- DeFiChain revealed that nothing “drastic” will happen to dAMZN holders after the stock split.

- Everything went “smoothly” during AMZN’s 20-for-1 stock split, according to a representative from DeFiChain.

- The team revealed that dAMZN, too, will break up, similar to what happened to the Amazon stock.

Nothing “drastic” will happen to Amazon Tokenized Stock Defichain (dAMZN) holders moving forward, says DeFiChain to CQ, following Amazon’s (AMZN’s) 20-for-1 stock split.

According to sources within the native decentralized finance (DeFi) platform, everything went “smoothly” during AMZN’s 20-for-1 stock split which broke each existing share of AMZN into 20 individual units.

Furthermore, the team revealed that dAMZN, too, will split up, similar to what happened to the Amazon stock. Notably, holders of the dAMZN DeFi coin will get 20 tokens for each dAMZN token that they own.

However, DeFiChain clarified that their investments will not increase by 20 times. Token holders will still hold the same amount of investments as they had before the June 6 split. Meanwhile, DeFiChain will update the dAMZN price from the oracles.

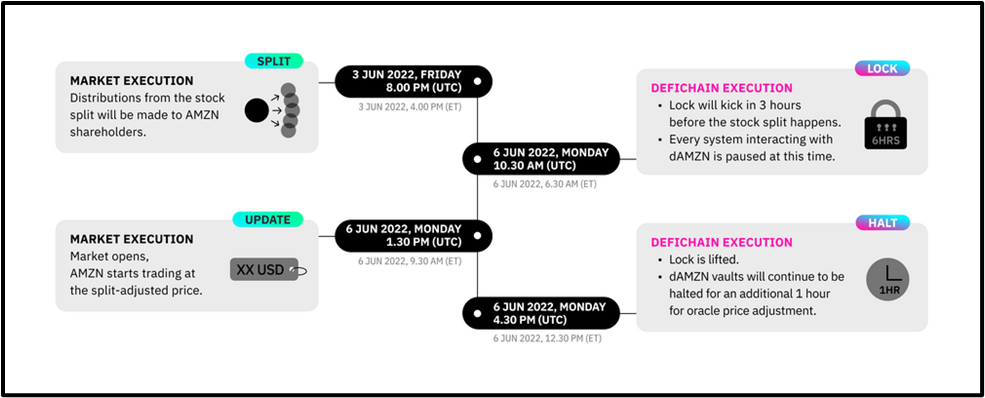

When asked about the intricacies of the split, DeFiChain explained that the process was enforced in two stages — market execution and DeFiChain execution. Based on cues from the stock market, DeFiChain locked all existing dAMZN tokens. DeFiChain then reflected the prices, following the market reopening with the updated prices post-split.

The announcement from DefiChain came on the heels of the mentioned split during the first week of June. Allegedly, the Amazon 20-for-1 stock split was performed to lower the entry barrier for newer investors looking to invest in the company. Prior to the split, Amazon shares were too steep for such greenhorn investors.

DeFiChain also offers other dTokens, including dTSLA (Tesla Inc), dDIS (Walt Disney Co), dINTC (Intel Corporation), dMSTR (MicroStrategy Incorporated), and more.