The broader crypto lending and the staking markets underwent one of the worst crises in history. Different networks suffered repercussions because of liquidation havoc.

On 19 June, Solend Protocol, a DeFi network used for borrowing and lending crypto-assets such as Solana [SOL] was affected. Fearing extreme sell-offs, the network released initiated proposals to avoid a cascade of possible liquidations.

Third time is the charm, is it?

Earlier, the Solend protocol planned to overtake the whale accounts with emergency powers. However, it faced a huge backlash from the community. While the liquidity risk continues to hover over Solend, it has come with a third proposal SLND3. This proposal seeks to put a cap on the borrowing limit and reduce the maximum liquidations.

A copy of the proposal is available here https://t.co/Uf63miMs9e

— Solend (we’re hiring!) (@solendprotocol) June 20, 2022

SLND3 proposal would incorporate some amendments as specified in the blog. Proposed to introduce a per-account borrow limit of $50M, any debt above this limit will be eligible for liquidation, regardless of collateral value; temporarily reduce the maximum liquidation close factor from 20% to 1%.

For its third proposal, Solend has so far reduced nearly 5,000 community votes with 98% in favor. The announcement noted,

“Solend is reaching out to market makers to help provide better on-chain liquidity. This combined with our proposals should reduce DEX market impact to a manageable level.”

If approved, the proposal would take effect. ‘Due to the need to move quickly, consider the 24-hour voting period as notice for users to reduce their borrow positions,’ the team added.

Solend team continued to post new proposals and ask interested users to vote. However, this proposal has the goal of controlling the risks of borrowing money through Solend.

Did it help?

Well, the response had more of a dual scenario to this initiative. Users had a mixed reaction following this development. For instance, one enthusiast criticized the proposal and asserted,

“Proposal to just turn off Solend so we can get this awful nonsense out of the timeline. Truly a drag on all of us and an embarrassment to defi.”

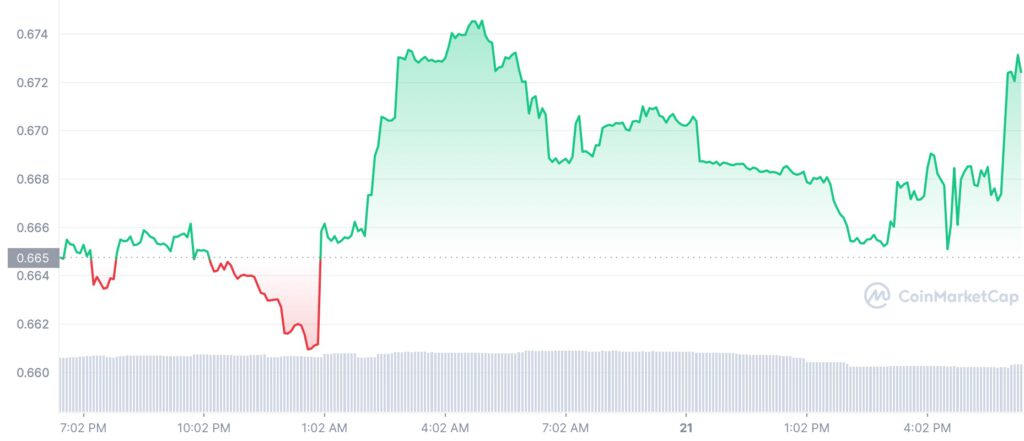

Whereas, the token surely enjoyed the traction. Solend Network’s native token – SLND recorded a 4% surge as it traded above the $0.6 mark. With the alt off 96% from its all-time high of $16.72, recent events suggest that the token might be on its way to the bottom.

Even SOL reaped some benefits following a massive 15% uptick on CoinMarketCap. At the time of writing, SOL traded around the $37 mark.

Volume metric on Santiment surged on the network over the past 24 hours. Solend’s iteration coupled with Solana’s latest mainnet upgrade to v1.10.25 led to a huge volume bump on Solana.

As of 21 June, the network volume was up by 64% and stood at more than $2 billion.