After reaching a bottom of $17,774 recently, Bitcoin retraced to above $21,000 but only for a short while. In the last few days, BTC struggled to hold above the $20,000 level.

As of writing, Bitcoin is trading at $19,635, down by 1.66% in the last 24 hours, according to price tracking website CoinMarketCap. Compared to last week’s price, BTC price is currently down around 6.19%.

Bitcoin Bottom Approaching?

Meanwhile, certain technical indicators are signaling a price movement approaching the bottom of the cycle. Taking into account previous instances of market bottom, Bitcoin reached the current levels during peak bear markets.

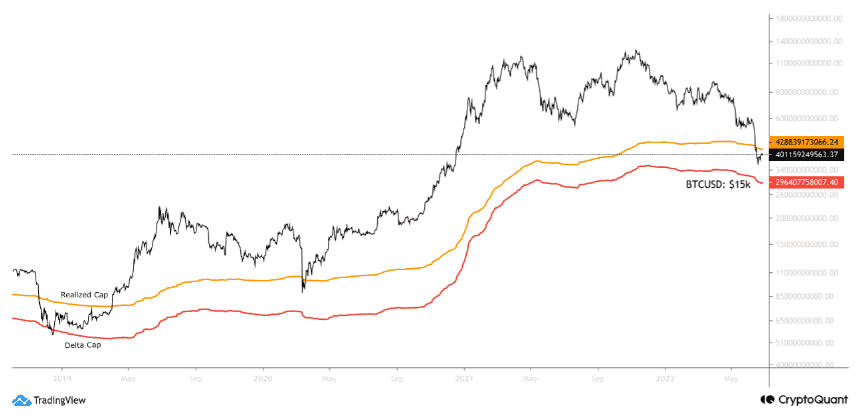

According to Chartoday on CryptoQuant, the current levels of realized cap and delta cap were touched in previous bear markets. In 2018, Bitcoin entered the current zone after a capitulation crash was realized. In 2014, it was the same, except that the bottom was more extended in time.

Adding to these are the threat of an upcoming recession and macroeconomic situation. These factors could further destabilize the market and Bitcoin bottom could be around $15,000, the analysts predict.

Trending Stories

“Bitcoin has already traded below the realized cap, and the current crash has slowed down. But the coming recession could destabilize things further. If we end up getting worse macroeconomic conditions, we could see price go slightly below the $15,000 level (delta cap).”

What Is Realized Cap And Delta Cap?

The realized cap and delta cap could be used to gauge how close is the next Bitcoin bottom. The realized cap represents the market cap while considering the price each coin was last moved. Whereas the delta cap is simply the realized cap minus the moving average calculated over the entire period.

Last month, Bitcoin failed to close above the 200 week moving average level for the third consecutive time. This is the first time in its history that Bitcoin’s weekly performance was so dismal.