Data shows the Bitcoin bear environment has caused the market to become inactive as transaction fees continues to be extremely low.

Bitcoin On-Chain Activity Remains Low As Price Action Stays Stale

As per the latest weekly report from Arcane Research, the last week saw the lowest average daily transaction fees since April 2020.

The “transaction fees” is an amount that senders have to attach with their transactions whenever transferring on the Bitcoin blockchain.

This is one of the two sources of revenue for miners (the other being the fixed block rewards), and so, they usually handle transactions with the higher fee first.

The BTC network has an upper limit for how many transactions can be handled in a day, and thus whenever there is large activity from investors, the chain gets clogged.

Those investors who don’t want to wait for their transfers to go through just attach a higher than average fee with their transactions.

Some other investors may similarly try to now outcompete these senders who put a high fee and in this way the average fees can blow up.

Related Reading | Bitcoin Saw Largest Ever Monthly Withdrawal From Exchanges In June

However, in times of little activity, there is no incentive for investors to opt for higher fees and the average remains low.

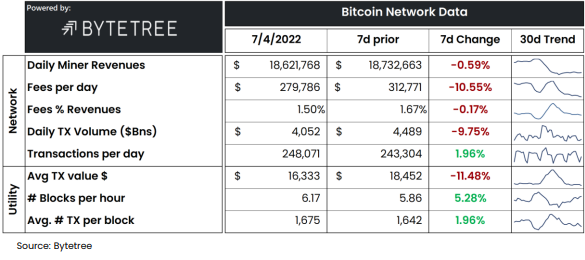

Now, here is a table that shows how the various metrics related to the Bitcoin network have changed during the last seven days:

The value of the fees per day seems to have plunged 10% over the past week | Source: Arcane Research's The Weekly Update - Week 26, 2022

As you can see above, the daily transaction volume has been just around $4 billion recently, a value that was usually $6 billion during the past year.

The Bitcoin fees per day has dropped more than 10% during the last week as the metric’s value is now around 279k. This average daily fees is the lowest it has been since April 2020.

Related Reading | Was Dan Peña Right That Bitcoin (BTC) Is Dead? Small, Quality Projects Like Gnox (GNOX) Look To Be New Crypto VC Haven

The historically low activity on the blockchain is likely because of the stale price activity during this bear market that is making investors lose interest in the crypto.

The report notes that the number of active Bitcoin addresses has also continued to be at a low value during the past week.

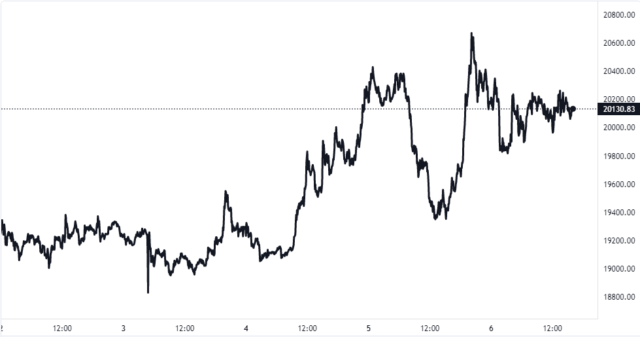

BTC Price

At the time of writing, Bitcoin’s price floats around $20.1k, up 0.3% in the last seven days. Over the past month, the crypto has lost 33% in value.

The below chart shows the trend in the price of the coin over the last five days.

Looks like the value of the crypto has surged up over the last few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Arcane Research