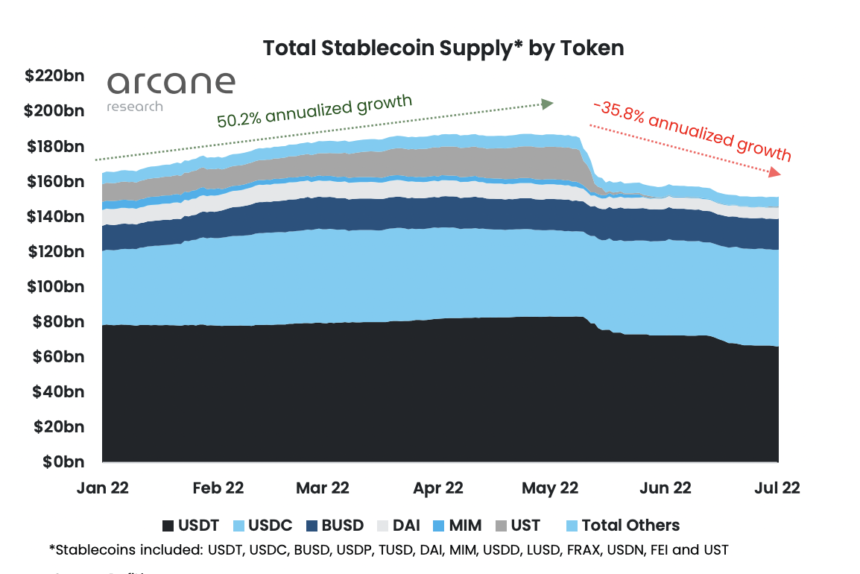

The crypto bear market of 2022 has spared no digital asset in the space, and stablecoins have been no different. The assets which have always served as a safe haven for investors when it comes to the high volatility of the crypto market had seen a drawdown coming into the new year. As a result of this, for the first time, these stablecoins are now seeing a reversal of their otherwise bullish growth trend over the last couple of years.

Stablecoins See Market Cap Plummet

Stablecoins had grown tremendously throughout the bull market of 2021. By the end of the year, the year-over-year growth of the stablecoin market cap had actually come out to a total of $151.3 billion. This growth is attributed to the popularity among investors who were holding their funds in stablecoins, either from profits or waiting to buy more cryptocurrencies.

Related Reading | Bitcoin Dominance Dives As Ethereum Takes Up More Space

The top stablecoins had enjoyed most of this growth. Assets such as USDT and USDC saw their market caps grow by double-digits in billions, although they continued to fiercely compete with one another. This competition would, however, come out in the favor of USDC. Most of the support had sprung from the fact that USDC had more regulatory oversight compared to USDT, whose reserves continue to be questioned even to this day.

The year 2022 would prove to not be a good one for USDT too. It had come into the new year with more than $78 billion. But in the first half of the year alone, it has lost more than $12 billion to be sitting at its current market of a little over $66 billion at the time of this writing.

Stablecoin supply drops | Source: Arcane Research

USDC, on the other hand, is enjoying much success even through the bear market. Its market cap has added more than $10 billion this year alone, growing from $42.2 billion to $55.31 billion at the time of this writing.

The Crash Of UST

A major factor behind the decline in the stablecoin market cap has been the crash of UST. By the beginning of this year, it was the largest and most popular algorithmic stablecoin, which is why the crash shook the market to the extent that it did.

Related Reading | Ethereum Classic (ETC) Reclaims $3 Billion Market Cap, More Upside To Follow?

Since then, the market cap of algorithmic stablecoins has dropped from $13.26 billion to around $3 billion. UST alone accounted for more than 94% of the decline after the crash, wiping off $9.7 billion from the crash. There was the crash of other algorithmic stablecoins such as DEI, but UST’s popularity and size made it the most prominent.

USDT market cap drops to $66B | Source: Market Cap USDT on TradingView.com

This has understandably led to reluctance on the part of crypto investors when it comes to using algorithmic stablecoins. As such, stablecoins such as USDT, USDC, and BUSD continue cot rule the market. However, the total stablecoin supply has been down 35.8% over the last six months. This can be regarded as a good thing, given that an increase in supply can often lead to a decline in value and vice versa.

Featured image from TRT World, charts from Arcane Research and TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…