Bitcoin [BTC], the largest cryptocurrency continues to showcase vital signs of life after suffering a major fall. The king coin came close to reclaiming the $23,000 level on 18 July, soaring to as high as $22.9k.

This uptick indeed helped to improve or rather inject some positivity into the market sentiment.

And miles to go before I sleep

The minor bounce saw Bitcoin prices gain 4% on the day to reach $22,127 at press time. Needless to say, dominant buyers took this opportunity to showcase their strengths or rather ‘unity’ towards the king of cryptocurrencies.

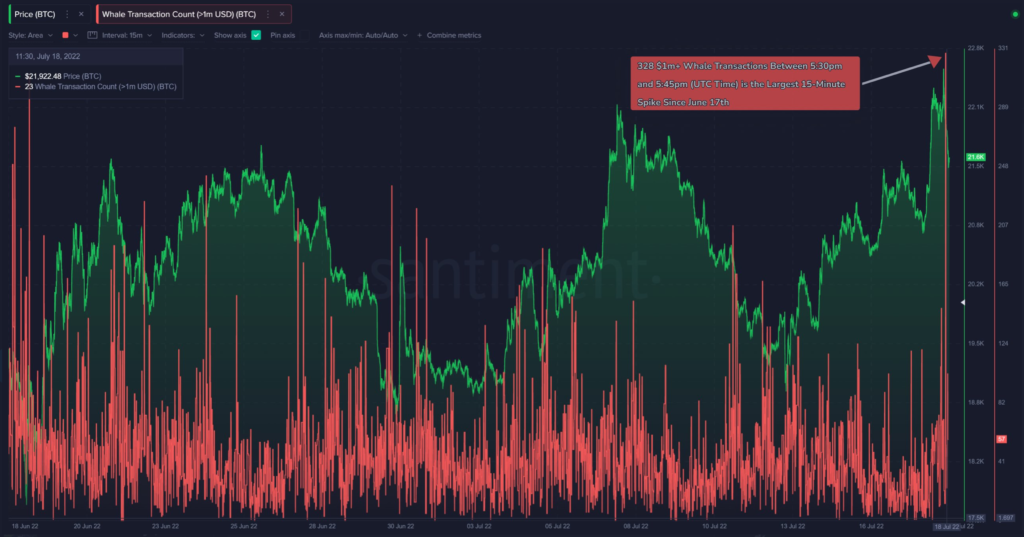

BTC saw its largest spike in large whale transactions in a month just after price topped the said mark.

Santiment highlighted this move in a 19 July tweet that read,

🐳 About three hours ago, the amount of #Bitcoin transactions valued at over $1m spiked to its highest value in over a month. Whale moves are busy today, and spikes such as this one can often be a precursor to price direction shifts. 👀 https://t.co/itoiFVP4ak pic.twitter.com/Txup7flFWC

— Santiment (@santimentfeed) July 18, 2022

Not just large buyers but even relatively smaller ones jumped on this bandwagon. The number of addresses holding 0.1+ BTC reached an all-time high (ATH) of 3,725,022 as reported by Glassnode.

Such developments could indeed help the network regain lost confidence. Interestingly, on-chain analyst Ali Martinez opined that for Bitcoin the path to $23,260 seemed clear.

#Bitcoin overcame all major supply barriers it was facing. The only considerable resistance $BTC has yet to break through to continue advancing further sits at $23,260, where nearly 108,000 addresses are holding over 100,000 $BTC. pic.twitter.com/msjV4obeRl

— Ali Martinez (@ali_charts) July 18, 2022

Roadblocks everywhere

Alas, not everyone seems to be sharing the positive sentiment towards the king coin in the current market structure. Coinbase noted that its on-chain data suggested, those holding BTC for six months or more have not been selling their holdings.

Whereas those holding onto the cryptocurrency for less than half of a year have been divesting their holdings.

One reason for the latter could be the declining profit margin as seen in the graph below.

The monthly average of the Short-Term Net Unrealized Profit to Loss (STH-NUPL) ratio is at its lowest level since November 2011. A NUPL value of -0.50 means that 50% of all value held by Short-Term Holders is currently at an unrealized loss.

Furthermore, the #1 cryptocurrency needs to showcase equal affection for both these cohorts. The lack of affection towards the short-term holders could offset BTC’s reign to reclaim its lost spot.