Key Takeaways

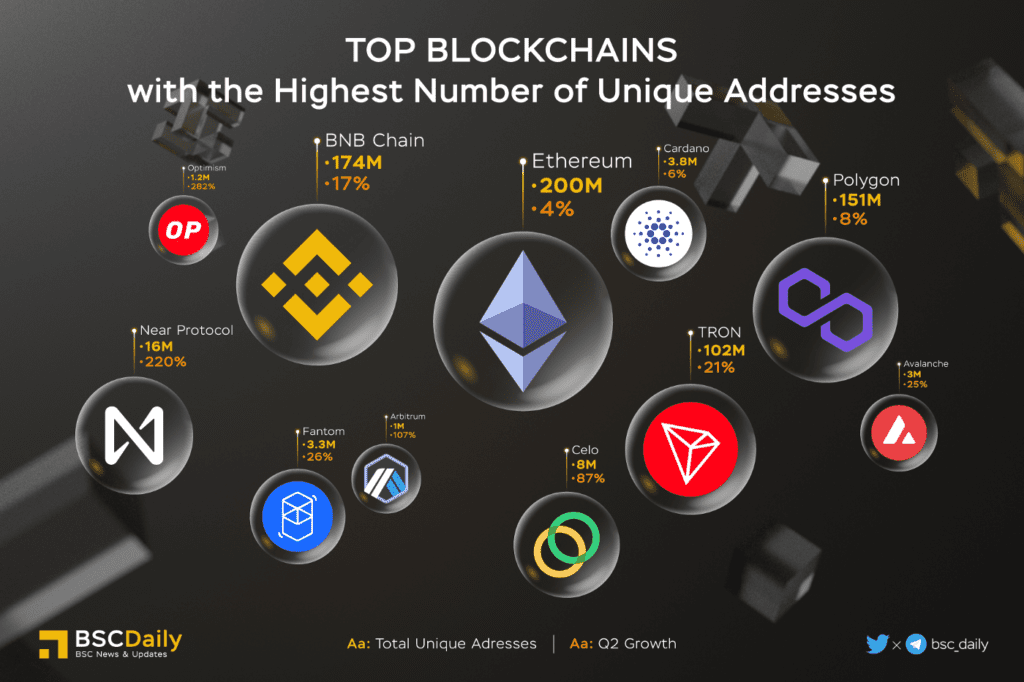

- Although Total Value Locked decreased by more than 50% in Q2, Total Unique Addresses on BNBCHAIN continued to increase by nearly 25 million, bringing the total number of BNBCHAIN wallets to 173 million, expected to reach 200 million in Q3.

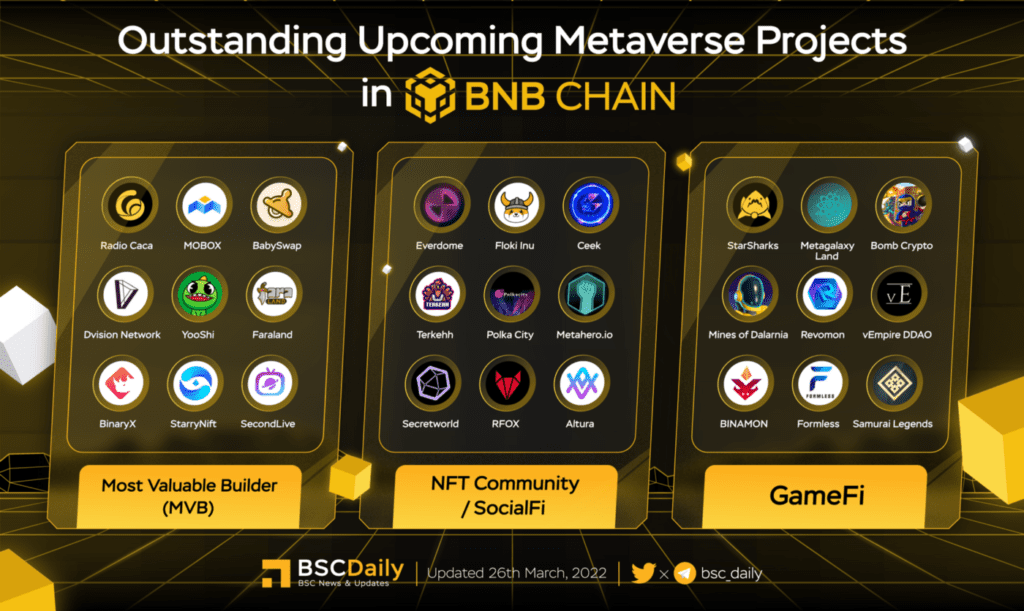

- BNBCHAIN launched MVB V — Uncharted Territory, covering key areas including Infrastructure, DeFi, GameFi, SocialFi, Metaverse, and other innovations.

- Binance Announced Collaborations With Many Artists and Influencers, including The Weeknd, CR7, and Khaby Lame,…

- Binance Labs Announces $500M Investment Fund With Deep Interests in Web3-Related Technologies, Bringing Web3 to Mass Adoption.

Introduction — BNB — “Build and Build” Cultures

BNB Chain currently has more than 1400 active Dapps, 173+ million wallets, and approximately 1 million daily active users. Over the past time, GameFi and Move-to-Earn seem to have not attracted interest from the community.

DeFi, Infrastructure projects are trying to adapt to the Bear market by Tokenomic & Product Updating.

Several potential fields, including Metaverse, NFTs, Infrastructure, SocialFi, and Web3, are still gaining attention and receiving investment from many large funds with the ambition to thrive in the coming cycle.

From our perspective, Infrastructure and NFTs are the areas that will see a lot of volatility in the future because of their accessibility.

Let’s dive into what has happened in the BNB Chain in Q2.

Market and Bitcoin Correlation

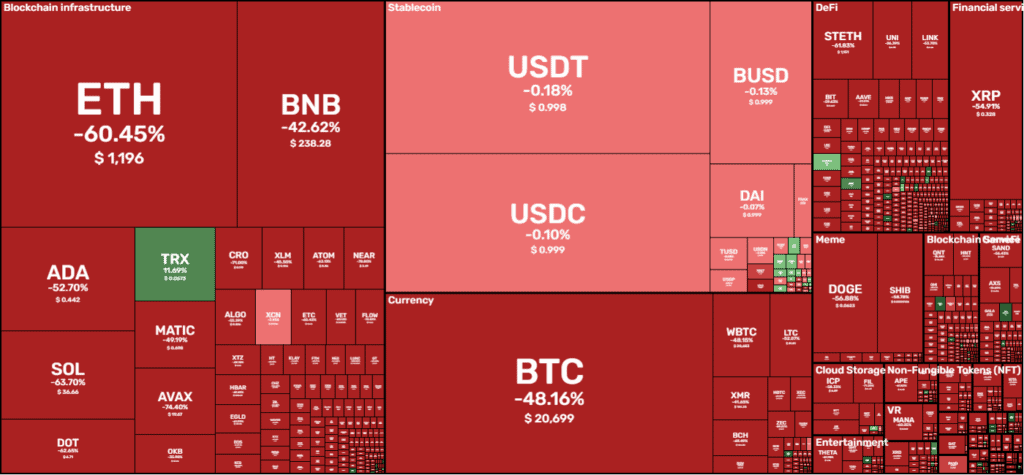

The second quarter of 2022 was one for the books amid a tumultuous period of what I like to call market madness, and the evidence keeps stacking up for the crypto markets. Q2 was full of massive crypto “losses” across the web3 ecosystem, some 97% of which were the result of hacks.

The pain continues as Q2 2022 was filled with many unfortunate events in the crypto space. The top 30 coins have lost over half their market cap since the previous quarter, as the total market cap now sits at approximately 900 billion towards the end of June. While prices have gone down by a fair bit, spot trading volumes have remained relatively stable at around $100 billion daily.

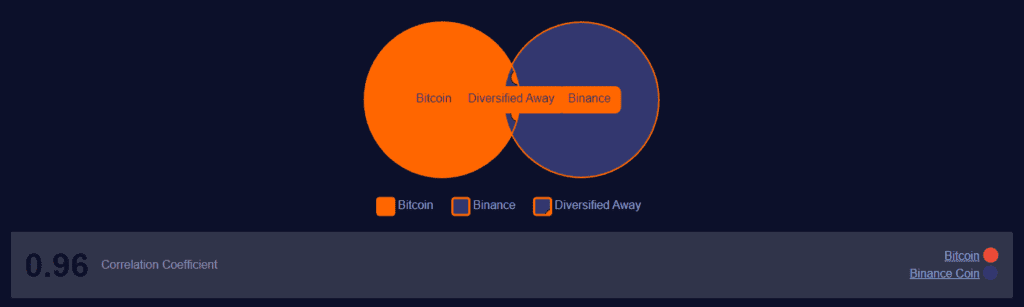

Diversification Opportunities For Bitcoin And Binance Coin

The 3 months correlation between Bitcoin and Binance is 0.96. Overlapping area represents the amount of risk that can be diversified away by holding Bitcoin and Binance Coin in the same portfolio, assuming nothing else is changed. The correlation between historical prices or returns on Binance Coin and Bitcoin is a relative statistical measure of the degree to which these equity instruments tend to move together

Values of the correlation coefficient are 0,96 means almost no diversification.

Pair Correlation Between Bitcoin And Binance Coin

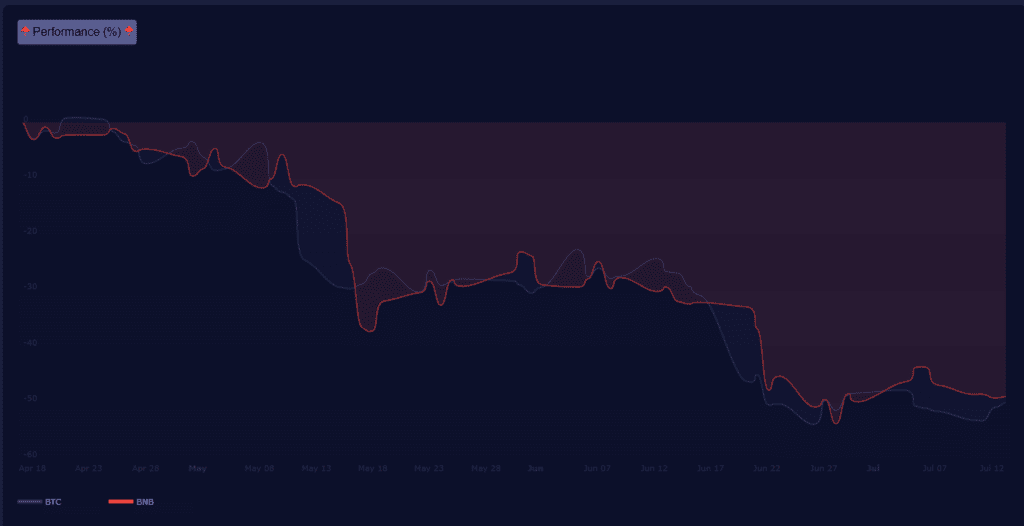

Assuming the 90-day trading horizon, Bitcoin is expected to underperform the Binance Coin. In addition, Bitcoin is 1.0 times more volatile than Binance Coin.

One of the reasons behind BNB’s relatively stable price action is that Binance has been stomping its foot into major European nations. Following regulatory approval in France in early May, as reported by FXEmpire, Binance now has its eyes set on Germany as part of its EU expansion goals.

The largest crypto exchange by trading volume has been on a rapid global expansion spree, even in the Middle East, securing regulatory approvals from Bahrain, Dubai, and Abu Dhabi. The same has acted in favor of BNB’s social narrative, keeping prices afloat even in a bear market.

In terms of the BNB Chain ecosystem, the decrease in BTC will purge the ecosystem, making it easier for investors to distinguish between good and bad projects. Therefore, investors will have more suitable choices and decisions for a long-term vision.

Besides, reducing many low-quality projects on the Binance Chain ecosystem will increase the overall reputation and quality of the BNB Chain network.

Network Activity

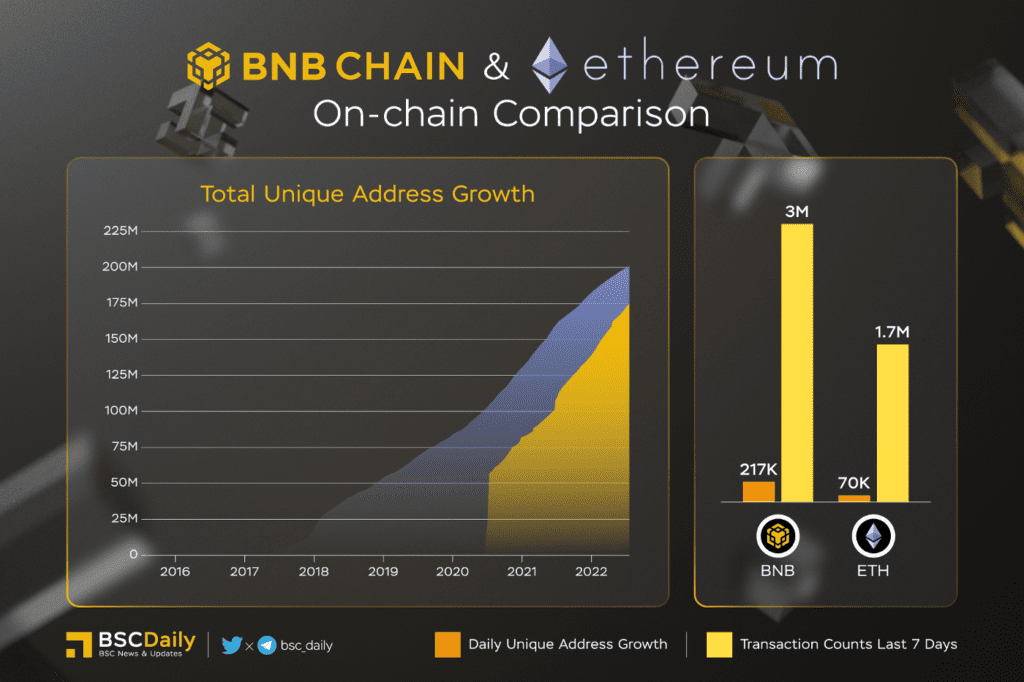

Unique Address Growth Between BNB Chain & Ethereum in Q2

BNB Chain Unique Address Growth has tripled compared to Ethereum in Q2, which proves the value of BNB Chain in attracting users and being an ecosystem that gives investors more opportunities to skin in the game.

It is expected that BNBChain will surpass Ethereum in Total Unique Addresses in 2023 if both ecosystems continue to grow according to the current run rate.

Daily Transaction Counts Between BNB Chain & Ethereum in Q2

Looking at Daily Transaction Counts, BNBChain is four times more active than Ethereum because trading on BNB Chain has many benefits, such as cheap fees and fast and easy scalability.

Thus, Dapps, Users, and Builders have considered the BNBconsidered BNB Chain an ideal ecosystem for development, investment, and experience.

The Total Unique Addresses on BNBChain have increased by nearly 25 million in the last quarter, proving that investors still consider BNBChain the most suitable place to participate in investment activities and experience.

In comparison with Ethereum, Fantom, Avalanche, Cosmos, Near Protocol, etc. BNB has outperformed clearly.

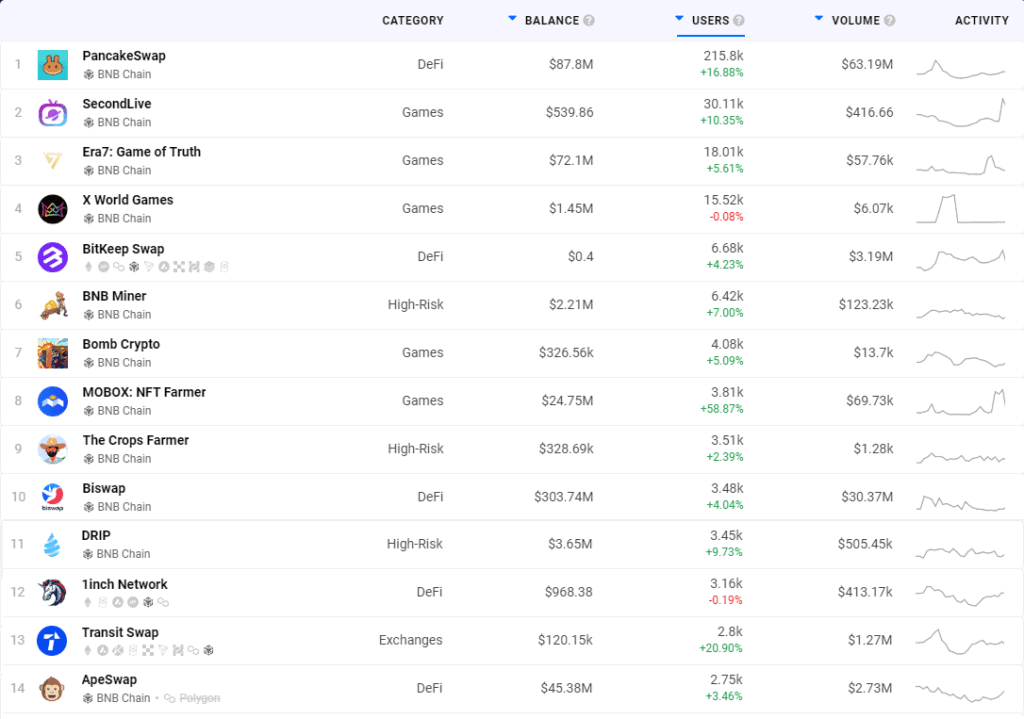

Looking at the User Number, the sectors occupying most are DeFi & GameFi, because DeFi is the first platform to support investors for swapping, staking & farming in a lousy market and increasing their daily profits.

Besides, GameFi are projects that bring joy and entertainment to investors after intense research and analysis time.

Moreover, Metaverse and NFTs experienced a sudden increase in both users and trading volume.

State of BNB Chain Ecosystem

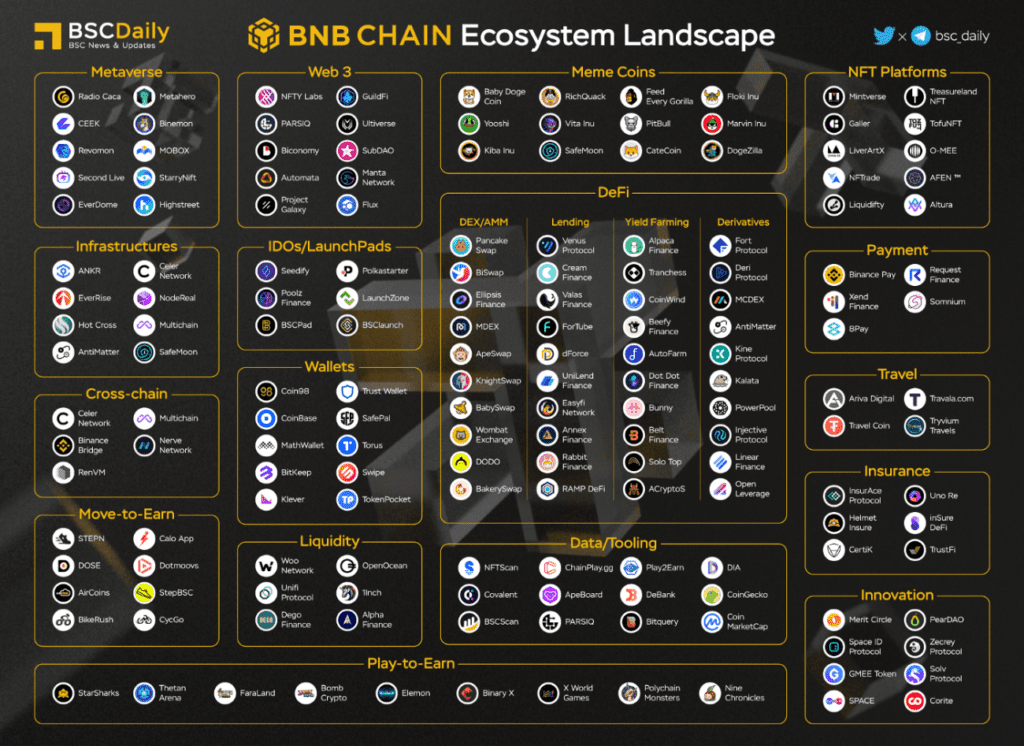

The BNB Chain ecosystem is the fastest-growing in Q2 with many GameFi, Metaverse, and NFT projects.

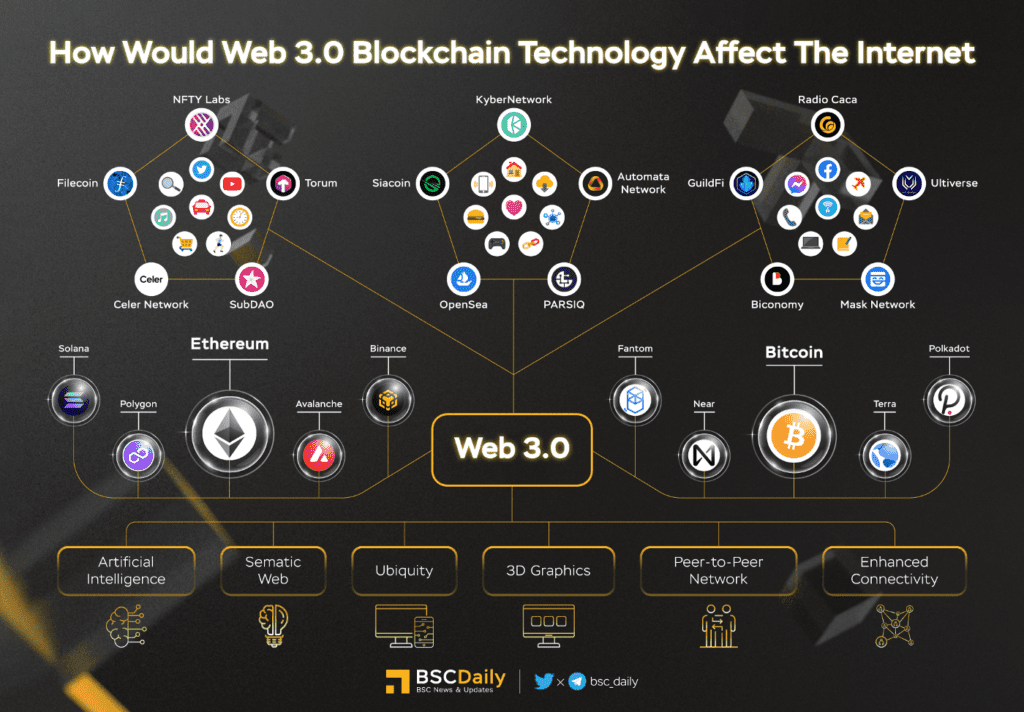

CZ, Binance, and Web3

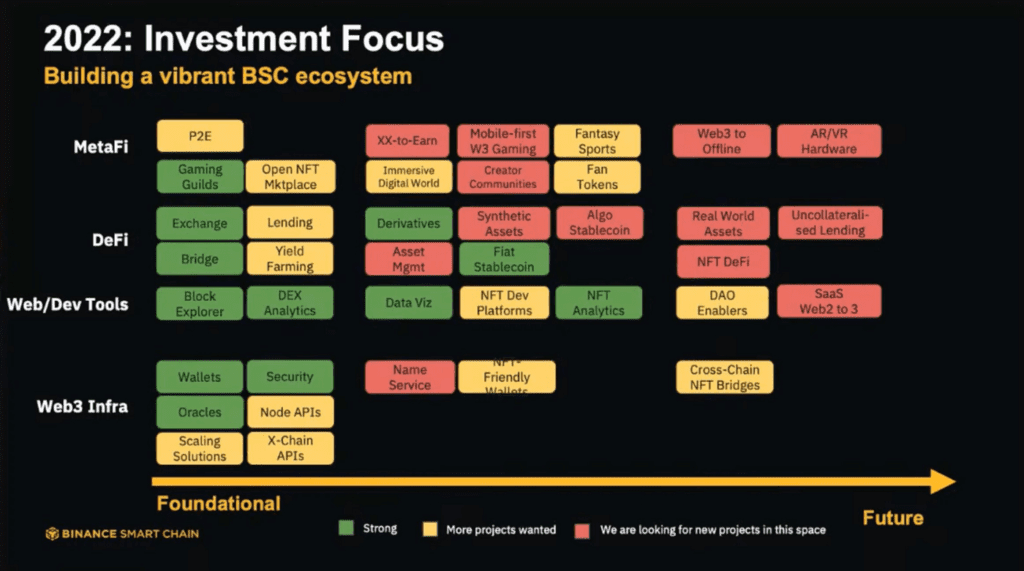

Recently, Binance announced the launch of a $500M investment fund to develop Web3 Mass Adoption. The fund is supported by leading global institutional investors such as DST Global Partners, and Breyer Capital. Other major private equity funds, family offices, and corporations also subscribed to the fund as limited partners.

Binance Labs has raised $500 million to establish a fund that will invest in Web 3 and blockchain companies.

“The goal of the latest investment fund is to discover and support projects and founders with the potential to build and lead Web 3 across DeFi, NFTs, gaming, Metaverse, social, and more,” Binance CEO Changpeng “CZ” Zhao said.

The new fund aims at projects that can extend the use cases of cryptocurrencies and drive the adoption of Web3 and blockchain technologies.

CZ and Binance have expressed a deep interest in Web3 technology and ways to optimize the user experience with this technology for Web3 mass adoption in the future.

BNB Chain Ecosystem Breakdown

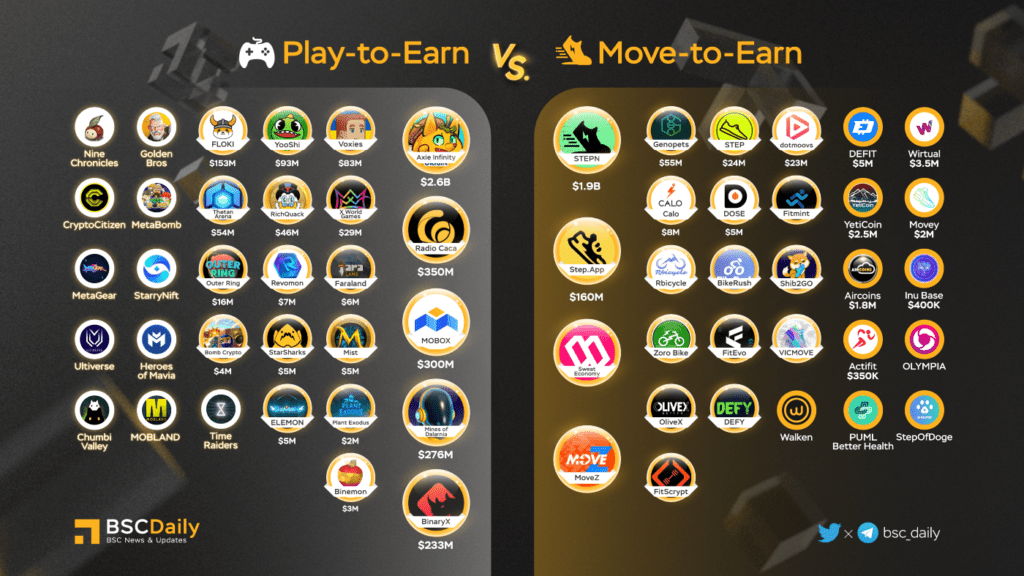

Move-to-Earn — The New Technology or An Old Product with New Packaging?

Move-to-earn Dapps reward people for moving around in the real world. But there’s more to this new industry trend than just picking up some tokens after going for a run. It means Move-to-earn isn’t a brand new concept.

Move-to-earn is not a brand new idea. Lympo has been around for a few years already, paying out LYM tokens to people for leading healthy lifestyles. But it’s only until 2022 that the movement has really taken off.

However, the move-to-earn trend emerging right in the middle of the bear market was not as lucky as Play-To-Earn or GameFi. Due to several factors, such as

• Macroeconomics is extremely bad.

• Many blockchain projects were hacked and went bankrupt.

• Tokenmonics has not been resolved yet.

• Many users cheated, spammed, etc.

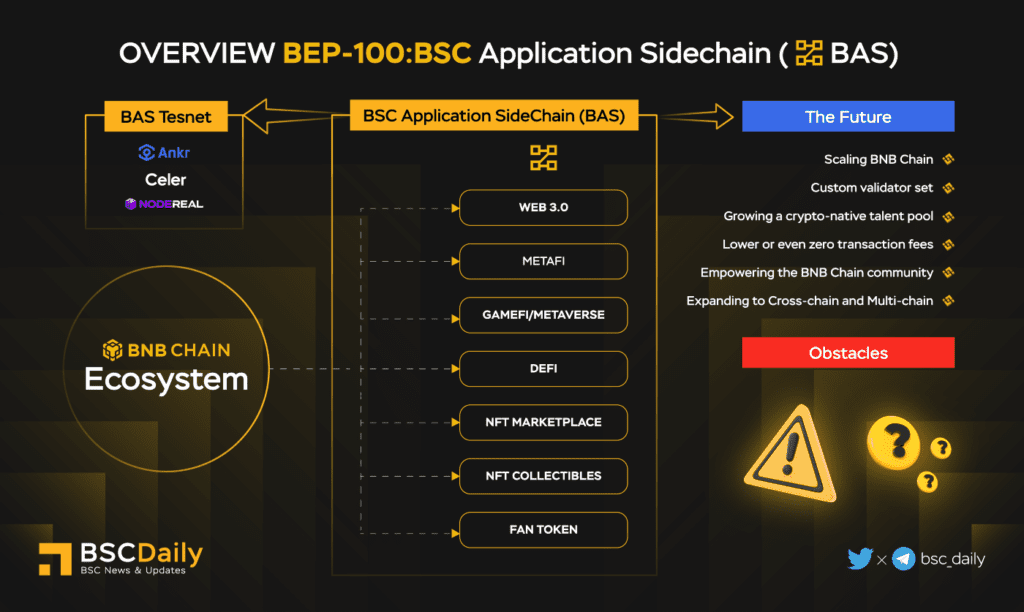

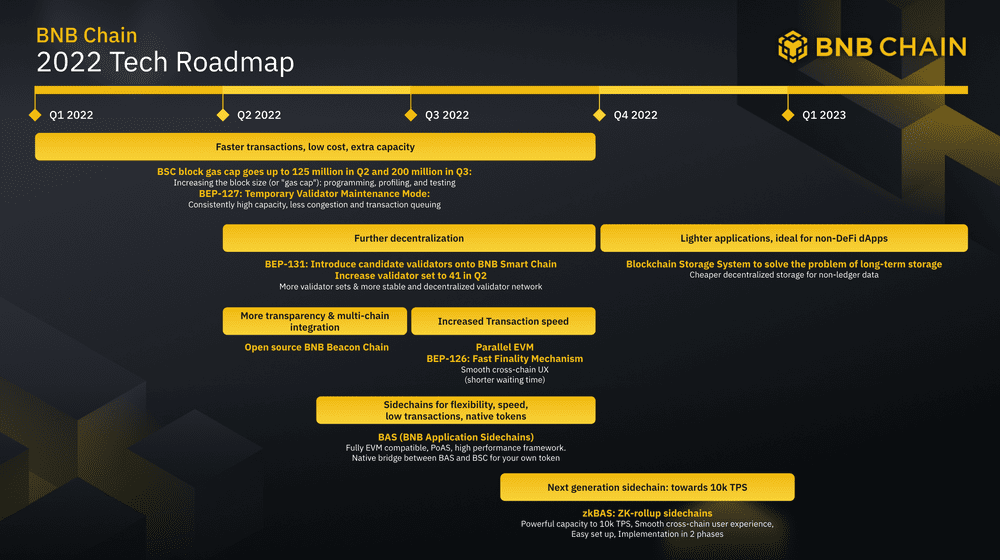

Binance Application Sidechain Current Stage

Finally, BNB Chain has been developing the final steps for Binance Application Sidechains to upgrade and expand BNBCHAIN.

Suppose BAS is completed in Q3 and Q4 as on the proper roadmap. In that case, the beneficiaries would be Nodes, Infrastructure, and GameFi/Metaverse projects because this upgrade will help projects expand their potential and reach customers easily.

At this stage, the BAS framework will go live to enable the development of new dApps on this new high-performance infrastructure with full Ethereum compatibility (EVM) and the PoSA consensus. Thanks to this, it’s a walk in the park for developers to start building on BAS without learning a new coding language or wasting hours reading technical materials.

A native bridge between BAS and the BSC Mainnet is a part of this integration and allows frictionless bridging for BEP-20 and BEP-121 tokens.

The first deployment on the BAS will be three decentralized applications (dApps) by META Apes, Project Galaxy, and Metaverse World, as well as integrations by leading infrastructure partners such as Ankr, Celer, Mathwallet, Multichain, NodeReal, and Pyth Network.

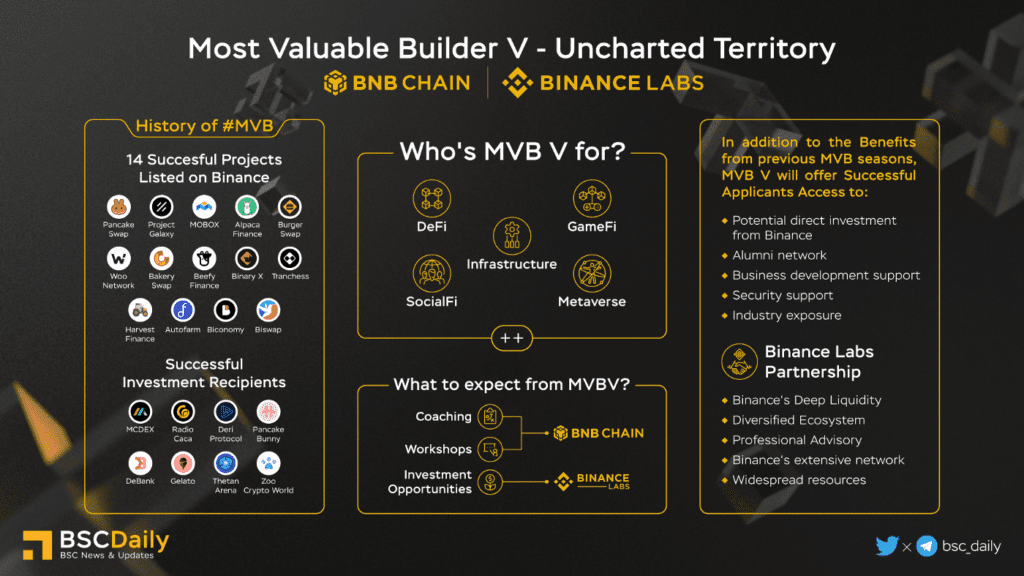

MVBI V — Uncharted Territory, Where No Developer or Buidler Has Gone before

Most Valuable Builder (MVB) Accelerator Program is back and the latest iteration, MVB V: Unchartered Territory, is set for launch as applications from innovators across the industry continue to flood in.

The incubation program is designed to equip builders on BNB Chain with the means to reach their full potential. With the developer community and ambitious projects out there, BNB Chain wants to embark on Uncharted Territories, where no developer or buidler has gone before.

Effects of Terra Collapse & BNB Chain Opportunities for Terra Builders

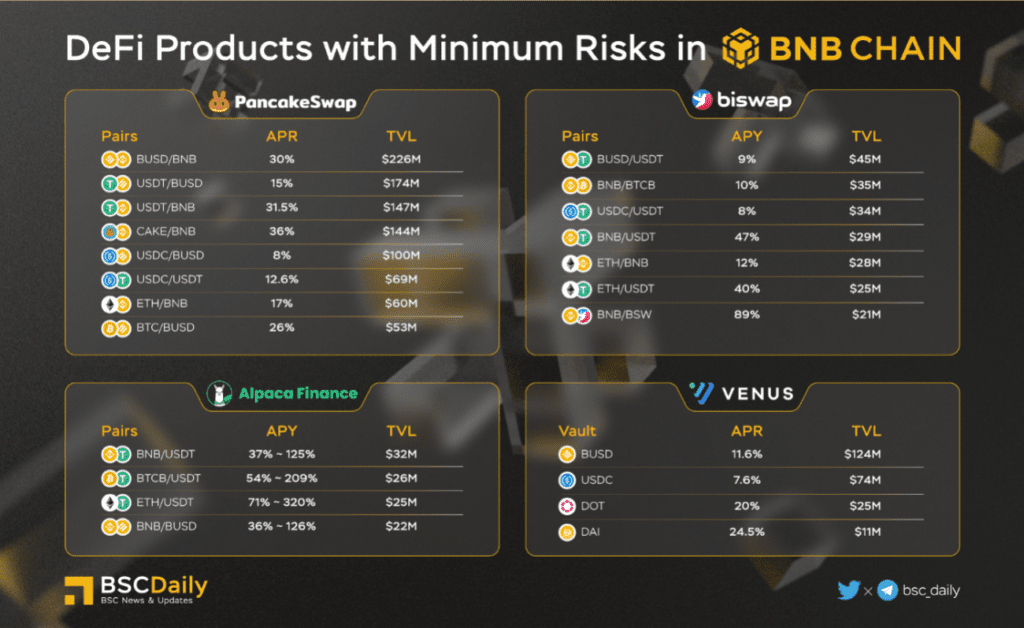

In the Second Quarter, many projects lost their Total Value Locked due to the market’s fierceness and Terra’s collapse.

However, some projects are less affected by well-designed and sustainable Tokenomics and Business models.

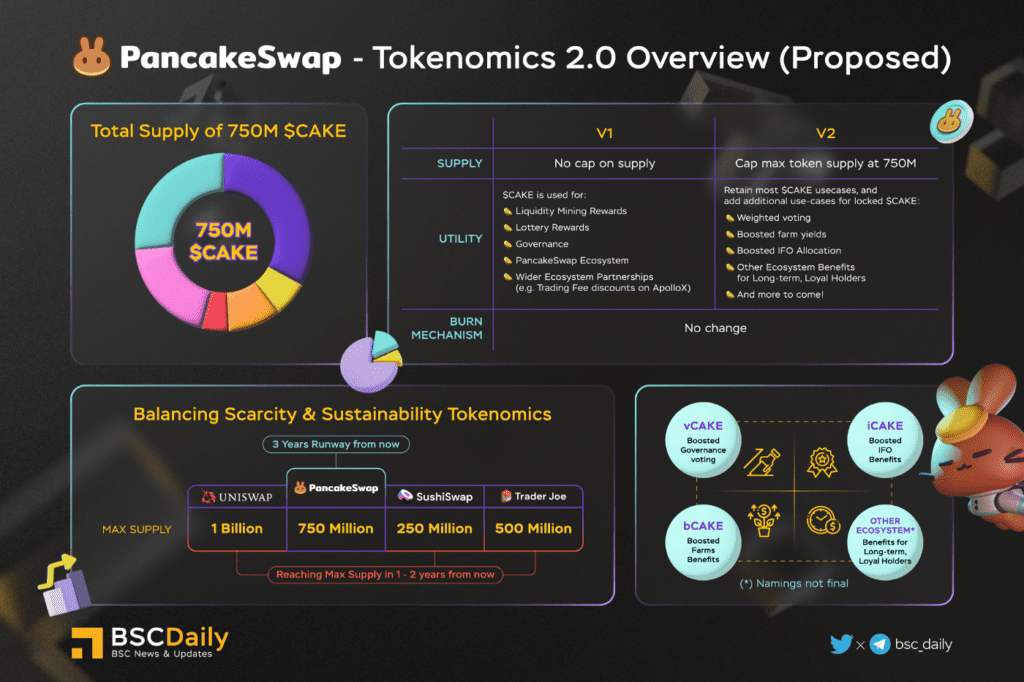

Some outstanding projects include PancakeSwap, Biswap, Alpaca Finance, and Venus Protocol. Significantly, PancakeSwap has updated Tokenomics 2.0 with a 3-year roadmap for New Cycle in the future.

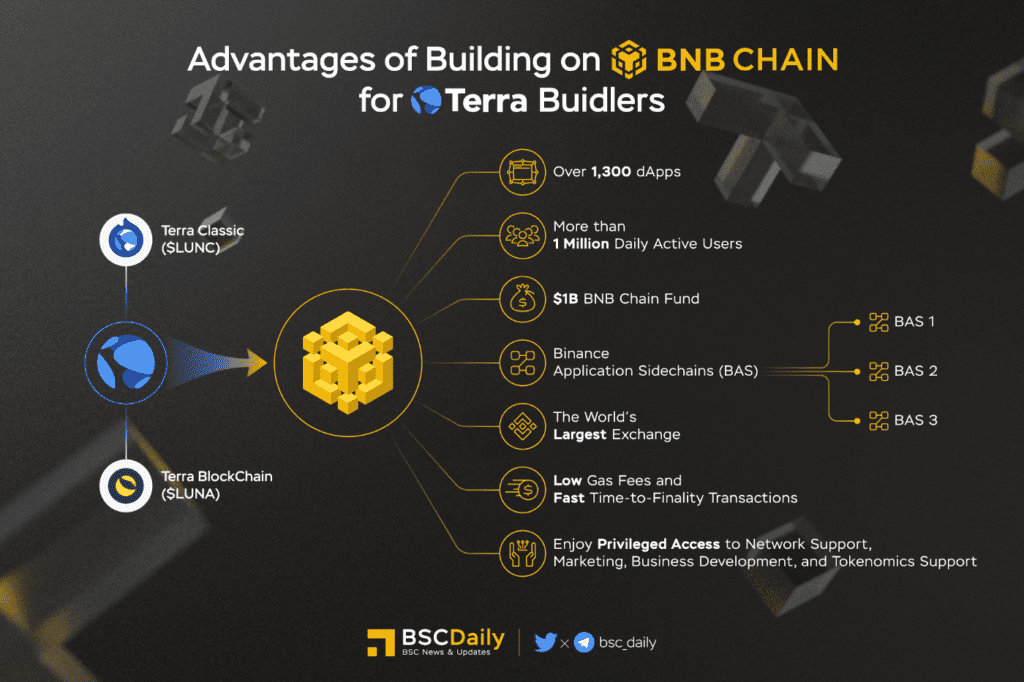

After Terra Collapse, BNB Chain believes that the Terra ecosystem has some of the most talented teams dedicated to building meaningful products and empowering their communities.

BNB Chain Team is confident that the BNB Chain community will wholeheartedly welcome Terrans to the BNB ecosystem. They want to offer a platform to either migrate their projects or build new and exciting Dapps. (Source Binance Blog)

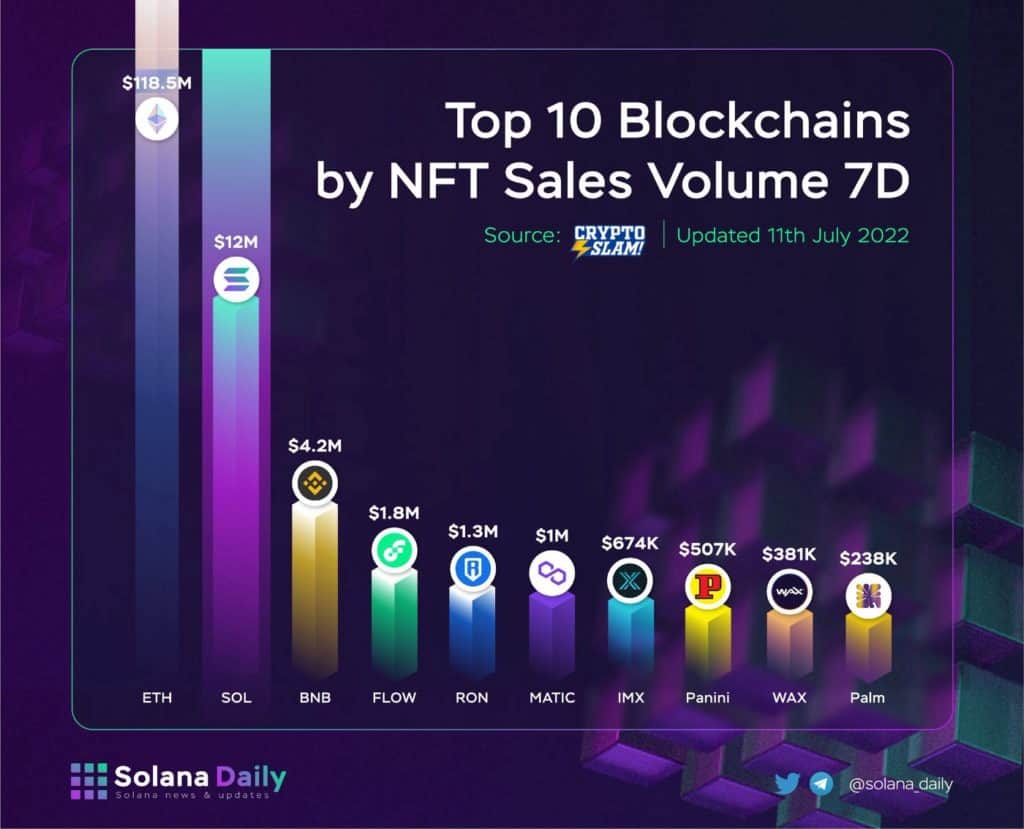

NFT & Fan Token — Forgotten Gems

Despite of notable projects with significant volumes, such as PancakeSquad, Gamester Apes, Pixel Sweeper, and Shit Punk, NFTs on BNB Chain are lacking some elements making a famous NFT, including Team, Diversify NFT, and NFT Utilities like other collections.

E.g., BAYC, Cool Cats, Crypto Punks, … on Ethereum. Or Genesis, Okay Bears, DeGods, etc. on Solana.

Therefore, in Q2, Binance had impressive partnerships such as The Weeknd, Ronaldo, and Khaby Lame.

Please note that these are the influencers in real life and social networks, promising to contribute to the development of Binance and BNBChain in NFTs, Fan Tokens, Music, etc

These two areas have huge potential and can be a trend to educate new investors from the traditional market to the crypto world.

Binance has been investing massively in cooperation with KOLs. After that, Binance’s NFTs & Fan Tokens ecosystem will expand in the direction of KOLs — Fans — People.

BNB Chain — The Road Ahead

From the achievements and impressive numbers on Price Actions, Total Unique Addresses, and Ecosystem Movements above, in my opinion, the BNB Chain Ecosystem is still thriving during the Bear Market because of several factors.

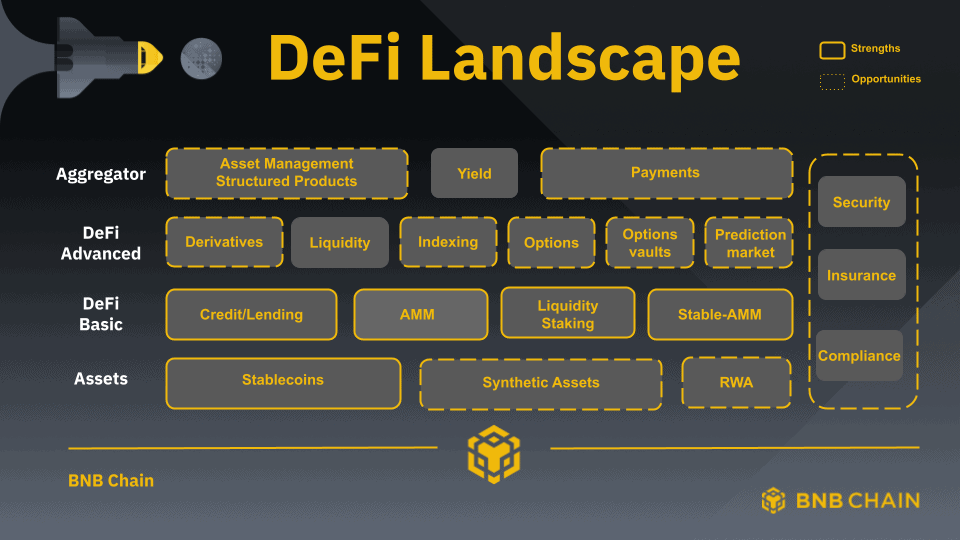

The Future is DeFi: Going Beyond the Traditional Norm

Decentralized finance is a concept that emerged in 2017 or so, a few years after the Ethereum Blockchain was introduced. Since then, a large number of significant opinion leaders, influencers, and investors have become more interested in the DeFi field.

Decentralizing financial operations and giving people more control over their finances is the overall notion. Since DeFi has been changing the financial landscape, many analysts and industry players see the network as the way of the future.

Because of financial ideas and the critical role of decentralized finance, I think DeFi projects need to upgrade and enhance the following features.

Bringing near instant and secure transactions

The space goes on the far side of traditional norms by offering speedy and secure transaction options. Traditional transaction networks invariably lack speed, convenience, and security.

Large transaction throughput will always require several visits to the bank and lots of paperwork. Banking institutions are highly centralized — hacking the institutions may simply result in loss of funds for all accounts. Even highly reputable financial institutions are susceptible to such hacks.

Decentralized finance is a transparent and very secure payment solution. It decentralizes services, making investors’ assets more secure. Completing transactions in platforms that leverage the technology is palatable, with no paperwork involved.

Easier borrowing and lending

The process of borrowing and lending is being streamlined through decentralized financial networks. Historically, obtaining loans has frequently taken a long period. Before approving a loan, banks will verify your credit report and request fixed asset collateral.

For anyone in DeFi, things are fairly straightforward. Collateral, which may be another crypto asset, is all that is required.

By omitting middlemen from the lending and borrowing process, decentralized finance goes beyond established conventions. As a result, you can obtain loans without using middlemen like banks. Instead, you could approach the lender directly to obtain a loan.

To guarantee loan repayment, the networks frequently over-collateralize. You provide greater security than the loan you intend to accept in this situation. As a result, the lender is certain that the money will be returned.

Cross communication and the ability to exchange assets

Interoperability in the traditional financial sector is somewhat limited. For instance, Swift is a mechanism that facilitates the connection of two banking institutions.

DeFi, however, provides the highest level of interoperability between two distinct financial realms and between blockchains (crypto and traditional). Currently, certain initiatives are integrating decentralization into fiat systems in a number of ways, including;

Trading synthetic assets instead of conventional financial assets in DeFi.

Several sites provide peer-to-peer payment options.

The traditional payment methods utilized in the music industry for royalties and other payments are already being reformed by NFTs.

To make it simple to convert a DeFi or Crypto token into money, cross-communication is essential (and vice versa).

Honesty and trust

Dishonesty has been a prevalent attribute of the traditional financial system. During the bear markets, many DeFi platforms have been hacked, hacked, or slow rug made investors clamor. Especially in the past 2nd quarter, several large platforms declared bankruptcy, causing severe damage to the market.

DeFi is offering more honesty, transparency and trust. Its applications are based on blockchains. All transactions are public and permanent for future review. Anyone can view and audit blockchain and DeFi data.

Improving customer services and accessibility

The majority of banks operate eight-hour days, five days a week. Therefore, it could be a hassle if you need to transfer money quickly, especially over the weekend.

There is no need for third-party approvals within the DeFi space. Because the network is operational around-the-clock, you can complete transactions promptly whenever necessary.

Accessibility and availability are essential. Adults without bank accounts numbered 1.7 billion in 2017 as a result of traditional finance’s failure to democratize accessibility. DeFi’s goal is to bank the unbanked by making financial services available to everyone.

The internet and a computing device are the only two prerequisites for using DeFi services. The minimal prerequisites make it very simple for anyone to access the fintech platforms.

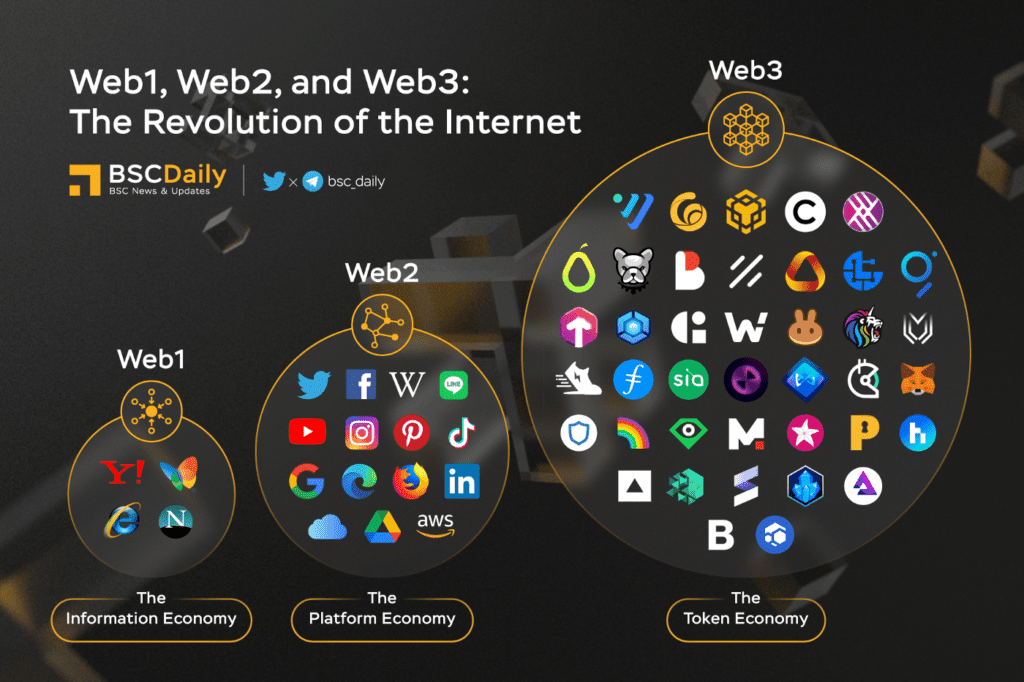

To Web3 or Not to Web3?

Web3 applications currently exist, but it is still unclear whether the idea will become widely adopted in its present form. The foundation of the vision is autonomy and decentralization, but whether governments and regulatory bodies will permit them is the crucial question. Safety, security, and legal concerns will always arise in the absence of oversight and control, which is currently a huge worry.

Elon Musk and Jack Dorsey, the former CEO of Twitter, have both expressed concerns about Web3 being truly decentralized and not merely a marketing gimmick to provide control to venture capitalists (VCs). Blockchains are known to be energy guzzlers that adversely contribute to climate change therefore greater adoption of the technology may have a bad influence on the environment. This is yet another reason against Web3.

In the end, each paradigm shift faces a unique set of difficulties as it develops. While many companies are still investigating the possibilities, several are already implementing Web3 technology to stay ahead of the curve. Business executives who are looking ahead must get ready for Web3 and get their teams on board.

GameFi and the Future of the Metaverse

Since they incorporate popular ideas like GameFi, non-fungible tokens (NFTs), and Web3, gaming metaverses are anticipated to be one of the major engines propelling this market. But there are also numerous drawbacks to ongoing projects.

The lack of contemporary integrated games, high-quality visuals, and other chances facilitates the creation of next-generation metaverse projects.

Gamers are finding it simpler to understand blockchain technology through GameFi, which is why it’s still a popular niche in the cryptocurrency world. Users value scalability, transaction costs, and performance on all GameFi platforms. The architecture of BNB Chain is suitable to meet these requirements.

Many players and investors are currently considering investing in GameFi. This refers to the enormous potential it develops quickly. Additionally, according to blockchain specialists, this kind of game would increase public awareness of cryptocurrencies and other digital assets.

Beyond the limitations of conventional games, the integration of NFT into the video game industry has demonstrated a lot of promise for giving a better user experience. Analysts anticipate that GameFi will benefit from cutting-edge technological advantages like VR virtual reality, augmented reality XR, augmented reality, etc. due to the parallel development of Metaverse. different technology.

The rising user base demonstrates GameFi’s significant potential and widespread appeal. GameFi has become even more advanced because of NFT-specific Blockchain initiatives that were created to meet user needs. This has increased opportunities for players and developers to learn more about the potential of this sort of Blockchain technology. In the future, more.

Conclusion

Thus, In Q2, BNB Chain has achieved many impressive achievements and numbers.

Although there has not been much change in trends and technology, the above achievements will be a solid foundation for the upcoming significant changes in the BNB Chain in Q3 and Q4 2022. There will be many surprises. Stay tuned!

Disclaimer

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of BSC Daily.