The crypto market crash on Monday saw liquidations in billions as a result of rising inflation, stETH-ETH depeg, and crypto FUD. Today, the Bitcoin (BTC) price slipped to $20,950 momentarily, before recovering some losses. Now, veteran trader Peter Brandt predicts that Bitcoin could possibly fall to $13,000.

Interestingly, Peter Brandt was the first to predict the Bitcoin’s fall to $28,000, when the BTC price was trading at the $38,000 level in early May.

Bitcoin (BTC) Price Faces Risk of Falling to $13,000: Peter Brandt

The Bitcoin (BTC) price is currently under massive pressure as the price continues to fall. Currently, Bitcoin is trading at $22,859, down 8% in the last 24 hours.

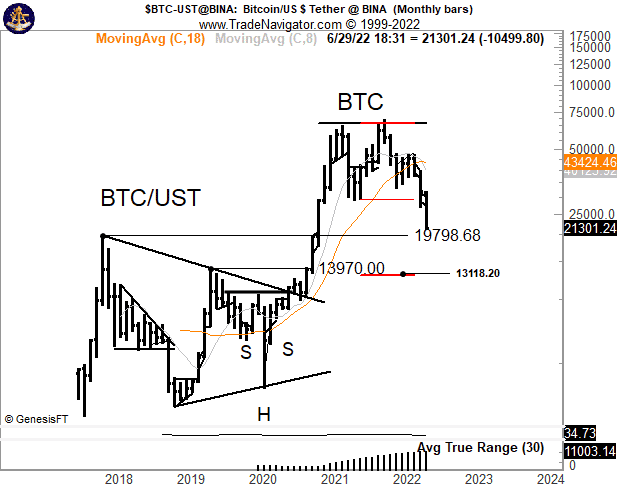

Peter Brandt announces in a tweet on June 14 that the BTC price could possibly fall to $13,000, based on the double top pattern. The December 2017 and June 2019 highs now seem like quite manageable downside targets.

The double top pattern indicates an impending technical reversal that happens when the price hits two highs consecutively and then goes on a moderate decline between the two points. The bearish sentiment is confirmed when the support level drops below the smaller high. In this case, December 2017 and June 2019 highs are the two targets.

Trending Stories

Therefore, if the Bitcoin (BTC) price plunges below $19,798, it would result in the BTC price to quickly fall around the 13,000 level. Historically, BTC has never violated the previous highs. This would be the first time in BTC history the price may pass the 2017 level and go lower.

In fact, the probability of an interest rate hike to 75 bps by the Federal Reserve on June 15 has jumped to 97%. It would put more pressure on the crypto market.

Bitcoin (BTC) Touches the 200-WMA

Bitcoin has also touched the 200-week moving average, where prices had generally rebounded historically. The 200-WMA has been considered by whales and institutional investors as the lowest entry-level for Bitcoin. Also, the rebound seen from the 21,000 level today is due to the 200-WMA. However, a wick has formed under the 200-WMA this time, and the possibility of fall is quite high.