Argentines are turning to bitcoin to battle an ever-increasing inflation rate. In April, inflation touched 58%, its biggest jump in 30 years.

Fear of inflation has been so strong that banks have bowed to public demand for crypto. Two major Argentine banks are set to offer crypto services in partnership with Lirium. However, the country’s central bank subsequently barred regulated financial entities from offering digital assets sending contradictory signals.

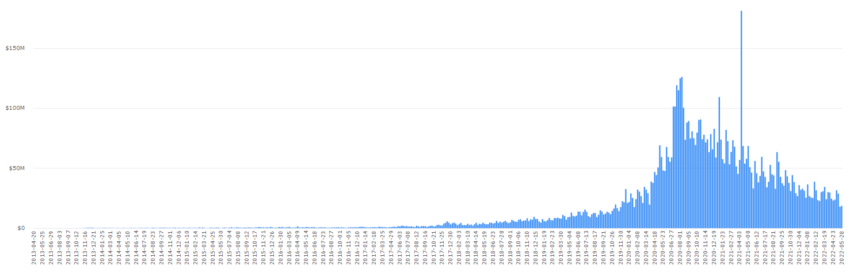

Weekly LocalBitcoins volume in Argentina stands at $18.6 million – not even close to its highest level, but still a sign of things to come. P2P trading volume in the country tends to fluctuate a lot, so there may be a lot more in store yet for these platforms.

One estimate suggests that crypto adoption in Argentina could grow by 235% in the next 12 months.

Authorities are taxing crypto for now, indicating that a regulatory framework may be on the way.

Can bitcoin serve as an inflation hedge?

While Argentina has one of the worst cases of inflation by far, nearly all countries are facing similar jumps in the cost of living. The United States and the United Kingdom are both dealing with the problem. The war in Ukraine has not helped global energy and food costs, and things may get worse.

It is in situations like these that bitcoin investors tend to double down on the benefits of bitcoin. The argument is that bitcoin is somewhat protected against global market effects, acting independently. As such, many have invested in bitcoin to hedge against inflation.

However, the narrative that bitcoin and the crypto market operate independently appears to be faltering somewhat. Crypto correlations to other markets have strengthened in the past few years, so investors will have to be wary.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.