Pros

- Users don’t have to go through KYC to begin trading.

- Offers a mobile app in addition to its desktop platform.

- Various order types available.

- High leverage options.

- Fees comparable with market.

Cons

- Doesn’t have a lot of regulation.

- Limited trading pairs.

- No trading for U.S. residents.

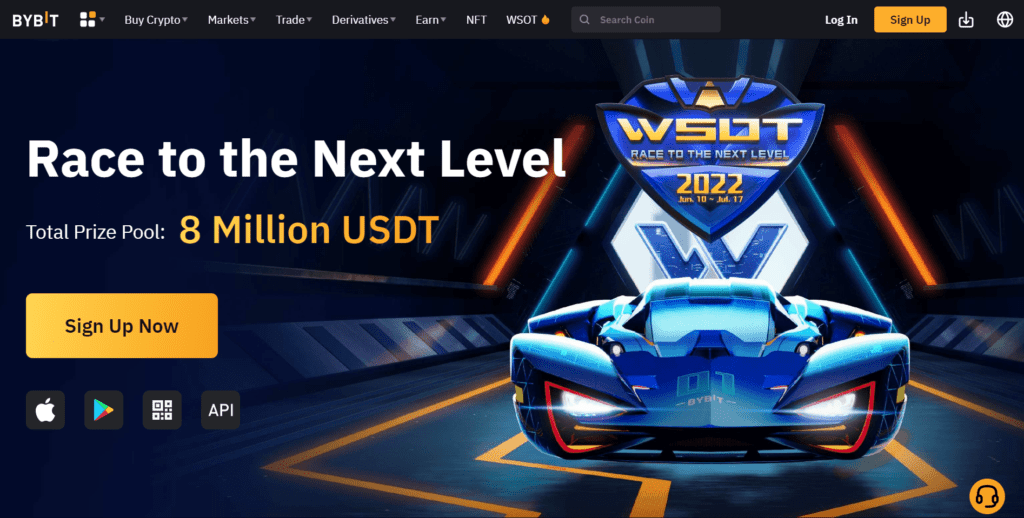

Bybit is only a few years old but has made noise in the crypto exchange market. With low fees, high leverage, and plenty of features, it’s not hard to see why Bybit is becoming one of the more popular exchanges in the world. What does Bybit have that’s bringing people in? Our Bybit review will tell you what you need to know.

What is Bybit?

Bybit is a cryptocurrency exchange that offers a wide variety of financial products, including derivatives trading options. The platform has only been around since 2018, but since it came on the scene it’s made significant noise. Bybit is headquartered in Singapore but has offices in Taiwan and Hong Kong.

The core Bybit team is made up of ex-financial professionals from popular banking institutions. In addition to having a wealth of knowledge about finance, these leaders were early to the blockchain party.

Ben Zhou leads Bybit as its CEO and is proud of the exchange he and his team have built. For example, the platform can oversee more than 100,000 transactions every second, which means one trade takes ten microseconds.

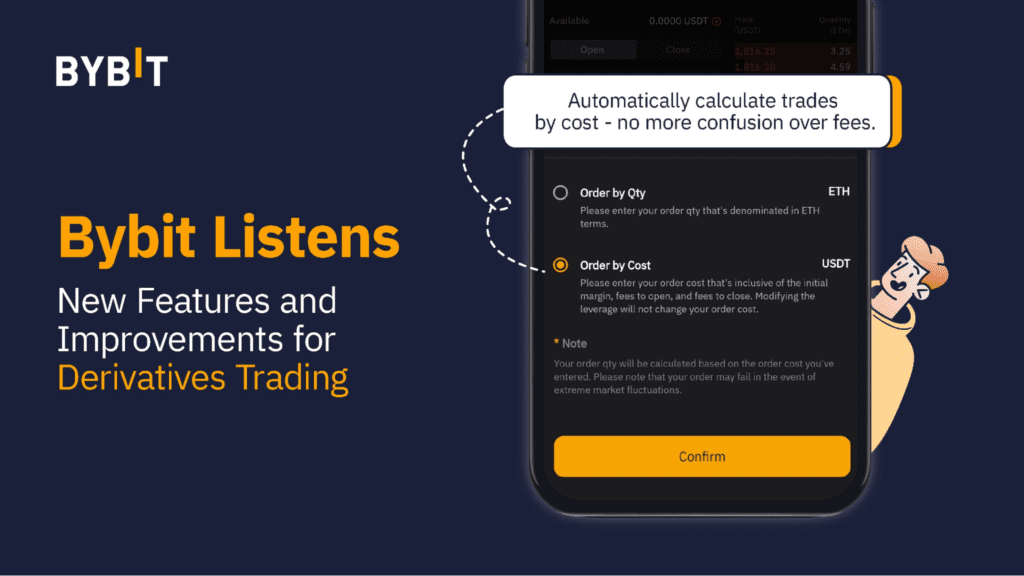

In addition to offering a platform that can perform transactions in a matter of seconds, Bybit also has a habit of regularly releasing software patches and updates. These updates bring new features and functionality to the exchange which makes the overall experience better for its users.

Bybit users also have access to the site’s mobile application. Users can download the app via the Android Playstore or iOS App Store. With this app, traders can track their investments while they’re on the go instead of needing to be tied to their laptops.

Trading Options & Order Types

Bybit is an exchange that offers advanced trading features. That means you’ll have plenty of financial products available if you’re the type of person who really likes to get into trading crypto. Here are just a few of the trading options and order types you can expect to encounter when using Bybit.

Spot and derivative trading

If you’re looking for an exchange that’s known for offering derivatives trading, look no further than Bybit. The platform offers high liquidity as it does more than $10 billion in volume every day. Traders have access to inverse perpetual contracts, USDT perpetual contracts, and inverse futures contracts while using Bybit.

Users also have access to spot trading, which Bybit introduced in 2021. Initially, there were only for trading pairs available for spot trading, but it became so popular that Bybit has since grown so much that more than 70 trading pairs are available.

Additionally, traders can use up to 100x leverage when performing trades. However, if you’re not an experienced trader, you might not want to start out with that much leverage. While you can see large profits with 100x, you could also suffer massive setbacks. Remember to never trade more than you can afford to lose.

Limit orders

Bybit offers limit orders, which allow you to determine the order price, the leverage amount, and the number of contracts. These types of orders are executed when the trade price reaches the order price.

Market orders

Market orders are also orders that allow traders to determine the order price and the number of contracts. However, market orders are executed by the order book, which determines the best available price. These are used to enter or exit the market quickly.

Currencies & Payment Methods

The only way to deposit funds into Bybit is via cryptocurrency. If you choose to participate in futures contracts, you’ll be able to use fiat currencies, but everything else is done through crypto. Traders can use Bitcoin (BTC), Ethereum (ETH), EOS (EOS), or Tether (USDT) to deposit funds into their Bybit accounts.

However, the platform has recently released a feature that will allow users to purchase Ethereum and Bitcoin with their credit or debit card. While they won’t be able to use fiat, they’ll be able to deposit funds without buying the coin elsewhere and then sending it to Bybit.

Bybit supports a wide variety of cryptocurrencies, including the followings:

- Bitcoin (BTC)

- Ethereum (ETH)

- Polkadot (DOT)

- Litecoin (LTC)

- Polygon (MATIC)

- Solana (SOL)

- Stellar (XLM)

Fees

For trading purposes, Bybit uses the common maker/taker model. This means that the fees you pay will depend on whether you’re the one creating the order of the one filling the order. Makers using Bybit don’t pay trading fees. Actually, they receive 0.025% of the transactions. However, if you’re the taker, you’ll pay 0.075% for each trade you make.

There are no charges for depositing funds into your Bybit account, whether you’ve performed the KYC (Know Your Customer) process or not. Many platforms won’t allow users to start trading until it’s completed. Bybit allows traders to deposit BTC, ETH, or EOS.

Withdrawals are free on the platform as well, but there are minimal withdrawals that each user has to meet before they can transfer their funds elsewhere. These minimums are:

- BTC – 0.0005

- ETH – 0.02

- EOS – 0.1

Limits

While there are no deposit limits on the Bybit platform, there are limits when you’re withdrawing your crypto. So, if you choose not to go through the KYC process, your withdrawals are limited to 2 BTC each day.

However, if you do go through the KYC verification, you’ll have access to 50 BTC each day if you’re level 1 verified, and 100BTC if you have successfully completed level 2 verification.

Security

Bybit hasn’t succumbed to hacks like other popular exchanges, but the platform is still relatively new. That’s not to say Bybit doesn’t take security seriously, because it does. For example, Bybit uses a wide range of security protocols, including full SSL (Secure Sockets Layer) encryption. This is used to protect customer information from hackers and other malicious parties.

In addition to encryption, Bybit highly recommends all users enable 2FA (two-factor authentication) on their accounts. This creates an additional layer of protection as it requires verification through either an SMS message or an external authenticator application.

All Bybiti user funds are stored in a cold wallet, with only small amounts accessible for withdrawals or other immediate needs. Plus, Bybit ensures customer funds are safe through the use of a multi-signature wallet system. With these methods in place, the possibility of the exchange getting breached is small.

Customer Service

Users have 24/7 access to Bybit’s customer support team. When it comes to customer service, Bybit might be one of the best exchanges in the market. Customers can reach the support team through email, ticketing system, or live chat. However, if you’re the type of person who likes to resolve things over the phone, you’re out of luck, as this isn’t an option with Bybit.

Bybit also has a solid presence on multiple Social Media channels. If you’re not getting an answer through one of the methods mentioned above, you can reach out to them through Facebook, Instagram, LinkedIn, Twitter, TikTok, Medium, Reddit, or YouTube. However, the support you get through social media will be very basic and could wind up directing you back to the exchange for additional help.

Alternative Exchanges

If you don’t think Bybit is the right exchange for you, the good news is that there are plenty of alternative platforms out there. Here are a few you could consider:

BitMex

Both BitMex and Bybit offer margin trading with leverage up to 100x. You can also trade futures and perpetual contracts on both platforms. Plus, each offers market rebates and trading fees that are in line with the rest of the crypto market. Both take security very seriously and both use multi-sig cold wallets to store user funds.

However, when it comes to KYC and user identification, the platforms diverge greatly. You already know that Bybit doesn’t enforce KYC. The biggest drawback is your withdrawal limit. BitMex, on the other hand, strictly enforces KYC procedures and requires that all users go through the verification process to use the platform.

BitMex does offer a few more cryptocurrencies than Bybit, but unless you’re heavy into altcoins, it’s not that big of a difference. One area in which Bybit sets itself above BitMex is through its 24/7 live chat customer support. This is something BitMex simply doesn’t offer. So if you value customer service, Bybit might be the way to go.

Binance

The Binance ecosystem is quite a bit more complex than Bybit. You can buy, sell, trade, store, and use your crypto assets all within the platform which offers tools that will help you find the best prices and margin trading fees. They offer more contract types like futures, allow the trading of leveraged tokens, permit buying and selling directly to other users, and allow users to invest in liquid swaps, whereas Bybit does not.

Binance is known for being an initial exchange offering springboard and its infrastructure is large enough to support impact funding for blockchain projects. Bybit is a relatively young platform, so while you can only do margin trading, it may soon develop more functionality.

One area in which the platforms are similar is that there are no limits on deposit amounts and there’s a minimum order when buying assets. The minimum varies based on the type of asset.

Both platforms have a 0.0005% withdrawal fee for BTC, but Bybit charges 0.01% for ETH withdrawals compared to Binance’s 0.005%. And Binance still has the edge over Bybit when it comes to the wide range of cryptocurrencies you can purchase, at a total of 23 asset types, including the native Binance Coin. Bybit only offers five assets, and only three of them are available for purchase with fiat currency. It also doesn’t have its own native coin.

Even though users in the United States can’t use Bybit, they only restrict users from 12 different jurisdictions compared to the 48 that Binance restricts. What you choose to use may depend on where you live. Both platforms offer excellent security, customer support, many deposit options, and a lot of self-help resources.

How to Open an Account

Follow these steps to open an account on the Bybit exchange:

- Step 2: Select either Email or Mobile Registration.

- Step 3: If you chose email, open your email account and enter the verification code sent to you. For mobile registration, enter the code you received via text.

- Step 4: Enter your credentials on the Bybit platform and start trading. That’s all there is to it.

FAQ

Is Bybit Legal in the US?

The Bybit platform itself restricts the United States’ use. US crypto regulations don’t offer as much clarity as the platform would like, so they made the decision not to let people residing in the United States use it. However, with a quality VPN software, you can safely buy, sell, and trade using Bybit, even if you’re in the United States.

Is Bybit Safe?

Because Bybit offers biometric options for logging in and two-factor authentication protocols, it’s completely safe to use. Their 100% cold storage policy ensures that no one can access your assets at any time. They’re also registered with FINTRAC and MSB.

How much leverage does Bybit offer?

One of the primary benefits of using Bybit is that users get 50x leverage on all cryptocurrencies, except Bitcoin, which offers 100x leverage. This means that if you open a trade with 50x leverage, you can multiply your potential profit by up to 50 times.

Bybit calculates these margins using the following formula: Contract Size x Open Price x Margin %

Does Bybit have trading fees/leverage fees?

Bybit’s trading fee structure is based on your VIP level, which is calculated by either your last 30-day trade volume or your asset balance. Levels include non-VIP, VIP 1-3, and PRO 1-3. Non-VIP traders receive the highest fees while PRO 3-level traders receive the lowest fees. Fees range from 0.012% to 0.1% depending on your VIP level and the type of trade.