Litecoin was among the cryptocurrencies that saw more than a billion dollars wiped off its market value due to the steep decline in digital assets in the crash of May.

Litecoin remains a top 20 digital asset by market capitalization in June 2022. According to Be[In]Crypto research, LTC closed the fifth month of the year with a market capitalization of around $4.82 billion.

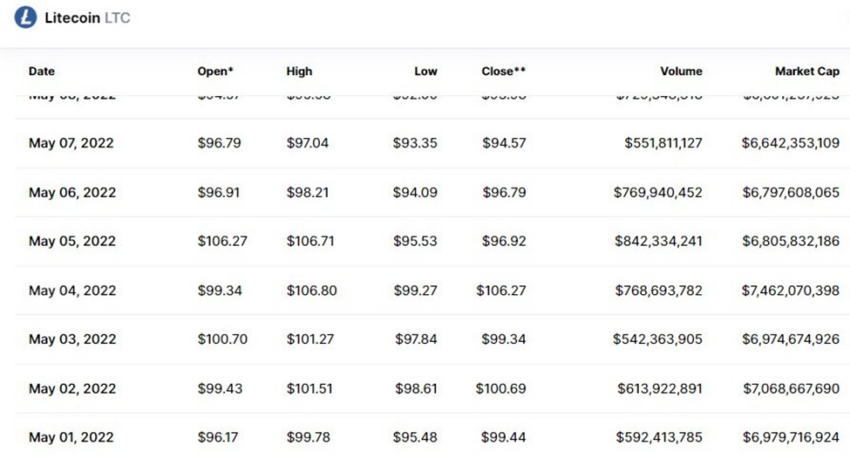

This was a 30% fall from its market cap at the opening of May. On May 1, LTC saw an impressive trading volume of $592.41 million which corresponded to a market capitalization of approximately $6.98 billion.

Why the sinking market capitalization?

An overall bearish crypto market led to the dwindling market capitalization of Litecoin. Factors that led to the massive sell-off of LTC by its holders were geopolitical events, rising inflation, a plunge in the stock market, and renewed interest in less volatile assets such as precious metals.

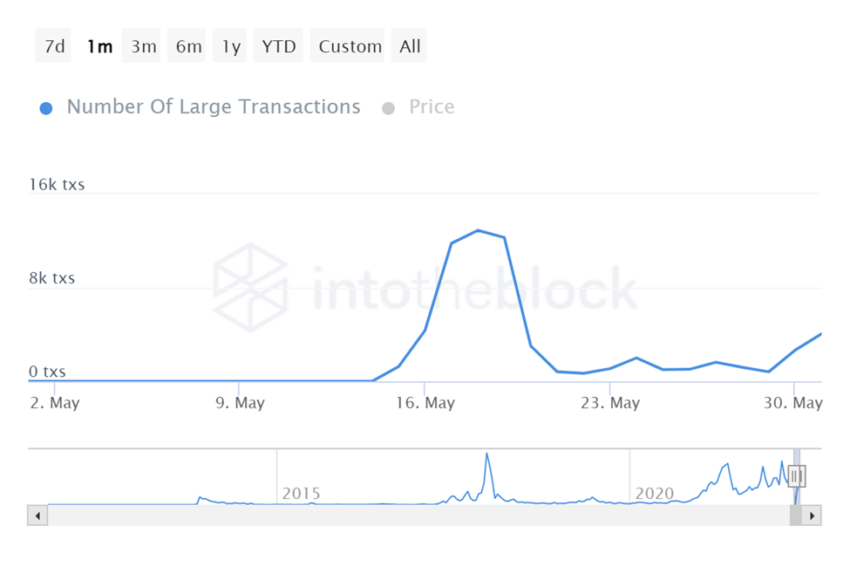

The number of large transactions involving Litecoin reached a peak of 12,910 on May 18.

This corresponded with a large transaction volume of approximately 84.31 million transactions at a price of $70. Overall, this equated to a transaction volume of $5.9 billion.

On May 18, LTC opened at $72.97 and reached an intraday low of $66.42. Trading volume was around $756.03 million and corresponded to a market capitalization in the region of $4.67 billion. This was a 33% decline in LTCs market value from May 1.

LTC price reaction

Litecoin opened on May 1, at $96.17, reached a monthly high of $106.80 on May 4, tested a monthly low of $55.32 on May 12, and ended the month at a trading price of $68.41.

Overall, this equates to a 26% dip between the opening and closing prices of LTC in May.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.