Key takaway

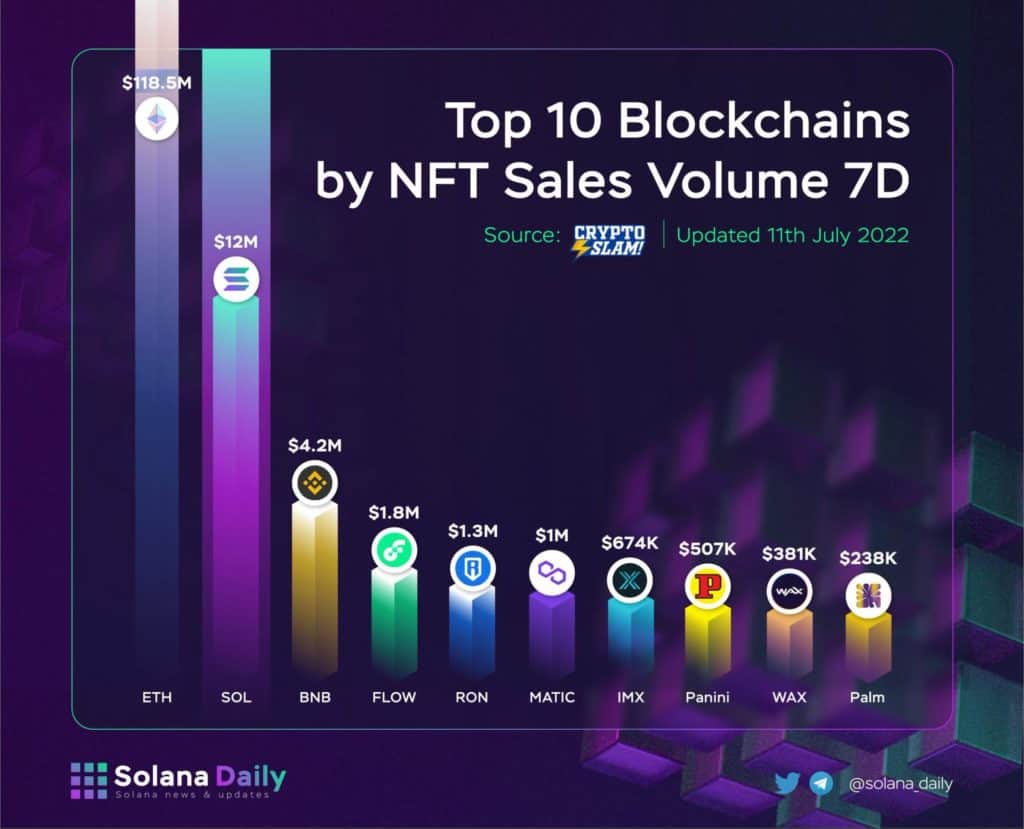

- The Total Value Locked (TVL) on Solana halved but NFTs trading volume on Solana is increasing compared to other blockchains and ranks in the top 2 after Ethereum.

- Solana launched Solana Mobile Stack (SMS) to develop a Web3 orientation for increasing user experience.

- Projects on the Solana ecosystem faced various problems relating to decentralization, security, and gaps between protocols.

- Hackathons on Solana are continuously conducted.

Introduction

- The Move-To-Earn StepN project revived the whole Solana ecosystem and pioneered a brand new trend for the entire cryptocurrency market in Quarter 2, 2022.

- The more new projects come, the more competitive that Dex, Lending, CDP, and Staking projects compete for the sake of market share on users number and trading volume.

- Several niche fields in Decentralized Finance (DEFI) have not received much attention, particularly Derivatives, Tools, Privacy, etc.

- Infrastructure solutions to bridge assets on Solana are getting better and better.

SOLANA ECOSYSTEM

Market and Bitcoin correlation

Bitcoin fell sharply for 3 consecutive months — Especially in June, it decreased by 37%, which is the highest percentage of the decline in Bitcoin price since 2009.

In addition, the decrease in Bitcoin led to the decline of altcoins including SOL tokens, and caused some chain reactions to large Venture Capitals including Three Arrow Capital and Voyager Digital; and several lending platforms consisting of Celcius and Solend.

The UST Crisis

The collapse of LUNA-UST in May 2022 is also a strong catalyst for the beginning of the decline of Bitcoin, which directly affects the Solana ecosystem (since there is a huge amount of UST and LUNA circulating in the Solana ecosystem in liquidity pools)

If you want to read some main events about the event of LUNA and UST, try having a look at our thread

How has Celcius solved their problem of insolvency

Celsius Network is a regulated, SEC-compliant, lending platform that enables users to receive interest on deposited cryptocurrencies or take out crypto collateralized loans.

You may have a glance at our short look back on the timeline of Three Arrow Capital’s bankruptcy.

Ecosystem breakdown

In the Decentralized Finance (DeFi) sphere, although there is a decline in the Total Value Locked (TVL), projects still continuously update their websites and push rewards to users in order to compete for market share.

Highlight Projects:

Orca

Orca with the update oriented similarly to Uniswap V3 in its model Concentrated Liquidity Market Maker (CLMM) has occupied a majority of all Dex’s trading market share on Solana for 2 months.

Solend

Solend faced the risk of default when the biggest whale wallet holding a large amount of Solana was about to be liquidated.

There’s a huge consequence if the whale account be liquidated

-> the other mortgage Sol was liquidated

-> the market will not be able to absorb in short time

-> According to the smart contract mechanism, it will lead to peg deviation of Sol pairs, thereby creating a domino crash on Solana.

So Solend Labs has to take action…

They take over the whale’s account so the liquidation can be executed OTC and avoid pushing Solana to its limits

Enact special margin requirements for large whales that represent over 20% of borrows

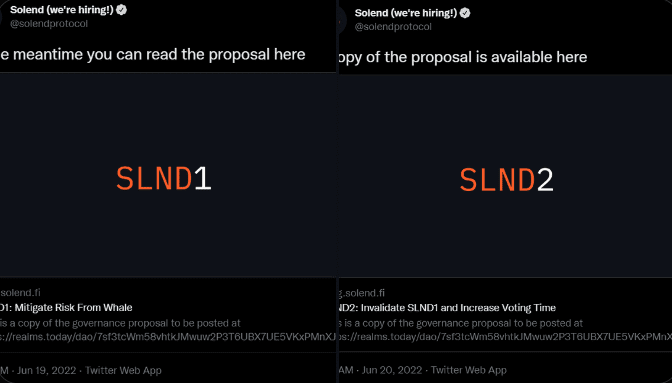

-> They conducted the proposals: SLND1 & SLND2

Timeline of the first proposals on Solend DAO

-> SLND1: Mitigate Risk From Whale

-> But $SOL has bounced in last 24h

-> They have conducted SLND2: Invalidate SLND1 and Increase Voting Time.

Note: The Solend core team did not vote in those proposals.

“There is no perfect solution” — That’s the thing Solend team said

-> They must trade-off between the bankrupt & the decentralization.

StepN — The leading of MoveToEarn

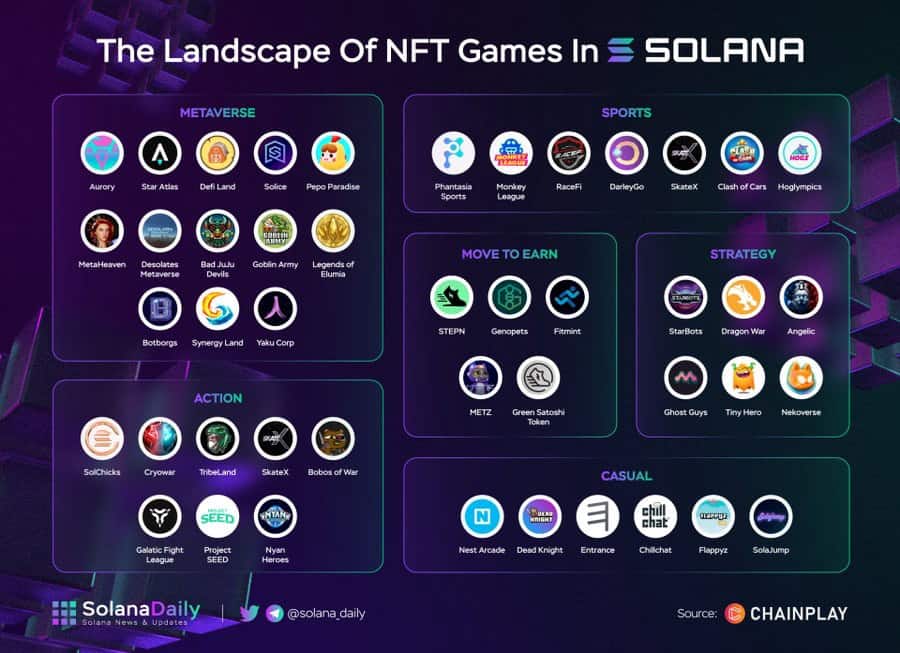

In the field of NFTs, Solana is the brightest name in the cryptocurrency market as StepN — a platform combining SocialFi and FitnessFi for users to gain income while exercising. The main reason for the success of StepN is that the project meets the huge demand of various users both inside and outside cryptocurrency.

Check this article about How has @Stepnofficial changed our mindset towards cryptocurrency?

NFTs on Solana Had Brought back The Solana Summer

NFTs Sales Volume on Solana

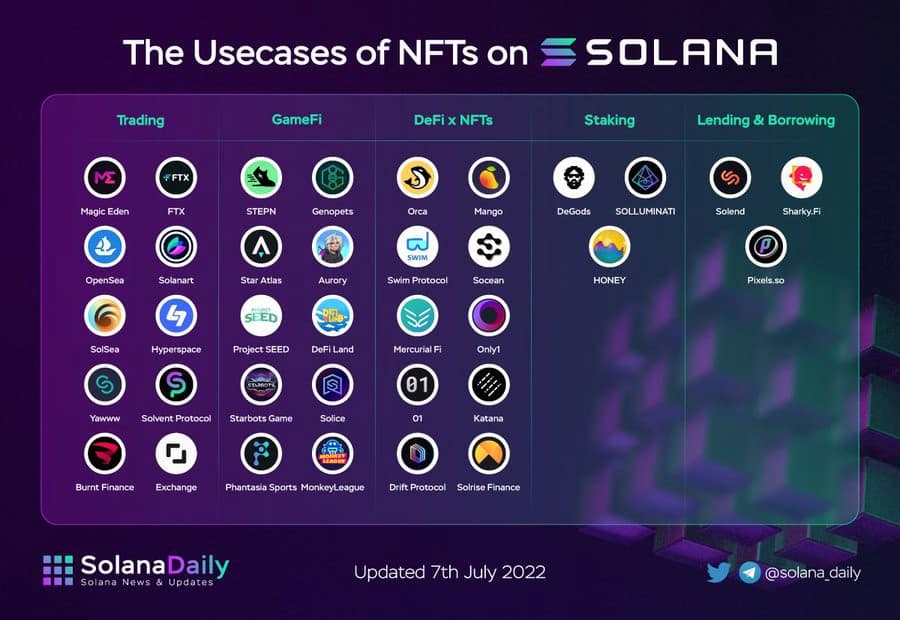

NFTs on Solana are also traded in a huge trading volume, with low initial entry and cheap fees advantage. Hence, Solana has risen to become the blockchain with NFTs transaction trading volume only after Ethereum (Exceeds Flow and Polygon).

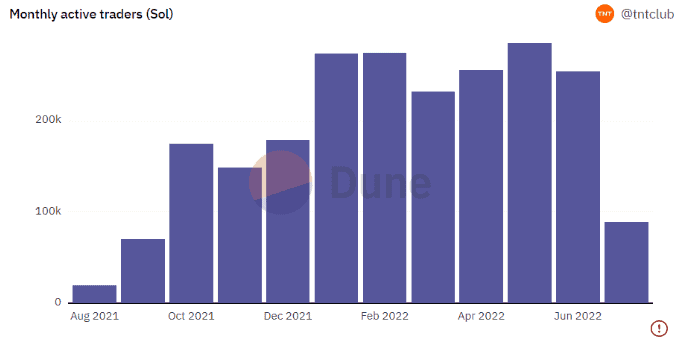

In addition, the number of active NFT traders on Solana also reached ATH in May.

Solana NFTs Marketplace

Moreover, the biggest NFT Marketplace on the Solana ecosystem — Magic Eden has raised $130 million co-led by Electric Capital and Greylock, bringing its valuation to $1.6 billion.

Opensea Support Solana NFTs

Opensea is the largest NFT marketplace on Ethereum. This integration makes Solana achieve more milestones for its ecosystem.

Projections

In Solana Daily’s point of view, Solana Ecosystem is the most comprehensive development ecosystem currently on DEFI. With the advantage of low transaction fees, Solana is expected to be the final destination of SocialFi and Metaverse projects in the upcoming bull season.

Another important milestone is that Solana’s trump card is the launch of Saga — a mobile product that integrates Dapps and Web3 on Solana. In the future, when it is widely used and applied, the number of users will increase significantly and new high-quality projects will come more and more to the Solana ecosystem.

PREDICTIONS

Here are some thoughts about motivation for Solana’s growth:

DeFi

Derivatives is an advanced puzzle piece that has received little attention at the moment. With the participation of many famous backers like Solana Ventures, Alameda Research. This will be the next piece in the next Solana Summer season

NFTs

High-value NFT collections are popping up more and more on Solana. Liquidity settlement for these collections will be a new direction for projects working on NFT on Solana in the near future.

GameFi

Like Axie Infinity, most games on Solana have a dual-token model. The success of Game projects on Solana in the future is how to solve the problem of inflation of earned tokens and create a good gameplay.

Conclusion

In conclusion, there are various changes in both DEFI, NFTs, and new orientations for the whole Solana ecosystem in quarter 2, 2022.

Let’s wait and see how StepN will solve their Dual-token problem?!

Will NFTs on Solana still keep their heat and DEFI on Solana accelerate any innovation?

Disclaimer — No Investment Advice

The information provided in this report does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the report’s content as such.

Solana Daily does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligent research and consult your financial advisor before making any investment decisions.