- CEL experienced an increase in price of around 28.40% to reach $0.733.

- Celsius Network files for bankruptcy following withdrawals being halted.

- Whales are unable to dump their entire CEL holdings.

After the Celsius Network halted withdrawals, it was only a matter of time before they filed for bankruptcy. Despite the bankruptcy news, top holders did not dump significant amounts of their holdings.

At the time of writing, CoinMarketCap shows that the native token for the Celsius Network, CEL, experienced an increase in price of around 28.40% to reach $0.733 over the past 24 hours. This price increase has now taken its fully diluted market cap to approximately $510,830,355.

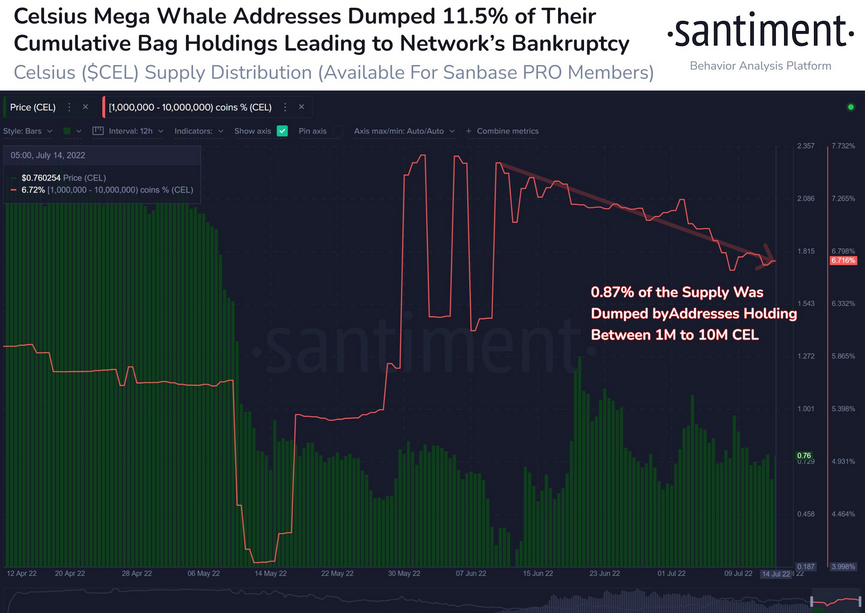

Despite the increase in CEL’s price, recent data released by the blockchain analytics firm, Santiment, shows that whales are consistently dumping their CEL holdings.

When looking at the chart above, it can be noted that 0.87% of the CEL supply was dumped by addresses holding between 1 million and 10 million CEL. Furthermore, mega whale addresses dumped 11.5% of their cumulative bag holdings. This inevitably led to the network’s downfall, leaving the team no choice but to file for bankruptcy.

With withdrawals being paused, and the Celsius Network filing for bankruptcy, why are there still whales holding on to CEL? Could they have an optimistic outlook for the project and are they confident that CEL will recover, or is there something else going on that is restricting them from dumping their entire holdings?

One factor that could be restricting CEL whales from dumping the coin could be that there is not enough liquidity to facilitate the trades.

When trying to create a swap on Uniswap, the transaction costs are through the roof! This is a clear indication that there is not enough liquidity for whales to swap their CEL holdings and dump the coin, leaving them trapped.