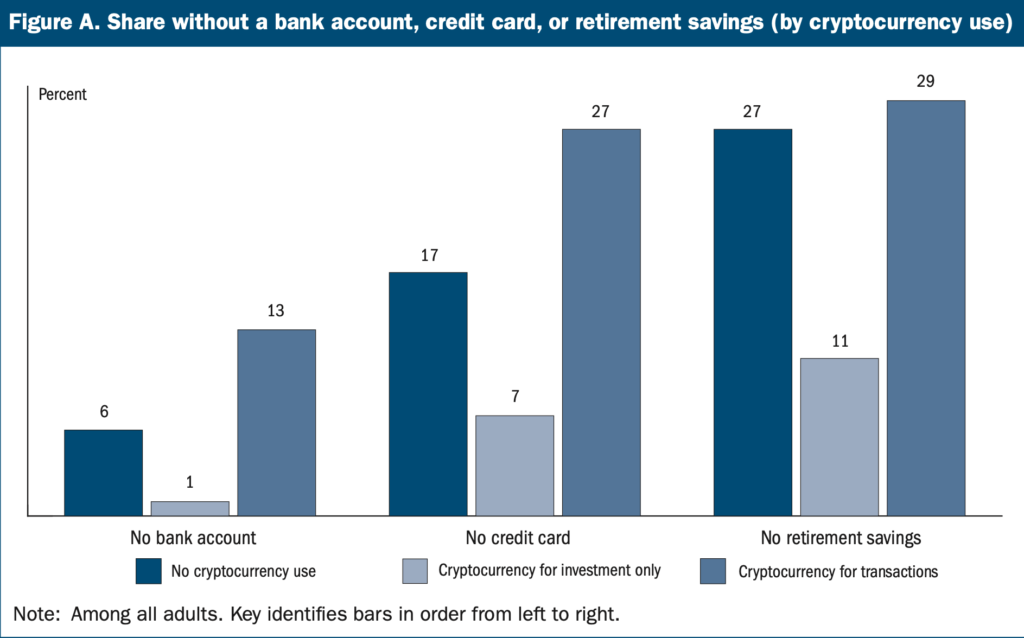

Lower-income adults used crypto for transactional purposes mainly due to the lack of traditional bank accounts as evident in the graph below.

Source: US Fed reserve

The chart showcases the strength of cryptocurrencies as a remittance tool as compared to traditional remittance services. Even the legacy banking framework for international money transfers.

But there’s a monetary gap- As an investment medium, only the higher-offs fancied the said asset class. The FED found that a large portion of adults with high incomes (greater than $100,000) held investments in cryptocurrencies.

“Those who held cryptocurrency purely for investment purposes were disproportionately high-income.”

46% of pure-play investors made $100,000 or more- Almost all of them had a bank account. The survey further went on to state,

‘“99% of those investing in cryptocurrency, but not using it for transactions, had a bank account, and 89% of non-retired cryptocurrency investors had at least some retirement savings.”

Good riddance of stormy clouds?

Indeed, this is a promising development for the cryptocurrency sector. However, it’s important to note that the sentiment and narrative change with time. Despite moving in the right direction, this “niche” sector still remains a victim of illicit activities and regulatory headwinds. Thus, the nature of the cryptocurrency market still remains extremely uncertain at least for the foreseeable future.