- Arcane Research showed that public miners sold nearly 400% of their Bitcoin (BTC) production in June.

- Core Scientific dumped almost 10,000 BTC, having only 1,959 BTC left, while Northern Data cleared the entirety of its BTC and ETH.

- Massive sales were due to mining firms couldn’t raise equity or debt for future infra upgrades.

The latest research from blockchain analytics firm, Arcane Research, shows that public miners sold nearly 400% of their Bitcoin (BTC) production in June 2022.

From January to April this year, they only sold 20% to 40% of their production, keeping up with their hodl-at-any-cost strategy. The dynamics, however, changed as BTC fell from $40,000 to $30,000 in May.

In June, miners liquidated 14,600 bitcoin, over $300 million, representing nearly four times their total production of 3,900 BTC.

The report pointed to Core Scientific and Bitfarms as the mining firms with the largest liquidation share. Core Scientific dumped almost 10,000 bitcoin, having only 1,959 BTC left. Bitfarms sold 3,353 BTC. On the other hand, Northern Data cleared the entirety of its BTC and Ethereum (ETH) holdings in May and June.

Arcane Research said these massive sales would pay for upcoming infrastructure upgrades and machine deliveries. In 2021 miners were able to raise equity or debt to pay for mining expenses. Now, access to external capital has drastically weakened due to the increasing interest rates and less investor interest in Bitcoin.

Marathon and Hut 8 now hold the most bitcoins after not selling in May and June. Marathon has 10,055 BTC on its balance sheet, followed by Hut 8 with 7,405 BTC. Riot comes third with 6,654 BTC after selling somewhat more than average but not close to the same extent as Core Scientific and Bitfarms.

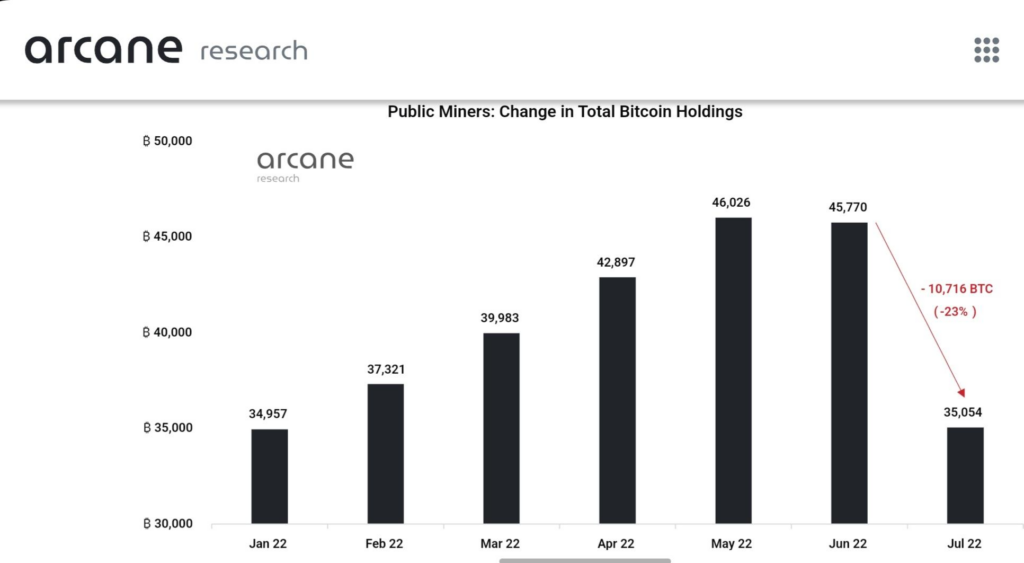

The chart shows how the public miners built their bitcoin holdings during the first months of 2022. Their collective holdings are now at the same level as when the year started.