The cryptocurrency market has witnessed one of the most brutal corrections of 2021 with the overall market tanking more than 15% in a matter of hours. The world’s two top cryptocurrencies plunged nearly 20% earlier today before bouncing back marginally.

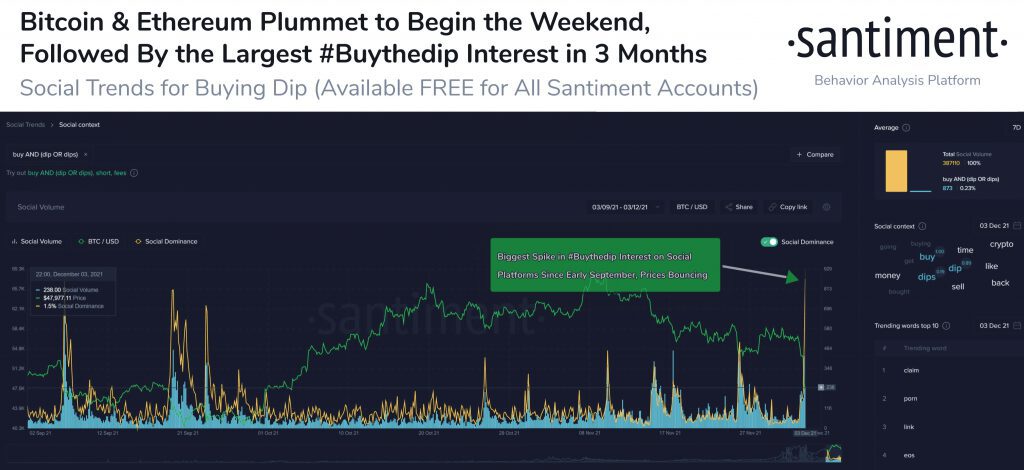

Bitcoin (BTC) witnessed a low near $43,000 while Ethereum (ETH) witnessed a low around $3,500. However, the chatter around buy-the-dips is gaining much traction. As on-chain data provider Santiment reports:

Bitcoin fell all the way to $43.5k about an hour ago, along with #Ethereum dropping to $3.54k. However, prices are bouncing with the largest #buythedip interest spike in 3 months. Renewed #covid concerns among larger stakeholders should tell the story.

El Salvador President Nayyib Bukele was quick enough to buy the Bitcoin dip. He announced an additional purchase of 150 Bitcoins at around $48,700 levels.

Omicron Fear Grips Global Markets

The recent spread of the Omicron Covid variant has put doubts on the economic reopening worldwide. This has put the global market under major pressure forcing investors to move towards safe-haven assets. Vijay Ayyar, head of Asia Pacific with crypto exchange Luno in Singapore.

“Markets have also been jittery with all the uncertainty around omicron, with cases now appearing in many countries. It’s hard to say what that means for economies and markets and hence the uncertainty.”

As a matter of today’s price correction, more than $2 billion from the broader crypto markets were liquidated in a matter of hours.

$2.2b liquidated in 12h.

Bitcoin OI plunged 25% pic.twitter.com/1QFCeX1rMp

— Lex Moskovski 🐙 (@mskvsk) December 4, 2021

The Bitcoin futures Open Interest (OI) has also plunged significantly with a staggering $3.3 billion worth of OI getting closed out in just an hour. This was around 17% of all the open contracts. Going ahead, the cooling-off of the Bitcoin open interest could be healthy leading to the price recovery. Lead on-chain analyst at Glassnode, Checkmate.btc expects the market to recover and wants investors not to panic at this point.

By the way –> hang in there.

Don’t get shaken out here, the damage is already done, and the market WILL recover from today’s red candle in due course.

Sit tight, you got that!#Bitcoin https://t.co/d3DbTutsXR

— _Checkmate.btc 🔑⚡🦬🌋checkonchain.com🌋 (@_Checkmatey_) December 4, 2021