Futures traders heavily rely on Contract Data to determine market trends and formulate trading strategies. Contract Data is needed by all professional futures traders for investment analysis. That said, how do we check Contract Data on CoinEx? Here is a concise illustration:

I. Check CoinEx Contract Data on Web/App

- For Web users:

First, go to the CoinEx website (https://www.coinex.com/) and log in to your CoinEx account, click on [Futures] on the navigation bar and then [Market Info], and select [Contract Data].

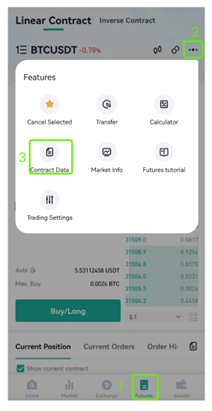

- For App users:

Tap the icon in the upper right corner on the [Futures], and select [Contract Data].

II. What is CoinEx Contract Data? How should it be used?

- Open Interest & Trading Volume

Open Interest refers to the total open interest of all users within a given period.

Trading Volume refers to the total executed volume of the futures contract within a given period.

Taken together, the Open Interest and Trading Volume help investors perceive the liquidation and closing volume in a futures market. For instance, A large number of futures contracts are closed or liquidated when the Trading Volume rises and the Open Interest falls; traders in the market are enthusiastic about opening positions if both the Open Interest and the Trading Volume rise.

- Taker Buy/Sell Volume

Taker Buy Volume refers to capital inflow volume.

Taker Sell Volume refers to capital outflow volume.

A large Taker Buy Volume shows that the market sentiment falls under the greed spectrum. On the other hand, a large Taker Sell Volume indicates that the market sentiment is within the fear range, and many traders tend to sell short.

- Long/Short Ratio (Account)

Long/Short Ratio (Account) represents the proportion of net long accounts to the net short accounts within a certain period.

This indicator shows us the market inclination of retail traders and top traders. In each Futures market, the long position value equals the short position value. And because of that, there are a few accounts with large value in Long positions when the Long/Short Ratio (Account) is 150% (i.e. Long Account / Short Account = 1.5), which indicates that these accounts might belong to the top traders. Conversely, when there are many accounts with small value in long positions, then they might belong to retail traders.

- Top Trader Long/Short Ratio (Account)

Top Trader Long/Short Ratio (Account) represents the proportion of the net long positions to the net short positions of the top traders in the market.

Top trader refers to the top 20% traders in terms of position amount in the current market, and each account is counted once without calculating the specific position volume.

When it comes to futures trading, it’s undeniable that top traders have better trading habits and are more sensitive than retail traders. As such, their tendency can be relied upon by retail traders. However, it should be noted that some top traders and institutions use futures contracts as a hedging tool against spot risks. Therefore, our own market insights should also make a difference when we refer to Contract Data.

In conclusion, Contract Data is a critical reference for futures traders that help them analyze the market, determine market trends, and formulate the corresponding trading strategies. Still, we should also rely on our own market insights when deciding on the suitable trading direction using Contract Data.