Bored Ape Yacht Club took a backseat in value during the month of May after the NFTs saw a steep decline in their average sales price.

May proved to be a tough month for the entire crypto finance space, especially non-fungible tokens. According to Be[In]Crypto research, BAYC ended May with a trading price of $152,658.

Although this figure may seem high compared to the prices of other NFTs such as NBA Top Shot, Otherdeed, The Sandbox, Azuki, Art Blocks, and its sister project, the Mutant Ape Yacht Club (MAYC), BAYC average values fell by 60% since May 1. On that day, BAYC NFTs were trading for an average price of $382,894.

What caused BAYCs price to decline?

The crypto market crash that carried into May led to decreased investor interest in NFTs and is largely responsible for the sinking value of Bored Ape Yacht Club NFTs.

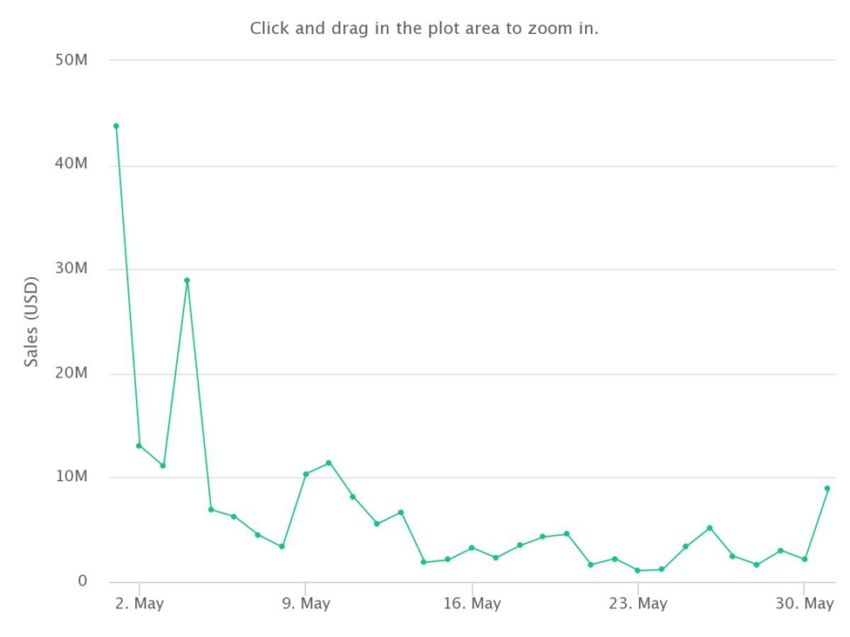

The total sales volume for BAYC NFTs in May 2022 was approximately $214.91 million.

Although there was an increase in unique buyers (591) from 475 in April 2022 which led to a spike in total transaction counts (982), average sales values dropped.

Bored Ape Yacht Club‘s average sales value for May was $218,850. This was $89,666 less than April ($308,517), $35,324 below March ($254,175), $55,812 beneath February ($274,663), and $50,202 under January 2022’s average sales value of $269,053.

The effect on ApecCoin (APE)

APE opened on May 1, 2022, with a trading price of $20.02. The token reached a monthly low of $5.25 and closed the month at $6.76. Overall, there was a 66% drop between the opening and closing prices of APE in May.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.