The Federal Deposit Insurance Corporation (FDIC) is probing crypto lender Voyager Digital over claims that it is FDIC-insured. The crypto firm previously explained that through its strategic relationships with Metropolitan Commercial Bank, “all customers’ USD held with Voyager is FDIC insured.”

Voyager Probed by FDIC

The Federal Deposit Insurance Corporation (FDIC) is looking into Voyager Digital Ltd. (TSE: VOYG) and its marketing of deposit accounts for cryptocurrency purchases, Reuters reported Thursday, citing confirmation by an FDIC official.

The FDIC is an independent agency created by Congress to maintain stability and public confidence in the nation’s financial system. It regulates and insures the deposits of a number of community banks and other financial institutions. “The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category,” the regulator’s website details.

While crypto lender Voyager is not an FDIC-insured bank, it claimed to be FDIC-insured through a banking partner. The Voyager team wrote in a blog post back in December 2019:

Through our strategic relationships with our banking partner, Metropolitan Commercial Bank, all customers’ USD held with Voyager is FDIC insured.

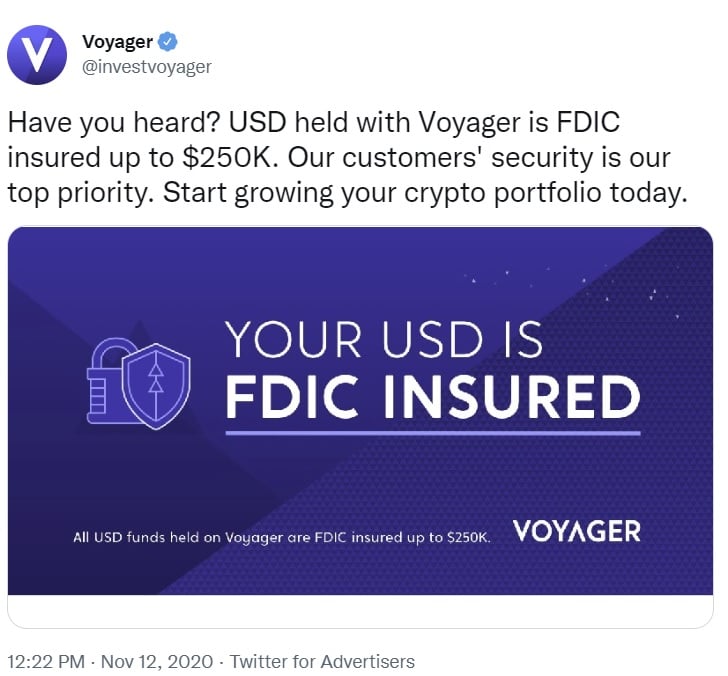

The official Twitter account of the crypto lender also tweeted many times, bragging about the company’s FDIC insurance. One of the tweets reads: “Have you heard? USD held with Voyager is FDIC insured up to $250K. Our customers’ security is our top priority. Start growing your crypto portfolio today.”

On several occasions, the crypto lender assured Twitter users who doubted its FDIC insurance that customers’ USD held with the company is safe and FDIC-insured.

When Voyager suspended trading, deposits, and withdrawals last week, Metropolitan Commercial Bank, a New York-chartered bank and a member of the FDIC, issued a statement regarding FDIC coverage available to Voyager customers.

The bank explained that it “maintains an omnibus account” in U.S. dollars for the benefit of Voyager customers. While noting that Voyager customer funds held by Metropolitan Commercial Bank are insured by the FDIC up to $250,000, the bank stressed:

FDIC insurance coverage is available only to protect against the failure of Metropolitan Commercial Bank. FDIC insurance does not protect against the failure of Voyager.

On Wednesday, Voyager said that it has filed for Chapter 11 bankruptcy. The crypto lender tweeted Sunday: “We currently have approximately $1.3 billion of crypto assets on our platform, plus claims against Three Arrows Capital of more than $650 million. We also have over $350 million of cash at Metropolitan Commercial Bank.”

What do you think about the FDIC probing Voyager over claims that it is FDIC-insured? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer