Avalanche’s price witnessed quite a good rally during the initial 20 days of November. In the aforementioned period, the asset witnessed a 134% pump from $62 to $147. Post that, however, the coin started spending more time towards the downside.

Despite the state of the broader market or its own ongoing correction phase, AVAX would soon re-kickstart and start setting records on the price chart.

Hearty state of its on-chain activity

Avalanche’s ecosystem is slightly different when compared to that of other networks. AVAX tokens exist on the X-Chain and can be traded there. While on the C-Chain, they can be used in smart contracts or to pay for gas.

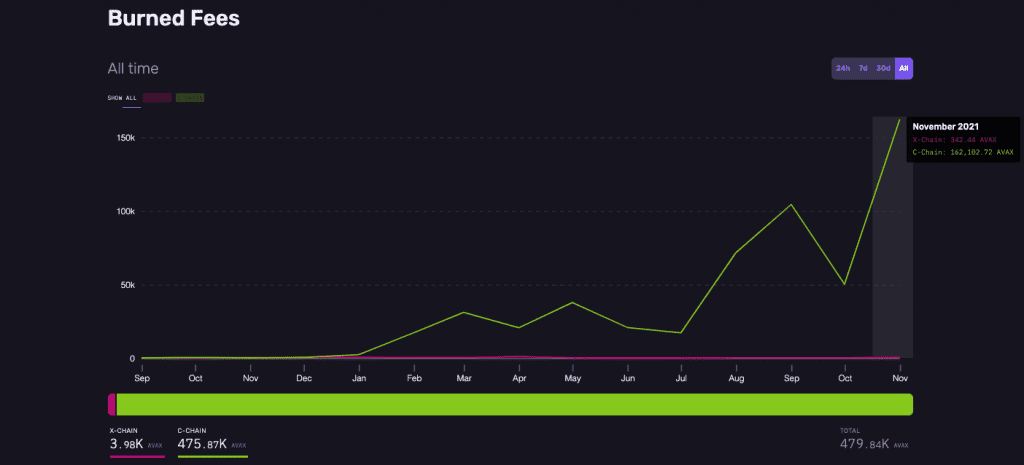

At this stage, it is important to note that Avalanche burns all the AVAX tokens received as transaction fees. In the month of November alone, 162,445.16 AVAX tokens were burned on both the C-Chain and the X-Chain. Thus, taking the total burned token tally to 479.84k.

In fact, the cumulative value of all the destroyed tokens was worth more than $50 million, at the time of writing.

Source: avascan.info

Burning tokens remove them permanently from the circulating supply and, in effect, makes the underlying asset deflationary. More so, because it directly affects the demand-supply dynamics. Thus, with time, AVAX would become scarcer and in turn, its valuation has the potential to massively boost.

Here it should be noted that Ethereum did not become deflationary straight off the bat when it started burning its tokens. It did take time and its price has, in fact, just started reacting to it positively. Such has been the case with Terra protocol’s LUNA too. So, it would take some time for AVAX to start consistently reacting to the whole burning mechanism.

On the other hand, the on-chain activity has also been the pretty sound of late. For instance, the daily transaction count on Avalanche’s C-Chain has been rising. This means that more and more people are using AVAX’s network to carry out their transactions.

Well, the network’s fairly low average gas price is one of the main reasons for the rising transaction count and the increased network traction.

Interestingly, the cumulative number of contracts deployed on Avalanche’s C-Chain has also been inching higher. This is essentially another sign of the healthy utilization of the network.

What’s more, when compared to the past months, the daily-active addresses witnessed one of their biggest jumps last month. Almost 652k addresses interacted with the network’s C-Chain in November.

Well, the robust state of the aforementioned metrics does have the potential to trigger an AVAX rally in the coming days. Along with that, the asset’s mid-term prospects also look fairly bullish at this point, thanks to the protocol’s burning mechanism.