Celsius (CEL) was one of the hardest-hit cryptocurrencies in May’s market crash and continues to decline in June after a huge sell-off by whales.

Celsius has come under scrutiny by market commentators as one of the world’s leading crypto lending platforms after its native asset, CEL plunged to new high lows in May. CEL closed the fifth month of 2022 with a market capitalization of approximately $199.8 million, according to Be[In]Crypto research.

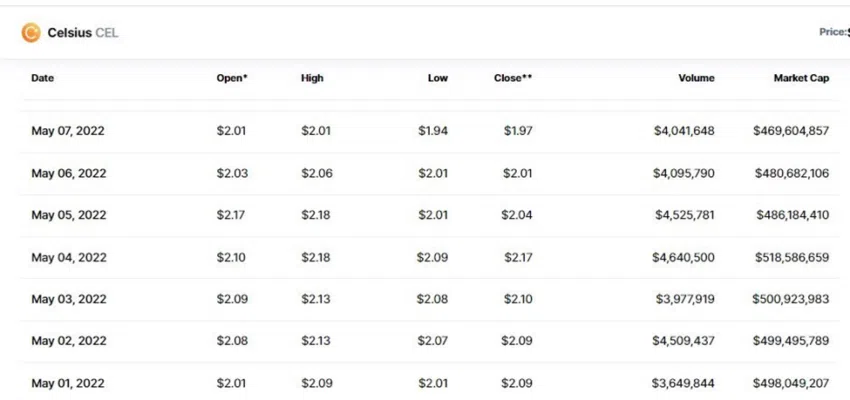

This was a 59% drop from the opening day of May’s market value. On May 1, CEL saw a trading volume of $3.65 million which corresponded to a market capitalization in the region of $498 million.

Why the sinking market capitalization?

A steep decline in the overall market capitalization of cryptocurrencies in May, primarily the week of May 9 to May 13 can be credited as the cause for the crashing market capitalization of Celsius.

Crypto’s correlation with the stock market which has plunged to new lows, geopolitical events, and rising inflation were factors for the huge sell-off by individual whales and institutional investors.

In May, trading volume reached a peak of $14.84 million on May 12. On that day, CEL opened at $1.03, reached an intraday low of $0.507, closed at $0.9907, and corresponded to a market capitalization of approximately $236.64 million.

This was a 52% decrease in Celsius’ opening day market value. Due to the price drop, CEL could not recover to retest the $1 mark for the rest of the month.

CEL price reaction

CEL opened on May 1, at $2.01, reached a monthly high of $2.18 on May 4, tested a monthly low of $0.507 on May 12, and closed the month at a price of $0.8366.

Overall, this equates to a 58% decrease between the opening and closing price of CEL in May.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.