Notice: Undefined variable: queried_object in /home/customer/www/coinspeaker.com/public_html/wp-content/themes/cs/functions.php on line 893

Notice: Trying to get property ‘term_id’ of non-object in /home/customer/www/coinspeaker.com/public_html/wp-content/themes/cs/functions.php on line 893

Notice: Constant WP_POST_REVISIONS already defined in /home/customer/www/coinspeaker.com/public_html/wp-config.php on line 113

Warning: Cannot modify header information – headers already sent by (output started at /home/customer/www/coinspeaker.com/public_html/wp-content/themes/cs/functions.php:893) in /home/customer/www/coinspeaker.com/public_html/wp-config.php on line 119

hourly

1

Former Ripple Labs Co-Founder Jed McCaleb Now Owns Only 46.7 XRP

A number of XRP proponents seem to be celebrating the dumping of the XRP tokens by Jed McCaleb for reasons that may be personal to these individuals.

Former Ripple Labs Co-Founder Jed McCaleb Now Owns Only 46.7 XRP

]]>Former Ripple Labs Co-Founder Jed McCaleb Now Owns Only 46.7 XRP

Jed McCaleb, one of the co-founders of Ripple Labs Inc, a blockchain payments firm has finally offloaded his infamous “Tacostand” wallet, leaving only 46.7 XRP coins worth about $16.95 at the time of writing.

Jed Mc Caleb at some point was one of the individuals with the largest amount of XRP coin holdings in the world. With his total crypto holdings worth over 9 billion XRP, a figure that represents 18.6% of the supply, many were unpleased with the massive sway McCaleb has over the payments token.

Since leaving Ripple Labs to go co-found a rival payment protocol, Stellar (XLM), McCaleb has gone on targeted dumping of his XRP holdings. The last tranche of 1.1 million XRP, worth about $398090 at the time of writing was sold off on July 17 as affirmed by the XRP Scan blockchain explorer.

Per the explorer, the Tacostand wallet has been listed for an “ACCOUNT DELETE” transaction, one that must have been initiated by Jed McCaleb. With the Account Delete transaction, the Tacostand wallet is bound to self-destruct, meaning it would not exist anymore.

Jed McCaleb and the XRP Dump off: Community Welcomes the News

A number of XRP proponents seem to be celebrating the dumping of the XRP tokens by Jed McCaleb for reasons that may be personal to these individuals. However, the initiated selloff which took a span of about 8 years has pushed XRP to be more of a decentralized coin with fewer individuals holding a significant percentage of the total supply.

“The moment we have all waited for is finally upon us. @JedMcCaleb has finally emptied his taco stand. His dumping of $XRP is now over after many years. Party time!!!,” Twitter account Rob XRP tweeted.

The moment we have all waited for is finally upon us. @JedMcCaleb has finally emptied his taco stand. His dumping of $XRP is now over after many years. Party time!!! 🎉🎉🎉 https://t.co/lS9kfCf98A

— Rob XRP ☀️ (@robxrp1) July 18, 2022

As if making a sigh of relief, an account dubbed XRP Whale said in its tweet that with the dump-off, an average individual can finally own more than Jed McCaleb, a feat that seems impossible some few years back.

Since the United States Securities and Exchange Commission (SEC) launched a lawsuit against Ripple Labs for selling unregistered XRP securities back in December 2020, the XRP coin has been taking a significant hit on all fronts. While Ripple chose to slug it out with the regulator, unique upheavals with respect to the case have been having a profound impact on the price of XRP.

An article published by “The Crypto Town Crier” alleged that the dragging feet McCaleb exhibited in selling off his last 5 million XRP coins was just to have more money in the bag should the coin moon over time.

“McCaleb, who has sold multiple billions of XRP since leaving Ripple in 2014, said he woke up in a cold sweat Thursday night and realized he just couldn’t let the last of his holdings go,” the said article reads, per an excerpt from a CoinTelegraph report.

With the selloff now, however, all hopes to cash out on any increase in price should Ripple win the case are lost.

Former Ripple Labs Co-Founder Jed McCaleb Now Owns Only 46.7 XRP

]]>The Future of Cross-Chain: MAP Protocol – The Omnichain Network for an Interoperable Web3

Due to the variety of chains available in the multi-chain industry, dApp developers rarely build cross-chain solutions.

The Future of Cross-Chain: MAP Protocol – The Omnichain Network for an Interoperable Web3

]]>Notice: Undefined variable: html in /home/customer/www/coinspeaker.com/public_html/wp-content/plugins/coinspeaker-infinite-scroll/index.php on line 213

The Future of Cross-Chain: MAP Protocol – The Omnichain Network for an Interoperable Web3

Background

Due to the variety of chains available in the multi-chain industry, dApp developers rarely build cross-chain solutions. Rather expectedly, public blockchain foundations provide official bridges or officially-endorsed bridges powered by cross-chain interoperability protocols. The reason is also well understood: blockchain teams have the resource and technical expertise to handle protocol-level transactions and are more experienced in safeguarding the assets.

However, different blockchain teams do choose different underlying cross-chain technologies and providers. Let’s examine what technologies are on their tables today and what can be improved.

Ethereum

Since Ethereum is the “original” smart contract-based blockchain, there is currently no official solution for moving assets from it, at least not in the form of a bridge. In fact, Ethereum’s founder Vitalik Buterin specifically discouraged using bridges as the cross-chain solution due to the “fundamental security limits of bridges.”

However, for Layer-2 chains that connect with Ethereum main-chain through rollups, bridges are currently available on platforms such as Arbitrum and Optimism. The bridge operations are secured by well-audited bridge contracts and are run in a trustless mode.

Solana

The official bridge for Solana is Wormhole’s Portal Bridge, the most used cross-chain solution to go from/to the Solana network. Wormhole uses a private set of relayers to achieve verification of signatures and have bridge contracts verify them. A major hack totaling $300M+ in assets happened to Wormhole earlier this February, exposing the security weakness of such official bridges and relying on complex contracts on different chains.

BNB Chain

BNB Chain, formerly known as Binance Smart Chain, does not have an officially-branded bridge as of today. BSC used to have a Binance Bridge 1.0; however, it was later on taken offline. BNB Chain recommends either a centralized exchange-based cross-chain swap or a trustless solution such as Celer (cBridge) or Anyswap (Multichain Bridge).

Looking at decentralized cross-chain solutions endorsed, neither cBridge nor Multichain enforces the highest level of security due to their MPC-based verification model that is susceptible to collusion and central control. However, when things run smoothly, these solutions provide end-users the cross-chain experience they need. But as we’ve seen with numerous other major hacks on bridges, the security limits are still there like a ticking time bomb.

Polygon

Polygon has an official bridge to move assets across several EVM-based blockchains. However, due to its limited scope, it can only support EVM-based assets. The bridge also has varying confirmation times, confirming a classic lock/mint and burn/unlock model secured by a set of centralized relayers/validators.

Avalanche

Avalanche’s Bridge (beta) is limited to transferring tokens from AVAX C-Chain and Ethereum main-chain. There are plans to support other EVM-based chains in the future, but currently, its only purpose is to help bring assets from/to Ethereum. AVAX bridge is quite limited in functionality, which looks more like an L2-purpose bridge than a general-purpose bridge.

NEAR

NEAR also has an official bridge called Rainbow Bridge. Rainbow bridge uses light client verification to synchronize between the bridge contracts on NEAR and Ethereum to achieve fast finality and security. As an official bridge, the slight drawback is obviously not supporting other chains in the EVM and non-EVM communities. There is also a potential long-term problem of high gas fees due to light client transactions and updates.

Summary

As we’ve seen from the most prominent public blockchains so far, their official cross-chain solutions are still limited to bridges, whether officially developed or licensed. Innovations won’t advance if public blockchains are still limited to bridge-based solutions.

MAP Protocol believes the change is now. As the solution to unify the different chains into an Omnichain system without compromising security, MAP is not simply a bridge solution, but rather the infrastructure supporting the most secure bridges and other forms of cross-chain tools to be built. MAP uses light-client verification to achieve instant security-finality, while proactively running cross-chain verifications on the MAP relay chain, to give developers and users the lowest transactional cost possible.

By partnering with the major blockchains above, and in addition with upcoming chains such as Harmony, Flow, KCC, and more, MAP believes in next-generation innovation in cross-chain infrastructure, powering an all-chain ready ecosystem and supporting even more creative cross-chain solutions down the line.

The Future of Cross-Chain: MAP Protocol – The Omnichain Network for an Interoperable Web3

]]>First Half 2022 Sees Highest NFT and GameFi M&A Deals Since 2013

The NFT market went big last year, getting the attention of notable names across different spheres of life. As a result of the NFT craze, the global NFT market hit $17.6 billion last year.

First Half 2022 Sees Highest NFT and GameFi M&A Deals Since 2013

]]>First Half 2022 Sees Highest NFT and GameFi M&A Deals Since 2013

Merger and acquisition (M&A) deals of non-fungible tokens (NFT) and game finance (GameFi) companies gained the most attention in the first half of 2022. Data compiled by The Block shows that NFT-related companies are continually establishing their presence in crypto deals. Specifically, about 38% of NFT and GameFi M&A deals happened in the year’s first two quarters.

NFT and GameFi M&A Deals Surge in 2022 Q1 and Q2

Citing a report by The Block Research, there have been 53 M&A deals in NFT and GameFi since 2013. About 20 of these 53 NFT and GameFi M&A deals were in 2022 Q1 and Q2. While 8 deals were in the first quarter, a record high of 12 was in Q2. The highest deal was in the second quarter, involving NFTs and GameFi. Specifically was OpenSea’s acquisition of NFT aggregator Gem for $238 million.

Also, the Q1 and Q2 deals represent the largest boost in M&A deals in both the NFT and GameFi industries. Stating its mission to bring more NFTs power and potential to more people globally, OpenSea said it acquired Gem to “invest in the future of the pro community.”

OpenSea added:

“After the acquisition, Gem will continue operating independently from OpenSea as a stand-alone product and brand. The Gem you know and love won’t change; and over time, we’ll bring key Gem features to OpenSea to make buying NFTs seamless and delightful for every experience level.”

Notably, M&A deals in these industries surged at a time the NFT buzz had cooled. The NFT market went big last year, getting the attention of notable names across different spheres of life. As a result of the NFT craze, the global NFT market hit $17.6 billion last year. The 2021 record signified a 21,000% growth over the market’s worth of $82.5 million in 2020. Despite the transaction volume of these non-fungible tokens, the hype remains, and many believe that the market is here to stay. The insane explosion has made NFTs the foundation for many projects that are expected to launch in the coming year. Also, the global NFT space is expected to reach $21.33 billion this year.

GameFi Contributes to NFTs Growth

GameFi also fueled NFT development by introducing play-to-earn games based on a blockchain. Players of these games earn in-game NFT assets as rewards. Examples of these play-to-earn games include “Axie Infinity” and “My Neighbor Alice.” Players can transfer their NFT to sell or trade on a marketplace. In addition to earning in-game NFT assets as rewards, players can also make real money. Some of the top projects underway to impact the gaming industry this year include Silks, Decentraland, and Chosen Ones. Others are Gods Unchained, and The Sandbox.

First Half 2022 Sees Highest NFT and GameFi M&A Deals Since 2013

]]>Web3 Messaging App Lines Raises $4M in Funding to Address User Communication Issue in Crypto Space

Lines has concluded a funding round to dive into the web3 space by providing verifiable user communication channels.

Web3 Messaging App Lines Raises $4M in Funding to Address User Communication Issue in Crypto Space

]]>Web3 Messaging App Lines Raises $4M in Funding to Address User Communication Issue in Crypto Space

New web3 messaging app Lines recently raised $4 million in seed funding from a host of investors led by former Twitter VP Elad Gil. Other participating investors were Hash3, Scalar Capital, Volt Capital, Caffeinated Capital, Ethereal Ventures, and Mischief. The list also includes Naval Ravikant, Balaji Srinivasan, and Gokul Rajaram.

In Light of Funding, Lines CEO Speaks on Company’s Value Proposition in Web3 Space

Lines’ co-founder and CEO Sahil Handa touted the company as a verifiable communication platform for crypto users. According to Handa, Lines’ user identity method would solve the crypto scam and hack problem that has caused people to lose millions of dollars. Speaking on the issue, the company’s co-founder and CEO explained:

“There is a rapidly increasing number of people using crypto pseudonyms to purchase digital currency, swap NFTs, vote on proposals, and manage treasuries. The problem is that whenever someone tries to communicate with another person in this network, there is no way of knowing whether or not they are talking to the right person.”

Handa further stated that Lines would allow its users to send messages directly from wallet to wallet. In addition, users of the upcoming app will be able to join group chats based on the tokens owned. In Handa’s own words:

“As a user navigates different DAO apps and NFT platforms, their Lines inbox will follow them around in the browser, enabling them to start conversations with users who hold the same tokens as them or who are members of the same communities.”

Also touching on Lines’ user operability, Handa said that users’ identities would be verifiable, pseudonymous, and secure. Furthermore, the company’s CEO added that users will have full control over their entity. Users will also control what parts of their identity they choose to share. In addition, users will be able to easily prove ownership of given currencies or tokens.

Lead Investor Also Weighs In

Speaking on the “intersection” of web3 and social messaging, Gil, lead investor of Lines’ funding round, was enthused about future prospects. According to Gil, merging social messaging functionality with crypto is one of the “more interesting parts” of the evolving web3 space. However, the former Twitter VP also added that today’s messaging tools may be insufficient for web3’s peculiarities. He concluded by suggesting that there were opportunities to fill these lapses and get it right.

As Lines looks to embark on its agenda, the startup faces competition from other web3 messaging apps. Gil admitted this prospect after revealing that he knows there are other teams working on similar projects. For instance, last week, Merkle Manufactory stated that it raised $30 million to develop a social networking protocol called Farcaster.

As it stands, Lines follows a number of other firms also trying to make headway in the marriage between web3 and social media.

Web3 Messaging App Lines Raises $4M in Funding to Address User Communication Issue in Crypto Space

]]>Stock Market Outlook Could Be Determined by Incoming Earnings Reports by Companies, Analysts Say

Analysts opine that expected earnings reports could impact investors’ reaction to the stock market after last week’s volatility.

Stock Market Outlook Could Be Determined by Incoming Earnings Reports by Companies, Analysts Say

]]>Stock Market Outlook Could Be Determined by Incoming Earnings Reports by Companies, Analysts Say

In light of last week’s stock market performance owing to rate fears, investors are now more likely to take cues from companies’ earnings reports. Throughout last week, stocks were volatile as hot inflation data triggered speculations of another substantial Fed interest rate hike. This changing investor sentiment on anticipated interest rates was only doused by strong Fed data by the end of last week. In the week ahead, investors will pay close attention to both housing and earnings data for future stock market predictions.

Stock Market Rebounds on Positive Fed Report as Other Business Earnings Loom

After a volatile week in the US stock market, all three major indexes posted sharp gains on Friday. This was probably caused by the market’s seemingly-dissipated concern that the Fed would raise interest rates by a full percentage point. Last Friday, Fed officials reported a surprise 1% June retail sales gain, and better-than-expected data on consumer inflation. Commenting on the reversal of expectations, Art Hogan, chief market strategist at National Securities, explained:

“It really was a great study in mob psychology. We went into the week with a 92% chance it was a 75 basis point hike, and we exited Wednesday with an 82% chance it was going to be 100 basis points.”

As of Friday, analysts concluded a 20% possibility for a 100 basis point hike.

However, the index gains were insufficient to totally erode the substantial losses sustained earlier. For instance, the S&P 500 was still down approximately one percent at 3,863.16.

Companies like PepsiCo (NASDAQ: PEP) and JPMorgan (NYSE: JPM) released quarterly earnings last week. In addition, a larger and even more diverse group of companies plan to release quarterly financial reports this week. They include Bank of America, Goldman Sachs, and Johnson & Johnson on Monday, and Netflix and Lockheed Martin on Tuesday. Wednesday’s quarterly earnings publications will feature Tesla and United Airlines, while AT&T, Union Pacific, and Travelers have a go on Thursday. For Friday, the market expects figures from American Express and Verizon.

Key Housing Reports

In addition to this week’s earnings, investors also have their sights set on key data releases – particularly around housing. Like the company earnings, these housing reports will be public at different times throughout the week. For instance, Monday will see a report from the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index. On subsequent days, there will be reports from the Philadelphia Fed manufacturing survey and the Purchasing Managers’ Index (PMI),

“Every data point matters and also what companies are saying,” explains Quincy Krosby, chief equity strategist at LPL Financial. Further touching on how these earnings paint a much broader picture of the economy’s trajectory, Krosby also added:

“If there are negative revisions and mounting concerns from the guidance, I think then you are going to see questions as to how the Fed is going to interpret that.”

Read other business news on Coinspeaker. Just follow this link.

Stock Market Outlook Could Be Determined by Incoming Earnings Reports by Companies, Analysts Say

]]>StarWORKS: Leading Hospitality and Tourism Blockchain Technology Company

What Is StarWORKS Global? Starworks Global Pte. Ltd is a blockchain technology developer that is commercializing an integrated ecosystem of products & services aimed at streamlining and revolutionizing the global Tourism and Hospitality industry. Their mandate is to create innovative blockchain-based products and services that will benefit the global Tourism and Hospitality markets. The blockchain […]

StarWORKS: Leading Hospitality and Tourism Blockchain Technology Company

]]>StarWORKS: Leading Hospitality and Tourism Blockchain Technology Company

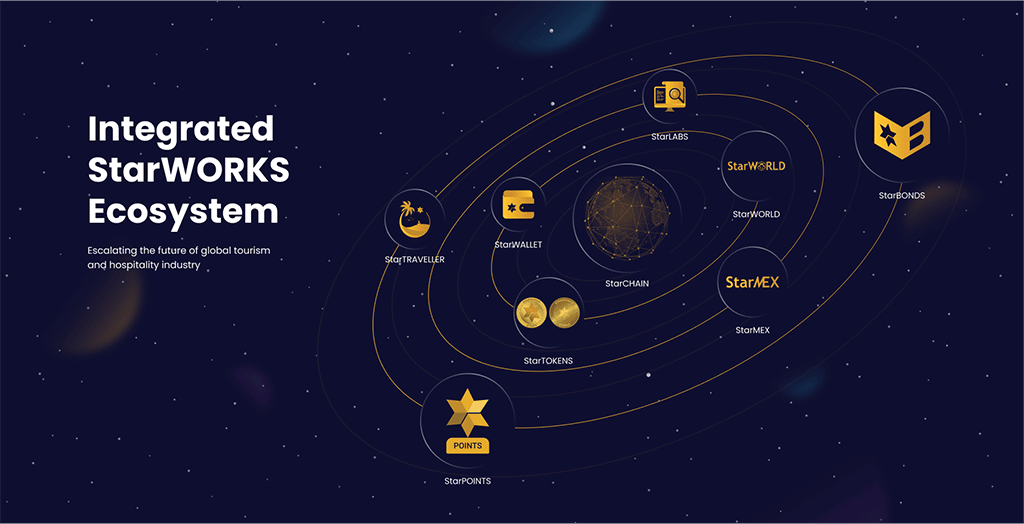

What Is StarWORKS Global?

Starworks Global Pte. Ltd is a blockchain technology developer that is commercializing an integrated ecosystem of products & services aimed at streamlining and revolutionizing the global Tourism and Hospitality industry. Their mandate is to create innovative blockchain-based products and services that will benefit the global Tourism and Hospitality markets.

The blockchain security and real-time data ledger technology they provide simplifies the workflow of hotels/resorts, airlines, restaurants, tour operators, and other retail businesses in the industry, increasing work efficiency and reducing business operating costs. When enterprises achieve sustainability and gain more opportunities, they can provide customers with more personalized products and services and a better experience that ultimately helps the enterprise survive and grow. The global B2B and B2C business model provides great benefits and opportunities for StarWORKS blockchain customers, merchants, and investors alike.

A Singapore-based company with over 20 years of industry experience in the travel and hospitality industry, StarWORKS will have technology-related operations in Indonesia, and the company currently has subsidiaries in the US and Australia, with further global expansion planned. The Operations team is made up of passionate individuals with broad knowledge and expertise in a variety of business, management, and technical disciplines.

Starworks Global Pte. Ltd’s product portfolio includes:

- StarPOINTS - Blockchain-Based Loyalty Rewards Program

- StarTRAVELLER - Exclusive Members Travel Club

- StarHUB - Crypto Collaboration Cafe

- StarMEX - Digital Exchange

- StarBOND - Digital Bond

- StarCHAIN – StarWORKS’ Proprietary Blockchain

- StarWALLET – Blockchain Crypto Wallet

Underpinning all this is the STARX token, the native currency of the StarWORKS ecosystem, which has been listed on December 24, 2021.

StarWORKS Ecosystem.

$STARX Coinstore Listing

Trade Time:2 July 2022, 15:00 (UTC+8)

Withdrawal Time:3 July 2022, 15:00 (UTC+8)

What Is the Token Utility of STARX?

The STARX token is the native currency of the StarWORKS blockchain and was developed based on the Ethereum Blockchain ERC-777 token standard. Released in 2019, STARX is the utility token that initial angel investors issued. These investors provided the development capital to help develop the StarWORKS Ecosystem to its current state of readiness. As the project moves forward, the products and services within the ecosystem will be offered to the Tourism and Hospitality sector to assist in its rebuilding after the disastrous effects of the COVID-19 Pandemic. StarWORKS will now launch the STARX on suitable digital exchanges, initially as an IEO, to raise funds to complete and commercialize the elements of the StarWORKS Ecosystem.

In 2019, StarWORKS issued 1,000,000,000 STARX tokens. There are approximately 125,000,000 STARX Tokens held by individuals and corporate investors.

What Is the STARX’s Economic Model?

- Public Sale (60%)

STARX is the native currency of the StarWORKS blockchain ecosystem which recreates functions to improve the StarWORKS Ecosystem. Comprehensively committed to planning a revolutionary and functional governance model, we plan to dedicate resources to developing the StarWORKS business.

- Affiliate Partner (15%)

15% of tokens were issued for marketing. On our basis, this allocation gives to investors or pre-donors of this project. We have a verified track record and can offer tokens a genuine ecosystem.

- Founding Team (20%)

The StarWORKS team will keep 20% of issued tokens. Soon, the allocation will use for development, research, and operations at StarWORKS Global.

- Reserved (5%)

5% of the tokens issued will be kept in reserve. We believe this should be standard practice for any team committed to making the project a long-term success.

StarWORKS X Coinstore will be hosting telegram AMA on 15 July 2022, at 3 pm (UTC+8).

Click here to Coinstore Telegram >>

StarWORKS’s Official Online Contacts: Telegram | Twitter

About Coinstore.com

As the world’s leading provider of financial infrastructure and technology in the crypto field, Coinstore.com is driven by its mission to advance the crypto industry to the next level. Coinstore.com is constantly on the ball to equip its users with experiences and techniques to buy, sell, and trade on the go through fast and smooth cryptocurrency trading services, derivatives business, and OTC and NFT services. Prioritizing users’ assets with bank-level security services, Coinstore.com is working towards becoming your first stop for popular crypto.

Coinstore.com Social Media: Twitter | Telegram

StarWORKS: Leading Hospitality and Tourism Blockchain Technology Company

]]>Will Gnox (GNOX) Defy the Bear Market Trend That Bitcoin SV (BSV) and Tezos (XTZ) Are In and Gain 50x as Analysts Predict?

While pretty much all altcoins have been in a death spiral since last fall (no pun intended), there is a way to assure some nice gains on your crypto investments in the coming month.

]]>Will Gnox (GNOX) Defy the Bear Market Trend That Bitcoin SV (BSV) and Tezos (XTZ) Are In and Gain 50x as Analysts Predict?

While pretty much all altcoins have been in a death spiral since last fall (no pun intended), there is a way to assure some nice gains on your crypto investments in the coming month. If altcoins return to their all-time highs investors could see up to 10X returns in the coming years. Here are a couple of examples plus one token that’s guaranteed to produce gains this summer.

Tezos (XTZ)

The Tezos (XTZ) blockchain is similar to Ethereum (ETH). Tezos claims to be future-proof, “secure, upgradable, and built to last.” According to Tezos, its network will “remain state-of-the-art long into the future,” meaning it can easily incorporate new blockchain technology developments.

So, how’s it going for Tezos this year? XTZ hit a high of about $9 in Oct. 2021. Since then, the price has fallen by about 82%. About two-thirds of its value has been lost in the past three months. If XTZ returns to its all-time high from today’s price of $1.69, it could return 500% on your investment.

Bitcoin SV (BSV)

Bitcoin SV (BSV) is a hard fork of Bitcoin. However, instead of trying to go its own way, BSV is closer to the original Bitcoin (BTC) protocol than Bitcoin (BTC) itself and the other hard forks, Litecoin (LTC) and Bitcoin Cash (BCH). BSV currently has a market cap north of $1 billion.

So, how’s it going for Bitcoin SV this year? BSV has dropped in price by more than half in the past three months and has lost more than 90% from its all-time high a year ago. If BSV returned to its all-time highs it could produce an 800% return from today’s price of $52.

Gnox Token (GNOX)

Gnox Token is a DeFi token that acts a bit like an ETF and a bit like a dividend stock. GNOX represents an underlying diverse basket of DeFi assets that generate passive income. All crypto investors have to do in order to collect passive income is to buy and hold GNOX. The rest is done for them by a team of experienced DeFi analysts.

So, how’s it going for Gnox this year? Interestingly, although the platform doesn’t officially launch until August 18th, early buyers have already seen gains north of 60% and are actually guaranteed to see additional gains prior to launch. This is made possible by an innovative ICO and tokenomics.

The pre-sale of Gnox Token is divided into three one-month-long phases with an allotment of GNOX set aside for each phase. At the end of each period, all unsold tokens allotted to that phase are burned. This reduces the supply and thus raises the price of the token for the pre-sale next round. This means that all unsold tokens will be burned prior to launch, which, of course, will once again reduce the supply and increase the price.

So what’s the future look like for GNOX? If it can get to just $0.50, early adopters will see gains north of 50X or 5,000%. While that might sound a bit, shall we say, hyperbolic, some analysts are predicting parabolic price action for GNOX as its simplicity makes it a prime candidate for mass adoption.

Another factor that will play heavily into the value of GNOX is the fact that the underlying treasury will be constantly growing in size and thus producing more and more revenue for holders. This is made possible by borrowing a trick from successful NFT collections. Essentially, an after-market royalty from all token sales goes into the GNOX treasury. Anyone who sells GNOX ends up leaving a portion of their stack behind for the rest of the holders to enjoy. Moreover, this royalty discourages swing trading and encourages early adoption and long-term hodling.

Find out more about Gnox here: Website, Presale, Telegram, Discord, Twitter, Instagram.

]]>Bitcoin and Ethereum Make Strong Moves: Is It Real Breakout or False Moves?

Bitcoin and Ethereum have shown a strong upside over the last weekend. A strong weekly closing can result in a further price rally ahead this week.

Bitcoin and Ethereum Make Strong Moves: Is It Real Breakout or False Moves?

]]>Bitcoin and Ethereum Make Strong Moves: Is It Real Breakout or False Moves?

Over the last week, the top two cryptocurrencies – Bitcoin (BTC) and Ethereum (ETH) – showed strong moves pumping mostly in the last weekend.

Bitcoin and Ethereum Price Movements

As of press time, Bitcoin is trading at $21,266 levels while Ethereum (ETH) traded above $1,400 levels. The recent BTC price pump comes largely on the backdrop of retail-driven thin liquidity. On the other hand, institutions have remained largely out of the picture.

In the past, Bitcoin has given such “fakeout” moves during the weekend. This time too, there’s no strong catalyst behind the recent price pump. Market analysts aren’t quite excited about the recent move. Popular market trader @Rage wrote:

“Weekend pumps typically are not to be trusted Let’s see how this one holds going into the weekly close tomorrow”.

Similarly, popular analyst Rekt Capital added:

“Typical #BTC Bear Market bottoms tend to take months to develop before a new macro uptrend begins. $BTC has been meandering at current prices for only a few weeks. History suggests it is too premature to expect a full-blown macro trend reversal so soon”.

On the other hand, exchange inflows suggest that traders are looking to exit the market. Over the last weekend, crypto exchange Binance witnessed heightened inflows. On Sunday, July 17, on-chain analytics platform CryptoQuant showed that inflows on crypto exchanges totaled 17,500 BTC, the most in a single day since June 22. This could likely put selling pressure on BTC once again. If BTC manages to register a weekly close above $21,300, this would be the second consecutive “green” weekly close.

ETH Price Shoots Past $1,400

Ethereum (ETH) has been one of the top performers with its price crossing $1,400 levels. The ETH price has gained 40% from the weekly low. As of press time, ETH is trading 5.53% up at a price of $1,427.

The latest price euphoria comes as developers announced that Ethereum will implement The Merge upgrade on its mainnet in the week of September 19. The news has brought renewed confidence among Ethereum supporters. Furthermore, on-chain data provider Santiment notes that the whale buying activity for ETH has shot up. There are more than 130 $100K addresses added on Ethereum since May 2022.

🐳 #Ethereum has recovered quite well in July, up +29% for the month and +14% alone in the past 24 hours. Additionally, there's an increase in the key 1k to 100k $ETH address tier since early May where 131 new whale addresses have popped up on the network. https://t.co/uGfRQ4dEls pic.twitter.com/ri8MhGIP0o

— Santiment (@santimentfeed) July 17, 2022

If ETH closes above $1,400 levels, this would open the doors for $1,700 and further for $2,000.

Bitcoin and Ethereum Make Strong Moves: Is It Real Breakout or False Moves?

]]>Your Road to Wealth Could Be Paved with Gnox (GNOX), eCash (XEC), and Aave (AAVE)

This article features three crypto projects to help any crypto investor start to build generational wealth.

Your Road to Wealth Could Be Paved with Gnox (GNOX), eCash (XEC), and Aave (AAVE)

]]>Your Road to Wealth Could Be Paved with Gnox (GNOX), eCash (XEC), and Aave (AAVE)

Rapidly expanding markets make investors who pick the right projects incredibly wealthy. This has always been true, and its most recent instance is within the crypto sphere. As blockchain technology and digital assets become more mainstream, they continue to attract increasing waves of capital. Investors backing solid projects in the early phases will make life-changing returns. This article features three crypto projects to help any crypto investor start to build generational wealth.

Gnox (GNOX)

Gnox is a protocol that several analysts have earmarked to be the most promising release on the BSC (Binance Smart Chain) in 2022. Currently, in its presale stage, this protocol offers ordinary crypto investors exposure to DeFi (decentralised finance) earnings. The DeFi ecosystem has birthed numerous novel ways for investors to generate passive income with their crypto holdings. Still, many investors are blocked from participating due to the fast-changing and complex formation of DeFi’s landscape.

Gnox is the first protocol to offer yield farming as a service and does all the hard work for the investor. By holding GNOX, the investor gains an hourly distribution of GNOX tokens and a monthly stablecoin reflection. These earning opportunities are made possible by GNOX’s tokenomics which include buy and sell taxes. Gnox is making DeFi investment easy and will likely see a massive influx of capital from investors who want to generate passive income in a low-touch manner. As stablecoin payouts materialise for investors, GNOX will become more desirable, and its price will reflect this.

eCash (XEC)

eCash is a protocol built on the foundations of Milton Friedman’s economics and seeks to implement a better form of money. It focuses on being an electronic payment that priorities individuals and their freedom, and for this reason, it offers the investors the possibility to remain anonymous when making transactions. Privacy within crypto is becoming a hot topic, with many investors lulled into a false sense of security by the pseudo-anonymous nature of wallets. However, with most people buying crypto on large exchanges that mandate KYC, all their transactions on the blockchain are now attachable to an identity. eCash and other privacy-focused cryptos will experience explosive growth when investors start to take privacy more seriously.

Aave (AAVE)

Aave is a DeFi ecosystem giant and primarily a decentralised lending protocol. It allows users to deposit and collateralise their assets and access permissionless loans. Several reasons investors choose to do this include a desire to avoid triggering a taxable event by selling their crypto. Typically, this is done with the belief that the collateralised asset will appreciate with time. The leveraging of assets is a financial strategy frequently employed by the wealthy, and Aave gives this power to ordinary investors. AAVE is the governance token, and its price action is directly tied to the growth of the protocol. AAVE now trades at $78.49, and during the next bull market cycle, it is likely to eclipse its prior ATH (All-Time High) of $666, making it a great investment choice.

Find out more about Gnox here: Website, Presale, Telegram, Discord, Twitter, Instagram.

Your Road to Wealth Could Be Paved with Gnox (GNOX), eCash (XEC), and Aave (AAVE)

]]>MyFunding.Network: Next Big Thing in DeFi?

Apart from the uniqueness of its algorithm, MyFunding.Network provides users with a handful of interesting features.

]]>MyFunding.Network: Next Big Thing in DeFi?

Over the years there have been numerous exciting projects to arise in the world of blockchain development and stake a claim to being the next big thing. Some live up to the expectation, while some fizzle out eventually.

Either way, it is a great thing that the blockchain community is vibrant enough to make it possible for so many truly fascinating projects to have a space to shine.

Recently, most of the highly promising projects have been into DeFi, and there is one that at the moment is showing more promise than we’ve come across in a while.

Believing that this could very well be the authentic next big time, we delve deep into the heart of this project, examining among other things, its backbone algorithm, development team, features, functionalities, and exciting future.

We’re talking about MyFunding.Network. A dApp that offers 1.5% of daily ROI and an APY of 547% on your investments.

A network committed to providing the users with a splendid opportunity to earn a consistent passive income of their investments. The rate of return on the investments you make with the bot in terms of BNB on a daily basis is 1.5% which is equivalent to $15 if you invested $1,000.

The dApp is free from any hidden charges and the only fees they charge is the 3% developer fees for fulfilling the purposes of app maintenance. However, the standard gas fee for the BNB is also charged which too is cheap.

What Is MyFunding.Network?

Simply put, MyFunding.Network is a decentralized application built for highly reliable automated crypto trading. Through this dApp, users who are interested in achieving financial success through crypto trading can do so conveniently without necessarily having the technical knowledge.

Thanks to a state-of-the-art algorithm, MyFunding.Network’s advanced AI takes care of all the important technical analysis and makes the right calls on behalf of each user.

The question, though, is why automated crypto trading? Is it that much better than personal trading? And if so, why MyFunding.Network?

Well, the answer is a lot simpler and more straightforward than we thought.

Technical Analysis in Successful Trading

You see, every seasoned trader knows that the key to successful trading is a solid technical analysis. Otherwise, the whole thing is just a glorified gambling process. And while there are experienced traders out there who are quite adept at carrying out this activity to near perfection, it is safe to say that there is a limit to how far the human brain can be pushed.

In fact, if there is a thing better than a seasoned trader carrying out a thorough technical analysis, it is a lot of seasoned traders carrying out the same thorough technical analysis at the same time.

This ladies and gentlemen is the backbone upon which MyFunding.Network was built. Numerous cryptocurrency trading experts and seasoned blockchain developers came together with one goal – to revolutionize the world of AI crypto trading by building a system so solid and so flexible that it will be almost impossible to say no to.

Thanks to the early success MyFunding.Network continues to enjoy, it is safe to say that this goal is starting to look more and more like an absolute success.

The dApp has managed to surpass the 470 BNB mark, which is equivalent to over 114,000 USD, and counting.

Features & Functionalities

Apart from the uniqueness of its algorithm, MyFunding.Network provides users with a handful of interesting features that are hard to ignore. Chief among these is its straightforward withdrawal and deposit processes.

A big problem for blockchain projects for a long time was the fact that every single process seemed to require an extra bit of step that most people outside of the crypto world were familiar with.

Thankfully, the team behind MyFunding.Network was able to alleviate this problem by integrating their dApp on the Binance Smart Chain thereby making deposits on the platform nothing more than a simple three-step process.

Another feature that you should be laying an emphasis on is the fact that the dApp does not require any minimum deposit. You can start earning profits with the least amount you invest. Could anything be better?

With a promise of high profits, MyFunding.Network has managed to experience notable growth since its beginning. The network is on a mission to enroll itself as a firm that offers the most profitable automated trading bot pools on the Binance Smart Chain.

As soon as the deposit period of 30 days completes, users can expect an impressive return of the 547% APY in the form of passive income.

With a simple Metamask or Trust Wallet, users can easily buy any amount of BNB they desire and load this onto the dApp with a quick linking process.

From then on, automated trading begins and traders are free to relax while the algorithm handles the bulk of the work.

Referral Program

MyFunding.Network also offers a referral program that will certainly grab your attention. When users make an investment in a smart contract, they are provided with a referral link, which they can share with their friends to receive additional rewards

With each deposit made by your referrals, you will earn a hefty 11.5% commission. This boasts the app as a trusted one with immense potential and great benefits for the users.

Interested in learning more about this project? Join the telegram channel here to get connected.

]]>