Cardano[ADA] witnessed an impressive rally last year in June following an important update. Well, the digital assets behemoth Grayscale added the token to its digital large-cap fund.

The firm bought the token as part of its quarterly rebalancing. Grayscale sold other components in its portfolio to allocate the proof-of-stake (PoS) blockchain’s cryptocurrency.

Here’s the sequel

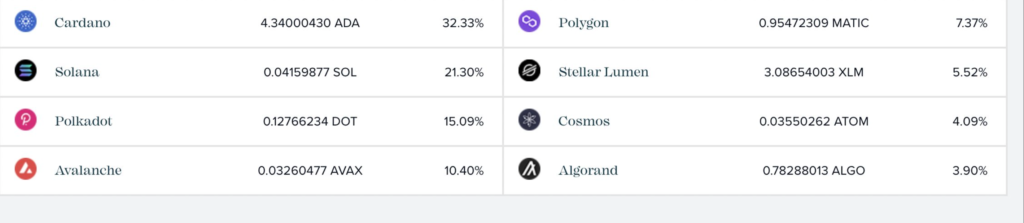

Grayscale has increased its allocation (32.33%) towards Cardano in their smart contract platform Ex-Ethereum fund. Here’s the fund component per share as of 6 June 2022, shared by Dan Gambardello– CEO of CryptoCapital Venture.

Source: Twitter

The fact that the firm chose Cardano as their number one is a massive feather in their cap. This development, indeed, speaks the sheer volume for the respective platform. But it could get even better.

Thanks to the excitement surrounding its upcoming Vasil Hard Fork, ADA surged over 20% to become one of the best-performing cryptos last week. The Vasil hard fork is due at the end of June. It aims to improve the network’s performance and make it easier for developers to use the Cardano blockchain to create applications. This is important as the competition for Ethereum alternatives continues to grow.

Furthermore, after the Alonzo hard fork added smart contracts, letting Cardano compete with blockchains, such as Ethereum, Cardano’s network has been continually rising since. According to its developer, Input Output, the Cardano network already has over 1,000 projects on it.

1003! 🎉

That’s how many projects are currently #BuildingOnCardano 💪

Join us at @Consensus2022 or at the free #CardanoAtConsensus meetup in Austin on 6/08 & connect with some of the people behind some of #Cardano’s exciting projects!

Register here: https://t.co/Jw4PE2ZI2a pic.twitter.com/5nzigL8alD

— Input Output (@InputOutputHK) June 6, 2022

Such bullish developments indeed play a vital role in aiding the network and its performance.

No more ‘Ghosting’

As per recent data from Messari, Cardano has recorded the highest 24-hour adjusted volume of transactions. Cardano outperformed leading cryptocurrencies like Bitcoin and Ethereum in adjusted transaction volumes, with a 24-hour volume of $10.71 billion.

ADA seems to have shifted gears in favor of a bullish recovery in June as is the case with its performance so far. But, the question is- Could it control this bullish narrative?

Well, only time will tell. Notably, given the overall correction in the crypto market, ADA at the time of writing witnessed an 8% correction as it slid below the $0.6 mark.