DeFi has been growing extremely fast with Total Value Locked (“TVL”) approaching 300 Bln USD according to DefiLama. Were DeFi a country, it would rank around 35th by gross financial asset: right below Ireland, Indonesia and Turkey, but above Greece, Columbia and Checz Republic. However, if a traditional investor analyzed DeFi like a country’s financial sector, some fundamental questions would be very hard to answer, e.g. what is the base level of interest rates and the country’s risk premium? In simple terms, 6% on your USD savings account in the US is huge, but how adequate is it for your stablecoin deposit?

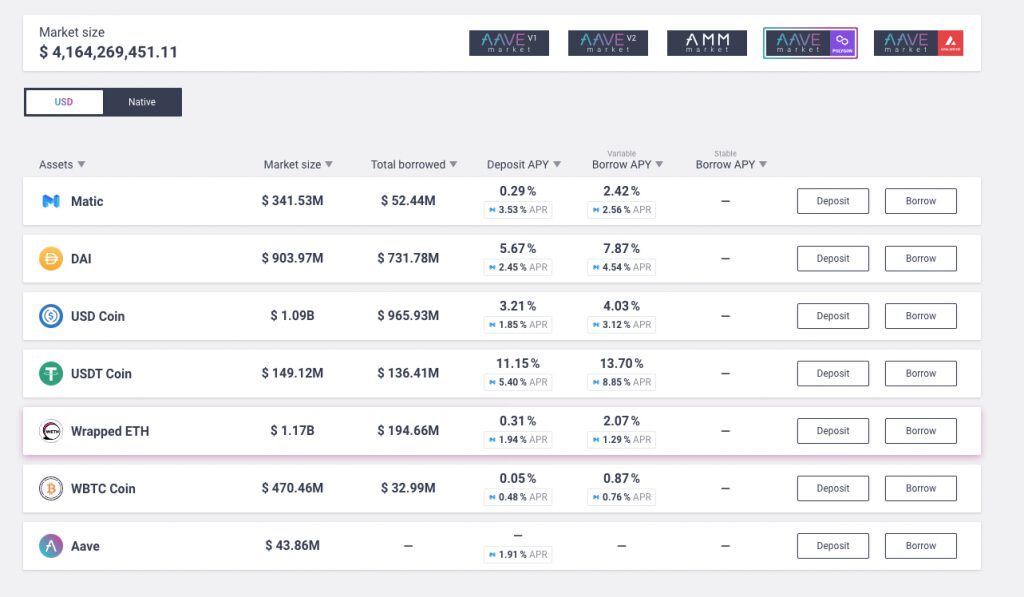

A traditional investor would typically answer such questions by looking at the country’s sovereign yield curve and comparing it to relevant benchmarks. However, DeFi does not yet have a yield-curve one can easily look at – which constitutes a barrier, in particular, to institutional adoption. The closest proxy are the money market rates with protocols, like AAVE or Compound, but they are hard to interpret as rate differential b/w 3 major stablecoins could be as high as 3-4x.

To address this, Polygon has joined forces with ‘Overnight’, the protocol behind interest-bearing stablecoin ‘OVN’, to develop PoLybor Overnight, the interest rate benchmark for DeFi.

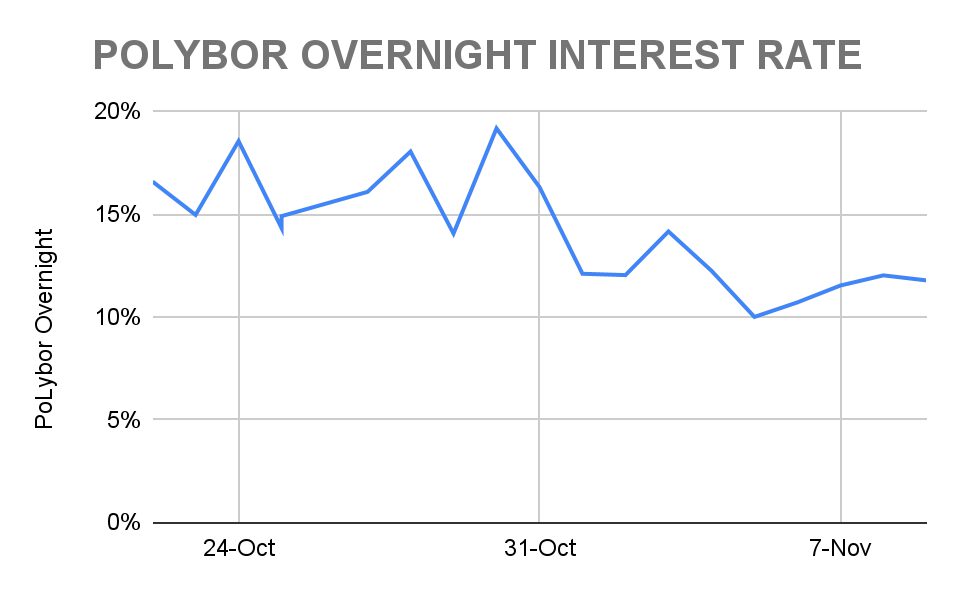

PoLybor is inspired by the commonly accepted Libor Overnight rate. Just like Libor is the rate at which most reliable banks could fund each other, PoLybor Overnight is the average interest rate at which one can deploy (1) a basket of mainstream stablecoins into (2) multiple reliable protocols. Essentially, it is DeFi’s quasi risk-free rate and can be immediately useful to assess :

- The returns on spare stablecoin liquidity: if you are earning less than the benchmark on your stablecoin cash and stablecoin deposits, you can do better by re-allocating your cash in the PoLybor Overnight benchmark

- The yield-farming performance: If your yield-farming strategies produce a premium over the Polybor Overnight, consider whether the premium is commensurate with risk and effort. Often, it is not

- Arbitrage opportunities: Sometimes, you might also notice a situation where your stablecoin borrowing costs are below the risk-free rate. This is an interesting phenomena and has to do with DeFi’s specificity, where (1) rewards can distort yields and (2) paradoxically, borrowing can be riskier than lending (due to risk of liquidations); one should carefully consider such situations as arbitrage opportunity where one can increase her leverage while investing ‘risk-free’

Long-term PoLybor Overnight should be the most useful to institutional investors, who could use it to assess DeFi’s premiums to fiat and contrast it with DeFi’s rate volatility, eventually, becoming comfortable with stablecoins’ risk-return profile.

In line with Libor’s updated principles, PoLybor Overnight’s calculation is standardized, transaction-based and data-driven. It is performed by ‘Overnight’, the protocol operating the interest-bearing stablecoin OVN, – purely as a smart contract, with no human intervention at the transaction level. At any point in time each OVN is backed by at least 1 USDC worth of lowest risk, maximum liquidity, yield generating DeFi assets; profit earned and paid out by the end of the day, including proceeds from immediate sale of rewards as well as the transaction costs, constitutes daily yield.

The portfolio deployed by Overnight is constructed to minimize risk, maximize liquidity and currently includes:

- Cash positions in 3 mainstream stablecoins: USDC, DAI, USDT; potentially, MAI, mUSD, PUSD

- Stablecoin deposits, including AAVE, potentially, Poliquity, mStable, Mai Finance

- Stable-to-stable liquidity provision, including Curve’s tri-pool, potentially, stable-to-stable liquidity pools on Quickswap, Balancer etc.

By design, PoLybor Overnight can’t be exposed to under-collateralized/algorithmic stablecoins (as these are considered riskier than asset-backed stablecoins), can’t maintain a position in nor stake a non-stable asset, including CRV. All reward tokens received are sold prior to daily profit payout and rate fixing. The rates are fixed daily, in a randomized manner around midnight UCT.

PoLybor Overnight runs on Polygon PoS chain as, so far, PoLygon is the only chain that combines (1) a selection of proven Defi protocols permitting low-risk strategies in size with (2) transaction cost enabling onchain portfolio management and daily P&L payout. PoLybor Overnight rate is published daily on awesomepolygon.com. Portfolio composition and payout details can be tracked further live on app.ovnstable.io and/or onchain. PoLybor interest rate is also available as a set of widgets to be integrated in the partner sites.

The introduction of Libor 37 years ago created many financial markets that they take for granted today, e.g. (1) Interest rate derivatives, including interest rate swaps, future rate agreements etc., (2) structured products, like ABS and RMBS, (3) floating-rate commercial products, e.g. floating rate term loans and mortgages. They hope that the PoLybor Overnight interest rate benchmark should stimulate further innovation in Defi as well as institutional adoption of stablecoins.

About Polygon

Polygon is the leading platform for Ethereum scaling and infrastructure development. Its growing suite of products offers developers easy access to all major scaling and infrastructure solutions: L2 solutions (ZK Rollups and Optimistic Rollups), sidechains, hybrid solutions, stand-alone and enterprise chains, data availability solutions, and more. Polygon’s scaling solutions have seen widespread adoption with 3000+ applications hosted, ~600M total transactions processed, ~60M unique user addresses, and $5B+ in assets secured.

If you’re an Ethereum Developer, you’re already a Polygon developer! Leverage Polygon’s fast and secure txns for your Dapp, get started here.

Website | Twitter | Ecosystem Twitter | Developer Twitter | Studios Twitter | Telegram | Reddit | Discord | Instagram | Facebook | LinkedIn

About Overnight

Overnight (‘OVN’) is developing interest-bearing stablecoin “OVN”. Each OVN is fully backed by low-risk, highly liquid, yield-generating DeFi assets and can be instantly redeemed for 1 USDC on request. OVN aidrops interest to your wallet daily, no staking required. OVN is your ‘go-to’ stablecoin, the stablecoin you go to when you are not invested nor yield-farming. One buys and holds OVN in order to receive interest on its temporarily available [stablecoin] cash without exposing to risk nor sacrificing liquidity.

If you want to know more, join the community here or start using OVN here.

Website | Twitter | Telegram | Medium | PoLybor Widgets